Warren Buffett is arguably the most successful investor of our time.

Buffett will retire as CEO of Berkshire Hathaway in early 2026, with Greg Abel succeeding him in this role. At 94 years old in 2025, Buffett's net worth has grown to over $120 billion, increasing by more than $16 billion this year despite market volatility. Known for his philanthropy, Buffett continues to give generously, with his total donations exceeding $41 billion over the past years, notably contributing to the Bill and Melinda Gates Foundation.

Buffett's legacy includes not only immense wealth but also a commitment to strategic, disciplined investing and giving.

Aside from his investment acumen, Buffett remains modest in lifestyle, though his focus today is on steering Berkshire Hathaway's future following his retirement and legacy planning.

Much of Buffett's wealth was earned later in life, with 99% of his net worth accumulated after his 50th birthday. Millions of investors admire his approach, and in this article, we explore seven ways you can think and invest like billionaire Warren Buffett in 2025.

Did you hear about Warren Buffett buying weed stocks? Or jumping on the latest cryptocurrency craze? Probably not.

Buffett remains faithful to investing in what he understands deeply. Cryptocurrencies and many new tech assets fall outside his circle of competence, with Apple being a notable exception in the tech sector. If you want to invest like Buffett, stick to industries and businesses you comprehend well.

The elevator pitch test remains a simple yet powerful tool: can you explain what a company does and how it makes money within 30 seconds? If not, you likely don't fully understand the investment.

Understanding the business helps you avoid panic selling when prices drop, allowing you to see beyond short-term volatility and focus on long-term value.

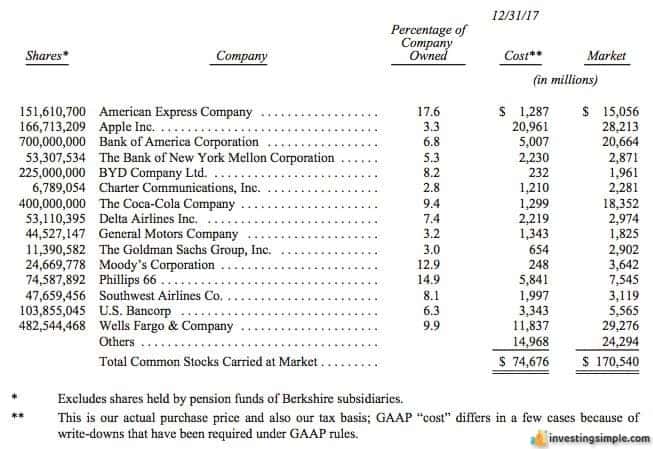

Buffett's portfolio is concentrated in banking, insurance, consumer staples, and utilities—simple and durable sectors. As of 2025, Apple remains Berkshire Hathaway's largest holding, valued at over $60 billion, followed by American Express, Bank of America, and newer substantial positions in Constellation Brands and Domino's Pizza.

Buffett also recently made a notable $6 billion investment in Japanese trading houses, demonstrating a willingness to look beyond the U.S. for strategic opportunities.

Another Buffett hallmark is investing in durable, time-tested businesses with long track records through various market cycles. Blue-chip stocks that have survived decades are often places he prefers to put capital.

The Dow Jones Industrial Average can be a good starting point for identifying such companies.

"Price is what you pay. Value is what you get." - Warren Buffett

Buffett is a long-term value investor who focuses on the intrinsic worth of companies rather than market hype. He notes that assessing true value is challenging, which is why he recommends most individual investors consider low-fee index funds.

Index funds provide broad market exposure with a low cost, a sensible choice given that over 90% of active stock pickers fail to beat the market.

Most investors chase high-priced stocks or short-term momentum, but Buffett advises buying shares trading at or below their intrinsic value based on solid fundamentals and company assets.

Buffett's patience is legendary. He often holds investments for decades—some American Express shares date back to 1964.

Short-term market fluctuations are unpredictable and should not drive your investment decisions. Instead, focus on companies with durable competitive advantages that will thrive over the next decade or more.

Buffett learned from mentor Benjamin Graham the importance of contrarian investing. Buying during market fear and selling amid euphoria can generate outsized returns.

This wisdom rings especially true as the market swings between optimism and pessimism. Buffett's record $334 billion cash hoard reflects his strategy of waiting for the right opportunities rather than being fully invested at all times.

In 2025's higher interest rate environment, with bond yields at 4-5%, bonds have become more attractive compared to prior years, influencing Buffett's advice to adjust stock vs. bond allocations based on market valuations.

Buying quality companies on sale and avoiding the herd mentality are key Buffett principles.

"We have long felt that the only value of stock forecasters is to make fortune tellers look good." - Warren Buffett

Buffett advises forming your own well-researched investment opinions rather than following market hype or analyst predictions.

One straightforward way to invest like Buffett is buying Berkshire Hathaway stock. Berkshire Hathaway Class A shares remain extremely pricey—over $320,000 per share—as the company has never split them. However, Class B shares (BRK.B), priced around $215, provide a more accessible option for retail investors.

While Berkshire Hathaway has outperformed the S&P 500 historically, generating a compounded annual gain of about 20.9% from 1965 to 2017, Buffett has acknowledged it may become harder to beat the market going forward due to the company's enormous size and the scale of investments required.

With Buffett's 2025 retirement and Greg Abel's succession, Berkshire Hathaway's future investment approach may evolve.

"Give a man a fish and you feed him for a day. Teach a man to fish and you feed him for a lifetime." - Chinese Proverb

Learning to invest on your own skills is more valuable than solely following Buffett's moves.

Buffett places great importance on strong, honest management teams. He evaluates how companies treat shareholders, employees, customers, and the environment.

Look for companies with a consistent record of dividends, dividend growth, and share buybacks. Reading annual reports, earnings calls, and management interviews can provide valuable insights.

If you're unwilling to dig deep into companies, Buffett's recommended two-fund portfolio might be more suitable.

Buffett has shared a simple retirement investment plan for the average person: invest 90% in a low-fee S&P 500 index fund and 10% in a government bond fund.

In 2025, with bond yields higher than the ultra-low rates of recent years, this allocation may shift slightly based on market conditions.

Vanguard's S&P 500 fund and short-term Treasury bond funds remain excellent options, available commission-free on platforms like M1 Finance.

Buffett's key advice is to own the entire market if you are not actively picking stocks and to maintain a long-term investing focus.

For personalized investing strategies, consulting a financial advisor is recommended.

Here are additional ways to invest like Warren Buffett in 2025:

Buffett favors companies with a durable competitive advantage or “moat” that protects their profits over time.

Apple, for example, has a strong moat due to its proprietary technology, vast network of users, significant scale, and large start-up costs for competitors.

Buffett famously mocks Wall Street analysts, saying "We've long felt that the only value of stock forecasters is to make fortune-tellers look good."

He conducts thorough research and sticks to his principles rather than following the crowd.

Developing your own investing knowledge takes time and effort, but it is essential to making informed decisions.

While social conversations about stocks are common, Buffett's principles warn against following hot stock tips blindly, as they often violate investing rules like understanding what you own.

Rely on your own strategy rather than chasing tips to build a sustainable investment approach.

Emotional decisions often lead to costly mistakes. Long-term investors like Buffett do not react to daily market swings but focus on the bigger picture.

Market panic can be an opportunity to buy quality companies at discounted prices, reflecting Buffett's advice to be greedy when others are fearful.

If you find yourself obsessively checking stock prices on apps like Robinhood, you may be letting emotions interfere with your investing discipline.

Buffett remains cautious about investing in emerging trends such as cryptocurrencies and most new technology companies outside his expertise. His recent investments remain focused on proven, understandable businesses, except for Apple, which he regards as an essential part of modern life.

This reinforces his longstanding principle to stay within your circle of competence and avoid speculative or overly complex investments.

Investing is a journey of learning and perseverance. Even Buffett makes mistakes; for example, he sold his entire airline holdings in response to the COVID-19 pandemic, incurring significant losses despite the business fitting many of his criteria.

The key is to learn from errors and adapt your strategies over time.

If deeply analyzing stocks is not appealing, Buffett's recommended index fund strategy may be better suited for you.

For those keen to pursue individual stock investing, applying Buffett's principles of patience, value, and discipline can guide you toward success.

Don't forget to grab your free stock worth up to $200 from Robinhood today!