Most online savings accounts offer a rather "one dimensional" experience. That is, a simple place to park your cash with a digital banking app.

Yotta is on a mission to change things up a bit with their prize-linked savings account. Instead of funneling money into the lottery, savers are rewarded with tickets each day based on how much they save.

Challenger banks like Yotta have emerged recently after the banking app Chime took the market by surprise. These new-age banks are garnering tens to hundreds of thousands of accounts in stealth.

So, should you jump on the Yotta bandwagon? Here's our full review.

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

So far, over 600,000 people have decided to make the switch and bank with Yotta.

Yotta is essentially a fancy application built on top of a traditional boring savings account.

There are two crucial things to understand about Yotta:

Yotta itself is simply a fancy application built on top of an old school bank account. Through their partner bank, you are fully FDIC insured.

Since there are so many features, it can be a bit overwhelming when you first sign up.

Here's how the app works when you get started.

To open an account with Yotta, you will need the following information:

The sign up process is simple and takes minutes.

Be sure to use our referral link or use referral code RYAN for 100 Bonus Tickets!

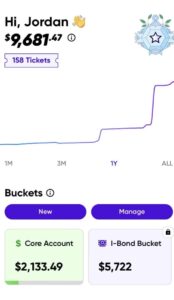

Once you open your account, you will get your 100 bonus tickets (assuming you used the code above).

At that point, you will want to make your first deposit. Based on the amount you deposit, you will earn recurring tickets into the daily drawing. There is a tiered system based on how much you have deposited.

So, the ticket incentive is a lot better on the first $10,000 saved up. In that case, you would have 400 daily tickets into the drawing.

If you deposited $100 and never touched it, you would have 4 daily tickets.

If you want to continue earning more tickets, the Debit card is your next step.

With the Yotta Debit Card, 10% of your dollar value purchases turns into daily tickets. If you spent $250 on a Utility Bill, you would earn 25 tickets for that daily drawing.

Lucky Swipes also come into play here. Your odds for a free swipe are based on a number of factors, including whether or not you have direct deposit set up and how many referrals you have generated.

Odds of a free purchase depend on if you have direct deposit setup as well as how many referrals you have. With direct deposit setup, your odds are 1 in 150 for the debit card on average and a 1 in 75 for the credit card on average. Every friend you refer unlocks you 30 days of 1 in 100 odds on average for free stuff on your debit card and 1 in 50 odds on average for your credit card. - Yotta Official Website

If you want to earn even more free tickets, or boost your Lucky Swipe odds, sign up for direct deposit. This is when you have an employer automatically depositing your wages into your Yotta bank account.

When you add direct deposit to your Yotta Checking Account, you unlock the following perks:

In the United States, American's spend $1,000 per year on average on the lottery.

Imagine, instead, if you put that money into a prize linked savings account like Yotta?

That $1,000 would earn you 40 tickets every single day.

If a bank account is able to help you save through incentive, while cutting down on bad habits like gambling, that is a win-win.

Be sure to use our referral link or use referral code RYAN for 100 Bonus Tickets!