Anyone who has ever played a game of Monopoly has experienced the thrill of having plenty of cash in hand – even though it's not real currency.

If you are new to the world of investing, any dollar you lose can feel like a big hit, because it's not play money, it's your hard-earned cash you are putting up.

Wouldn't it be great if you had a chance to try your hand at investing without the risk?

There is a way, and it's called paper trading. This is where you are investing with play money, monopoly money if you will.

However, you might be wondering if the popular commission free trading app Robinhood offers a trading simulator (a.k.a. paper trading).

Here's the verdict on this!

New to Robinhood? Check out my full tutorial below!

Paper trading is essentially a simulation of real trading, where individuals practice buying and selling financial instruments like stocks without risking any actual money.

It's a valuable tool for beginners to hone their trading skills, test strategies, and gain confidence without the fear of losing capital.

The reason why it's called paper trading is because most people would jot down their hypothetical trades on paper, including the number of shares they would've purchased and the cost basis.

Then, they could check back and see how they would've done.

Today, paper trading has largely been replaced with trading simulators - which allow you to do this within an app.

As of 2025, Robinhood does offer limited paper trading capabilities – but it's not what most traders would consider a full trading simulator. Robinhood does not offer a traditional paper trading account with virtual cash to practice general stock trading, but they do provide specific tools for practicing options trading.

Robinhood recently announced new features at their HOOD Summit 2025, including enhanced options simulated returns on Robinhood Legend, their advanced desktop platform. This means Robinhood has evolved its paper trading capabilities significantly from previous years.

Robinhood offers a practical way to practice options trading through their Options Watchlist feature. Here's how it works:

You'll know which options are in your watchlist by the checkmark indicator next to them. This allows you to practice both single-leg and multi-leg options strategies without risking real money.

One of Robinhood's most valuable practice tools is the Simulated Returns feature, which helps you visualize how your options returns could change over time based on different market scenarios. This tool is available on both the mobile app and Robinhood Legend.

When you view an options contract, you'll see a button that says "Simulate My Returns." Clicking this allows you to:

For example, if you simulate what happens if CRM (Salesforce) reaches $335 before expiration, the tool will show you the estimated return on your position. This is particularly useful for beginners learning options mechanics.

The tool uses the Bjerksund-Stensland model for options on stocks and ETFs and the Black-Scholes model for index options. However, it's important to note that this model doesn't account for dividends or regulatory fees, and assumes implied volatility and risk-free interest rates will stay constant.

While Robinhood does offer options practice tools, there are significant limitations to be aware of:

For many beginners wanting to practice general stock trading, these limitations mean Robinhood's tools may not be sufficient.

If you're looking for a more comprehensive trading simulator with virtual cash to practice all types of trading, consider these alternatives:

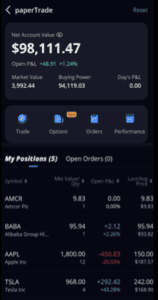

With the Webull Paper Trading Simulator, you can test new strategies and hone your skills using unlimited virtual cash. Webull offers paper trading for stocks, options, and futures across multiple markets (US, Hong Kong, China-A-shares). To access it, download the app and go to "Discover > PaperTrade."

New to Webull? Check out my full tutorial below!

There is no risk, as it's pretend money, but everything else is exactly how it would be when using real cash.

Here are additional platforms that offer robust paper trading capabilities:

Paper trading is more important than ever in today's complex markets. Here's why:

Remember that success in paper trading doesn't guarantee real trading success. The emotional component of risking real money is missing in simulations, which is a critical factor in actual trading performance.

To get the most out of your paper trading experience:

No, Robinhood does not offer paper trading for stocks or ETFs. You can only practice options trading through the Options Watchlist and Simulated Returns features.

Robinhood doesn't provide virtual cash like comprehensive paper trading platforms. Instead, you track real-time performance of hypothetical positions in your watchlist without actual buying power.

The Simulated Returns tool uses established options pricing models (Bjerksund-Stensland for stocks/ETFs and Black-Scholes for indices), but it has limitations. It doesn't account for dividends, assumes constant implied volatility, and ignores regulatory fees. It's a helpful educational tool but not a perfect predictor of actual results.

For most users, Webull offers the best balance of features, ease of use, and comprehensive paper trading capabilities. However, Interactive Brokers is superior for advanced traders wanting to practice complex strategies with the most realistic market conditions.

Robinhood works well if you're specifically interested in practicing options trading and already use the platform for real trading. It's less suitable if you want to practice general stock trading, test portfolio management, or learn platform fundamentals from scratch.