Investing in the S&P 500 index remains one of the most accessible ways to gain broad exposure to the largest and most influential publicly traded companies in the United States. Using Robinhood, a popular and user-friendly investment platform, you can easily invest in ETFs that track the S&P 500 without needing to pick individual stocks.

In this updated guide for 2025, we’ll walk you through how to invest in the S&P 500 using Robinhood, explore key strategies such as dollar cost averaging and dividend reinvestment, discuss diversification, taxes, and provide tips to help you build a resilient investment portfolio.

The Robinhood app offers commission-free trades, fractional shares starting as low as $1, and features like recurring investments, making it a great tool for beginners and seasoned investors alike.

If you prefer a visual walkthrough, check out the video tutorial below! (Skip ahead to 7:21 for the Robinhood S&P 500 investing demo.)

The Standard & Poor’s 500 Index is a market value weighted index consisting of the 500 largest publicly traded companies in the US, representing a large portion of the American economy.

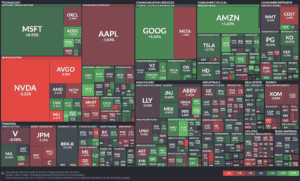

Being market value weighted means companies with larger market capitalizations have a greater influence on the index’s performance. This means stocks like Microsoft, Apple, Amazon, and others carry more weight in the index due to their size.

For instance, Apple remains the most valuable US company, with a market capitalization of approximately $3.17 trillion as of mid-2025.

A heat map from Finviz visually illustrates how the largest companies dominate the index — the bigger the square, the greater the share of your investment allocated there.

Yes, the S&P 500 index composition is dynamic. Since its launch in 1957, companies included in the index have changed over time based on market capitalization and economic importance.

This video by RankingCharts shows the evolution of the top 10 largest market cap companies over recent decades, reflecting the S&P 500’s adjustment to economic shifts.

Investors choose the S&P 500 for a few key reasons:

Warren Buffett famously advised most investors to hold an S&P 500 index fund, emphasizing its reliability and broad exposure.

To invest in the S&P 500 on Robinhood, you’ll typically buy shares of an ETF that tracks the S&P 500 index. ETFs (Exchange-Traded Funds) pool money from investors to hold all the stocks in the index, and trade like a stock on exchanges.

Robinhood offers a streamlined way to invest in these ETFs, with features including fractional shares (invest as little as $1), commission-free trades, and recurring investments.

How to find S&P 500 ETFs on Robinhood:

Dollar cost averaging is a disciplined investment strategy that involves investing a fixed dollar amount at regular intervals regardless of market conditions.

This approach reduces the risk of making a large investment at the wrong time and averages out your purchase price over time.

If you invest $100 every month into an S&P 500 ETF over three months, the number of shares you purchase will vary depending on the ETF’s share price each month:

In total, you invest $300 and own 30.83 shares, making the average cost per share approximately $9.73. If you had invested the full $300 in March at $12/share, your cost basis would be higher.

Many ETFs distribute dividends, which can be automatically reinvested through a Dividend Reinvestment Plan (DRIP). This enables your dividends to buy additional shares, harnessing the power of compounding.

DRIP benefits include:

Robinhood supports automatic dividend reinvestment, which can be enabled via Account → Menu (3-bars) → Investing → Dividend Reinvestment.

While the S&P 500 offers broad exposure to the US market, diversifying beyond it can strengthen your portfolio:

Combining these strategies can reduce overall portfolio risk and improve long-term returns.

Understanding taxes related to ETFs can help maximize your after-tax returns:

Consult a tax professional to tailor strategies to your situation.

The stock market, including the S&P 500, fluctuates in the short term, sometimes dramatically. Yet history shows that maintaining a long-term perspective typically leads to positive outcomes.

For example, despite downturns and volatility, the S&P 500 has returned an average of about 10% annually over the past 100 years. Short-term losses are often temporary; patience and consistency are key to wealth-building.

You can invest as little as $1 by purchasing fractional shares of S&P 500 ETFs on Robinhood.

While Robinhood offers commission-free trades, ETFs charge an expense ratio (annual fund management fee) typically ranging from 0.03% to 0.10%. These fees are deducted automatically from fund returns.

Yes, Robinhood offers recurring investment scheduling, allowing you to invest a fixed amount on a daily, weekly, biweekly, or monthly basis.

You can choose to receive dividends as cash or enroll in a dividend reinvestment plan (DRIP) to automatically reinvest dividends into more shares.

Risks include market volatility, potential economic downturns, and sector-specific shocks. Diversifying your portfolio and maintaining a long-term outlook helps mitigate these risks.

Sign up with Robinhood through our affiliate link here to receive a free stock worth up to $200 when you open your account!

Choose your free stock from a curated list of leading American companies.

Within the app, tap the search icon and type “S&P 500” or the name/symbol of an ETF that tracks the index. Review fund details such as expense ratios and dividend yields before deciding.

On the ETF page, tap the Trade button, select Buy, and enter the dollar amount or number of shares you want to purchase. You can buy fractional shares starting at $1.

Double-check your order details and swipe up to submit your purchase.

To automate investing and apply dollar cost averaging, set up a recurring investment:

Go to Account → Menu (three bars) → Investing → Dividend Reinvestment and enable the feature to automatically reinvest dividends.

Monitor your portfolio regularly using the Robinhood app’s tools to stay informed about performance and dividend payments.

Panic selling during market downturns can lock in losses. Remember, market dips can present buying opportunities, and history shows the S&P 500 rebounds over time.

Pay attention to expense ratios and trading costs. Even small fees can compound and reduce your net returns significantly over the long haul.

While the S&P 500 is diversified within the US large-cap space, consider diversifying internationally and across asset classes to reduce overall portfolio risk.

Investing in the S&P 500 through Robinhood is easier than ever with fractional shares, commission-free trades, and automated investing features. Whether you start with $1 or more, adopting a long-term, disciplined approach with dollar cost averaging and dividend reinvestment can help you build wealth steadily.

Don’t forget to sign up using our link to claim your free stock worth up to $200 as you begin your investing journey.

Happy investing!