The Roth IRA is the most powerful wealth building tool out there for most people, and I’m going to prove that to you in this comprehensive guide for beginner's.

In fact, the IRS even limits the amount of money you can put into this account because of how lucrative it can be.

So if you’re looking for a crash course on investing for retirement and becoming a tax free millionaire, this is the article for you.

And be sure to check out our video below on the Roth IRA retirement account. Let's dive in!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

For starters, a Roth IRA is a special type of Individual Retirement Account that comes with a set of unique tax benefits.

Most people are familiar with a 401(k) - which is a tax deferred retirement account offered through an employer. With a 401(k), you are able to contribute your pre-tax income - lowering your taxable income in the process.

But, when you’re ready to start withdrawing from your 401(k) later in life, you have to pay taxes on your distributions.

With the Roth IRA, you are contributing money you’ve already paid taxes on - or your post-tax income. This means there is no upfront benefit of lowering your taxable income or anything like that - instead, all of the benefits are at the end.

As long as you've had a Roth IRA account open for at least 5 years, you can withdraw your earnings and contributions tax free after you turn 59-½ years old.

Think of your 401(k) as receiving instant gratification, meanwhile the Roth IRA is a form of delayed gratification.

Investing through your 401(k) gives you instant gratification in the form of a tax write-off.

You can either get the benefit upfront with a 401(k) or Traditional IRA and pay taxes later, or let your money grow tax free for your lifetime with a Roth IRA.

In most cases, it makes sense to have both a 401(k) and a Roth IRA - especially if your employer offers a company match.

Some employers will offer a bonus contribution for employees who take advantage of a 401(k) - such as matching 50% of the contribution up to a certain percentage of your paycheck contributed.

Most Roth and Traditional IRA’s do not have any type of match, however a newer age brokerage platform Robinhood does offer an IRA match, and it’s become very popular for retirement investing as a result.

We'll talk more about the Robinhood retirement accounts later on.

Each year, the IRS sets a limit on how much you can contribute to an IRA and it normally goes up over time to adjust for inflation.

These limits apply to all of your IRA Accounts, so even if you have multiple accounts you can’t contribute more than the maximum. Also, your annual contribution for a given tax year must be made by the tax filing deadline for the owner of the IRA - which is April 15th.

For 2024, you could contribute any time from January 1st through April 15th 2025 - or whenever you file your taxes - potentially giving you a 15 month window of time.

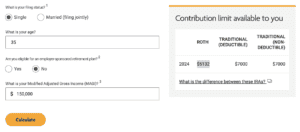

Now there are also income limitations for the Roth IRA, meaning you have to earn under a certain amount of money to contribute.

As mentioned before, there are limits on how much income you can earn while still being able to contribute to your Roth IRA.

And just like the contribution limits, these income limits go up over time too.

To make things a little more confusing, there is a partial contribution allowed for those earning a high income that falls just under the limits above.

For single filers in 2024, that is $146,000 to $161,000. And for married filing jointly, that is $230,000 to $240,000.

If you fall within these limits, your contribution amount fluctuates - TIAA has a handy calculator for figuring this out.

For example, a single filer who is 35 and making $150,000 would be able to contribute $5,132 to a Roth IRA in 2024.

These income limits only apply to the Roth IRA, meaning there is no income limit for contributing to a Traditional IRA.

![]()

Robinhood offers both Roth and Traditional IRA accounts. Customers can do both if they want to.

Robinhood IRAs support the full range of recognized contribution types including both deductible and non-deductible Traditional IRA contributions, Roth IRA contributions and rollovers.

All of the stocks and exchange-traded funds (ETFs) available in a regular Robinhood account are also available in a Robinhood IRA.

In addition, they offer a portfolio builder tool if you need help curating an investment portfolio.

Click here to Sign Up with Robinhood + Get 1 Free Stock!

Robinhood offers an “unheard of” incentive of matching your contributions to the account - just like some employers do with a 401(k).

The Robinhood Match is either 1% or 3% depending on whether or not you have Robinhood Gold.

Robinhood Gold is a premium subscription that costs $5 a month or $60 per year. You get a handful of benefits with it, but the main one to focus on for this video is the 3% IRA Match.

Here’s how the Robinhood IRA Match works.

If you’re under 50 and maxing out your $7,000 annual IRA Contribution - you’d be getting a $70 Match from Robinhood at the 1% level, or $210 assuming you had Robinhood Gold and earned 3%.

If you deduct the Gold Subscription of $60 a year, your still getting $150 a year as an extra kick-in.

If you’re over 50 and contributing the maximum of $8,000 - that would be an $80 Match at 1% or $240 at 3%.

After deducting the Gold subscription, your bonus would be $180 a year.

Here’s a few more important details about these Robinhood Retirement Accounts.

If you want to check out Robinhood IRAs yourself, be sure to use our link to get a free stock worth up to $200.

You’ll end up getting a free fractional share, and you’re able to pick your free stock from a list of 20+ leading American companies.

So let’s say you’re a young person and you want to become a millionaire using a Roth IRA retirement account.

One of the best investments you can make with a Roth is investing in a low fee S&P 500 ETF. This allows you to invest in the 500 largest publicly traded companies in the US, giving you a little slice of each one.

According to NerdWallet, the S&P 500 Index returns about 10% on average annually - assuming dividend reinvestment.

If you’re 20 years old, the contribution limit is $7,000 per year - or about $583 per month.

Using this Compound Interest Calculator, we can determine how long it would take for you to become a millionaire.

Assuming you invested $583 per month and earned the average 10% return from the stock market, here's how long it would take.

It would take you approximately 29 years to become a tax free Roth IRA millionaire.

Once you have opened a Roth IRA and contributed to it, there are certain types of investments that can be made.

The most common would be mutual funds, stocks, bonds, ETFs and fixed income investments like CDs. However, in recent years, Crypto IRAs have emerged.

While you aren’t able to make contributions using cryptocurrencies, you are able to invest in cryptocurrencies within the IRA itself.

If you’re looking to have the widest range of investment options, you will most likely want to open a Self Directed Roth IRA. With this type of account, the investor is able to pick and choose the investments versus relying on the financial institution to do so.

Robinhood is considered to be self directed, as you are able to pick and choose your investments.

In addition to limits on the amount you can earn and the amount you can contribute, the IRS also specifies what type of income can be used to make a contribution.

The gist of it is you can only contribute earned income - which would be money earned through a job or income earned from a business you own.

The types of income that do not count include rental income from real estate, interest income, money from a pension, stock dividends or capital gains as well as passive income from partnerships.

So far, we’ve talked at length about money going into a Roth IRA - but what about when you start taking money out?

First of all, we need to define what your Contributions are versus your Earnings.

At any point, you can withdraw your Contributions from the Roth IRA tax free and penalty free - regardless of your age or the time the account has been open.

However, if you withdraw the Earnings - it would have to be a Qualified Distribution - otherwise you’d have to pay taxes and penalties on the Earnings withdrawn.

The Penalty is 10% - plus whatever your normal tax rate would be on the capital gains.

So what is a Qualified Distribution then?

The first rule here is the distribution needs to occur at least 5 years after the account owner funded their first Roth IRA.

In addition, the Roth IRA owner needs to be at least 59-½ years old.

If you withdraw the Earnings from the account before meeting the above requirements, this is considered a Non-Qualified Distribution.

As mentioned, you’ll end up paying taxes and a 10% penalty - however, there are a few exemptions from this.

If you’re using the money for medical expenses, health insurance, pursuing a higher education or for childbirth or adoption expenses - there are special circumstances for each. I would recommend researching each of these individually should that apply to you.

There is also a First Time Home Buyer exemption which allows you or a family member to take a one-time distribution of the earnings early without penalty. And the limit for that is $10,000.

So for the most part, don’t plan on touching the Earnings from your Roth IRA until you’re in your retirement years. But after that, you are good to go.

There are several benefits associated with investing in a Roth IRA.

While most are tax-related, not all are.

The first benefit, which we already discussed, is the tax-free retirement income.

Anyone with earned income can begin contributing to a Roth IRA.

If you don't have earned income but are married to someone who does, you may be able to take advantage of a spousal Roth IRA.

As long as you are within the income limitations, you can maximize your contribution year after year.

Retirement is for some people, but it isn't for everyone. Maybe you want to continue to work into your 60's or even your 70's.

If that is the case, you might want to continue contributing to your retirement savings as well. Or, you at least don't want to touch that money yet.

The Roth IRA has a huge benefit that the Traditional IRA does not have, and it comes down to required minimum distributions.

This means that you do not have to take money out at any time. It also means that you can continue contributing to the Roth IRA, so long as you have earned income.

There is a loophole called a Backdoor Roth IRA that allows high-income earners who exceed the income limitations for a Roth IRA to contribute anyway.

If you make less, you can contribute to a Roth IRA directly.

If you make more, keep reading, as we will explain the Backdoor Roth IRA later on.

Since you are contributing your post-tax income, you can withdraw your contributions at any time tax and penalty-free.

As long as you don't touch the Earnings, you can take your Contributions out at any time without taxes or penalties.

For those who are not familiar, estate planning is anticipating and laying out plans for when you pass away.

Your Roth IRA is passed right along to your heirs tax-free and penalty-free.

As long as they meet the required criteria, the Roth IRA continues to grow tax-free.

The next benefit of the Roth IRA is that you have complete freedom over where you open one and what you put in it.

With the 401(k), you are stuck with whoever your employer works with, and whatever that plan offers. In some cases, this could be high fee mutual funds that are just not an appealing investment.

You can open a fee-free Roth IRA with Robinhood for example, and pick and choose whatever stocks or ETFs you want to invest in.

You are allowed to withdraw earnings from your Roth IRA if you are under the age of 59-1/2 as long as that money is going towards your first time home purchase.

If this is the case, you will not pay any taxes or penalties on the withdrawal from your Roth IRA.

The maximum amount of earnings you can withdraw is $10,000.

A backdoor Roth IRA is how you can get around the income limitations that are in place for contributing to a Roth IRA.

As we mentioned earlier, you can't directly contribute to a Roth IRA if your income exceeds the current annual limit.

Instead of contributing directly to a Roth IRA, you contribute to a Traditional IRA instead.

Then, you convert that Traditional IRA into a Roth IRA.

Based on current laws, which could change eventually, anyone can convert a Traditional IRA to a Roth IRA regardless of their income.

As Benjamin Franklin wisely wrote many years ago, "in this world, nothing can be said to be certain, except death and taxes."

Fortunately, taking advantage of a Roth IRA can allow you to eliminate some of the money you could've ended up paying in taxes. This makes the Roth IRA one of the most powerful wealth building tools out there.