Cash App and Robinhood are two platforms designed to make investing and banking easy.

In this article, we provide all the steps necessary to transfer from Cash App to Robinhood.

There are three possible options for transfers, all of which are covered within:

Let's dive right in!

Check out my video on how to transfer your brokerage account below, let's dive in!

Regardless of what type of transfer you're looking to do, you'll need to open a Robinhood account.

Use the button above to get a completely free stock when you sign up! Keep in mind that limitations apply to this promotion.

Investors often find themselves wanting to transfer their stock holdings from one brokerage platform to another for various reasons.

If you're a Cash App Investing user looking to move your stocks to an external brokerage account, you can do so using the Automated Customer Account Transfer Service (ACATS).

In order to initiate the ACATS transfer from Cash App to Robinhood, you will need to find your Cash App account number. This number can be found at the top of any trade confirmations or monthly statements.

With the account number, you are all set to initiate the transfer. The receiving broker—Robinhood—will work with Cash App's carrying broker, DriveWealth, LLC, to facilitate the transfer. Please note that as of now, Cash App charges a $75 fee for all completed outbound stock transfers. However, Robinhood might reimburse this fee up to $75 for accounts transferred worth $7,500 or more, so it's best to check their current policies.

Cash App's transfer fee and Robinhood's reimbursement policy can change, so always check the latest terms before initiating a transfer.

Cash App Investing supports the transfer of whole shares only. Any fractional shares you own will remain in your Cash App Investing account. However, you have the option to sell these fractional shares through Cash App after the transfer is complete.

If you are looking to close your entire Cash App Investing account after the transfer, you may wish to sell the fractional amount of shares that you own prior to the transfer. Make sure you consider any tax implications and consult a tax professional if necessary.

ACATS transfers must be initiated by the receiving brokerage, not Cash App. To transfer stocks from Cash App Investing to Robinhood, you’ll start the process directly within your Robinhood account.

To begin the transfer:

Open the Robinhood app or log in on desktop

Navigate to Transfers or Move Money

Select Transfer an account to Robinhood

Choose Cash App Investing (clearing broker: DriveWealth, LLC) as the delivering firm

Enter your 17-digit Cash App Investing account number exactly as it appears on your statements

Choose whether you want a full or partial account transfer

Once submitted, Robinhood will initiate the ACATS request with DriveWealth. Eligible whole shares will transfer automatically, while any fractional shares will remain in your Cash App Investing account.

Most transfers are completed within 3–6 business days. After the request is submitted, Robinhood will provide status updates as the receiving brokerage.

New to the world of Crypto? Check out my full Coinbase tutorial below!

Finally, the other option you have is transferring your Bitcoin from your Cash App wallet to your Robinhood crypto wallet.

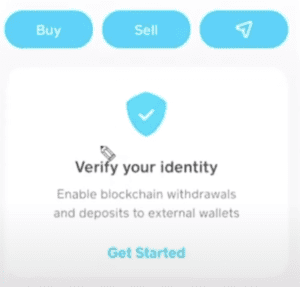

In order to send Bitcoin from Cash App to Robinhood, you will need to verify your account.

This entails taking a photo of the front and back of your government-issued ID. You will also need to activate a Robinhood Crypto Wallet, which requires verification and enabling 2 Factor Authentication.

Here is how to send Bitcoin to another wallet, such as Robinhood, from Cash App:

Don't forget to grab your free stock worth up to $200 from Robinhood today from Robinhood today! (limitations apply)

Both Cash App and Robinhood offer unique features that cater to different user needs. Cash App is great for those who want to manage multiple financial services in one place, while Robinhood is renowned for its commission-free trading and user-friendly interface.

When deciding which platform to use, consider your investment goals and the type of assets you want to manage. Regularly review both platforms' policies and features to ensure you're making the best choice for your financial situation.