Investing Simple is affiliated with Fundrise, and we earn commissions for this endorsement of Fundrise.

Compound interest is arguably the most important tool used to grow wealth. However, most people are unaware of how to use it. For some, compound interest is the reason they never have to worry about money. For others, it is the reason they will never get out of debt.

Those who understand it can apply this powerful force and accelerate their wealth. Those who do not understand it will often let their debts grow uncontrollably.

I'm sure you have met someone in the past who always seemed to be in debt. Maybe it was a retail store credit card or a monthly payment on a brand new vehicle. Most people in these situations do not understand this powerful concept.

One of the most amazing things about compound interest is that it does not discriminate. If you are rich, compound interest can make you richer. If you are poor, compound interest can make you poorer. It does not matter what race, gender, ethnicity, or religion you are.

Anyone in the world can earn compound interest, and it can change your life for better or worse depending on how you use it.

The easiest way to understand compound interest is to think of the process required to make a snowman. Imagine yourself going outside on a snowy day. As you begin packing a large ball of snow to make your snowman you begin to roll the snowball along the ground.

At first, it appears that nothing is happening at all. It seems like you are rolling this ball of snow around for no reason!

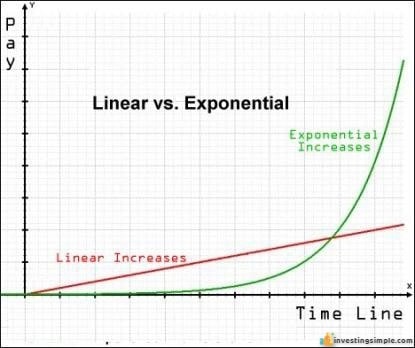

However, you'll quickly notice that as you roll the ball, it is building size and weight at an exponential rate. Once that snowball is larger, it has a greater surface area to pick up more snow. It may have taken 2 minutes for a snowball the size of the basketball to double in size, but the next doubling cycle will take less time. This is known as the snowball effect. Another modern analogy is a social media post—once it starts getting shared, each share exposes it to more people, and the rate at which it spreads accelerates rapidly.

The same effect can happen with your wealth. When you begin to earn compound interest, the returns seem insignificant at first. As you continue to allow your money to grow, the compounding effect becomes greater and greater and the growth rate accelerates.

But what exactly is compound interest? Compound interest is interest calculated not only on your original investment (principal) but also on any interest you've already earned. In other words, you earn "interest on interest," which allows your money to multiply at an accelerated rate compared to simple interest, where you only earn interest on the principal.

Compounding can happen at different intervals: daily, monthly, quarterly, or annually. The more frequently interest is compounded, the faster your money grows because interest is being added to your account (and so earning more interest) more often.

It's not about how much you have, it's about how long you allow that money to grow.

When it comes to earning interest, you can either earn simple interest or compound interest. With simple interest, you earn the same rate of interest every single year on your principal alone. With compound interest, you are able to earn interest on top of your interest.

Compound interest allows you to earn a greater return every single year. While this change seems insignificant, the growth takes place over a long period of time. Using the snowball analogy, those initial years are the packing of the snowball. The growth is invisible to the naked eye.

Consider this. If you invested $10,000 and allowed it to grow for 25 years at a market rate of 7%, your money would have grown to about $54,000! Now, imagine investing that same amount of money for just 5 years.

After 5 years, that same initial investment would have grown to just about $14,000. Compound interest works best for those who give their investments time to grow!

Here's how the compound interest formula works:

Where:

A = the future value of the investment/loan, including interest

P = principal investment/loan amount

r = annual interest rate (decimal)

n = number of times interest is compounded per year

t = time the money is invested or borrowed for, in years

Let's see how compounding intervals affect your returns:

Play around with different amounts using my favorite compound interest calculator to see the true power of compound interest.

One of the best parts about compound interest is the ability to compound your growth even faster by investing a little bit each month over time. Let's say that in addition to your initial $10,000 investment, you add $100 monthly to the pot. In this case, your investment would have grown to $130,000!

The main factor that matters here is how long you invest, not how much. While both are important, having a large investment isn't everything.

Rich people understand the power of compound interest and they have likely been applying it for years.

So... why do the rich keep getting richer?

It is simply because they started investing their money and allowing that money to grow into more money over time. They understood the power of compound interest early on and they had the patience to see it through.

Despite what we'd like to believe, more people get rich because of hard work and patience than because of inheritance. If you simply live off of the interest or growth of your account without touching the principal (a.k.a. your original investment) it is very possible to never run out of money!

The number one skill you need to have in order to get rich is patience. Compound interest will not make you a millionaire overnight. Earning compound interest is about as exciting as watching paint dry on a wall or grass grow in your lawn. However, it is crucial if you want to experience major growth in wealth over your lifetime.

Few people can become millionaires overnight. For the other 99%, it takes time, patience, and regular contribution!

On the other side of the coin, compound interest can be your enemy. Consider the credit card in your wallet. The debt on that credit card can compound in the same way that interest compounds on your investments.

Pop quiz!

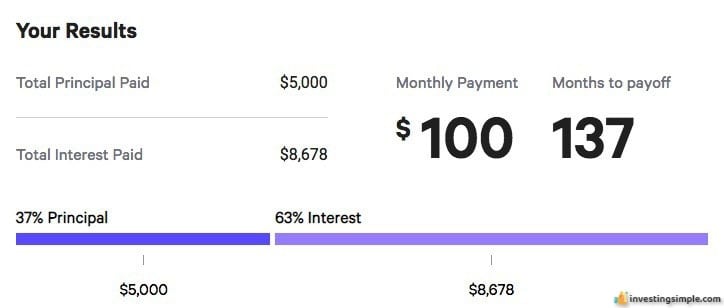

Let's say you have a $5,000 limit on your credit card and you made the unfortunate mistake of maxing it out. Your interest rate on this card is 22% and you are making a payment of $100 a month.

First, how long will it take you to pay off this card?

And second, how much did you pay in total in interest and principal?

Don't worry, most people can't answer this. It seems like something that would have been useful to learn in school, but the world just doesn't work like that.

If you were paying off $5,000 in debt with no interest at $100 a month, it would take you just 50 months to pay off that debt. If you were paying off $5,000 in debt at $100 a month with 22% interest, it would take you 137 months to pay off that debt.

Here is how I found this out.

To answer the second question, you would pay $5,000 in principal and $8,678 in interest at a total of $13,678!

Would you rather roll a boulder uphill or downhill? Earning compound interest is like rolling a boulder downhill. Paying off compound debt is like rolling a boulder uphill. As we said before, compound interest does not discriminate. It can be your best friend or your worst enemy.

There are many ways that you can earn compound interest. Some of these methods are better than others as you will see by going through the examples.

While this isn't the best way to earn compound interest, interest earned from a bank account is compound interest. With a savings account, checking account, money market, or certificate of deposit, for example, you can earn compound interest at various intervals.

Interest rates paid from banks are generally low but have increased recently. As of 2025, the average high-yield savings account interest rate is around 4-5% APY (Annual Percentage Yield), while traditional savings accounts may still offer much lower rates, often below 1%. You should always shop around for the best rates.

One important factor to consider is inflation. While the average inflation rate fluctuates, in recent years it has ranged from about 3% to 6%. That means if your average return from an investment does not exceed this rate, you are actually losing purchasing power over time.

Investing in the stock market is one of the best ways to earn compound interest through capital appreciation. If you are interested in learning more, check out our beginner's guide to investing in the stock market!

With the stock market, higher risk yields a higher potential for reward. Long-term stock market investors can expect an average annual return of about 7-10%, depending on the period and index measured. It is important to remember that you will not see this type of return every single year! This is the average return experienced over a long period of time.

At a 10% return, you would double your money every 7.2 years using the "Rule of 72," where you divide 72 by your expected annual return to estimate doubling time. That's why compound interest is best achieved when started at a young age. A young person would be able to experience more of these doubling cycles than an older person. This is why it is imperative that you get started early.

Another way you can earn compound interest is through dividends. Dividends are regular cash payments paid out to shareholders. When you are investing in a dividend stock, you have two options. The first option is to receive these dividends in cash and the second is to reinvest these dividends.

Reinvesting your dividends through a Dividend Reinvestment Plan (DRIP) allows you to purchase more shares, which in turn generate more dividends for you—this is a powerful way to achieve compound-like growth within your stock portfolio. While DRIPs are not technically compound interest, they function similarly by increasing your investment base and future dividend income.

Another common way that people earn compound interest is by investing in real estate. If this type of investment interests you, check out our comprehensive guide on real estate investing for beginners!

Here is one of the ways that you can earn compound interest through real estate. Consider an investor who flips properties for a living. This is a type of real estate investor who buys a piece of real estate for cheap, fixes it up, and sells it for a profit.

In Year 1, they invest $100,000 in a piece of real estate. They fix it up and after expenses, they make a profit of $15,000 on the flip. This investor made a return of 15%.

In Year 2, they invest $115,000 in another piece of real estate. They fix it up and they earn another 15% return, but this time it is a profit of $17,250!

At a 15% return per year, you would double your money every 4.8 years. Remember, riskier investments have a higher potential return, and higher return investments will have a shorter doubling cycle.

One of the problems with investing in real estate is that it typically requires a high upfront capital investment. If you are looking to own a two-family home, get ready to put down $20,000 or more!

Fundrise is a real estate investing platform that has come up with an interesting solution to this problem. Thanks to modern-day technology, people from all over can pool their money together to invest in real estate projects. You can read our full review of Fundrise here.

There are a number of advantages to this. First of all, the minimum to get started is just $10 making the barriers to entry significantly lower. Second of all, you are investing in a diversified pool of real estate and not just one property.

If you own a two-family house and one of the units goes vacant, you just lost 50% of your rental income from the property. If you and 1,000 other people collectively own 10,000 units of real estate all over the world, one vacancy will not make a difference. That is the beauty of diversification.

Newer platforms and trends in 2025 are making real estate investing even more accessible. For example, tokenized real estate—where you can buy digital tokens representing shares in real estate assets through blockchain technology—offers even lower minimums and greater liquidity. Always research and choose reputable platforms.

Fundrise and similar, vetted platforms are great investment options for earning compound interest!

Learn more about Fundrise here!

The world of investing is constantly evolving. Here are some additional ways people are harnessing compound growth in 2025:

Understanding the tax consequences of your investments can help you maximize your compound growth. Here are key points to consider:

Using tax-advantaged accounts can significantly enhance your wealth-building over time.

Consider the story of Laura, who started investing just $100 per month at age 22 in a diversified portfolio earning an average of 8% annually. By age 65, her account balance had grown to over $400,000, thanks to compounding and consistent contributions.

Or take Mark, who focused on reinvesting dividends from blue-chip stocks through a DRIP. Over 30 years, his initial $20,000 investment ballooned to more than $300,000, even though he never made additional contributions beyond reinvesting his dividends.

These stories illustrate the power of starting early and letting compounding do the heavy lifting.

Here are actionable steps you can take today to start earning compound interest:

Try out these interactive tools to see the power of compound interest in real time:

When I was younger, I can remember my dad sitting down with me and showing me a compound interest calculator. Unfortunately, not everyone is as lucky as I was to get exposed to this at a young age.

As mentioned earlier, the most important factor when it comes to earning compound interest is time. The more time you have, the longer you can allow your money to grow.

If you are wondering when the best time is to start, the answer is now!

Don't forget to grab your free stock worth up to $200 from Robinhood today!