Robinhood is a popular investing app that offers commission-free trading for stocks, ETFs, and cryptocurrencies.

Once you've bought a stock on Robinhood, you may decide to sell it and cash out your profits. There are a few steps involved with this process that we will dive into.

Here's how to sell stock on Robinhood and cash out your funds.

Check out our video tutorial below on how to do this - step by step!

First of all, in order to cash out funds from Robinhood, you may need to sell a stock, ETF or crypto that you own.

To sell a stock on Robinhood, you first need to navigate to the stock's detail page. You can do this by searching for the stock in the search bar at the top right of the home screen or by scrolling through your portfolio until you find the stock you want to sell.

Once you've found the stock you want to sell, tap "Trade" at the bottom of the screen.

On the next screen, tap "Sell" to start the process of selling your shares.

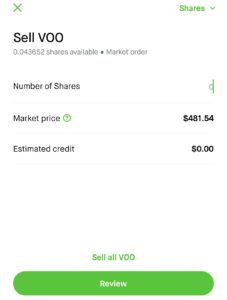

In the upper right corner of the screen, you'll have the option to choose whether you want to sell your shares in dollars or shares. Choose the option that works best for you.

Before you submit your sell order, review the details to make sure everything is correct. You'll see the number of shares you're selling, the price you'll receive per share, and the total value of the sale.

If everything looks good, swipe up to submit your sell order.

Assuming you used a market order, your sell order will be executed at the next available market price.

It's important to note that the settlement period for equities on Robinhood is the trade date plus 1 trading day (T+1), which means it takes one business day for your funds to settle after a sale.

So if you just sold off an asset in Robinhood, you might need to wait until the next business day before you can cash out.

Once you've sold your stock on Robinhood and the funds have settled, you may want to transfer the funds to your bank account or debit card.

To cash out on Robinhood, first select the account icon at the bottom right-hand corner of the screen.

Next, select "Transfers" from the menu.

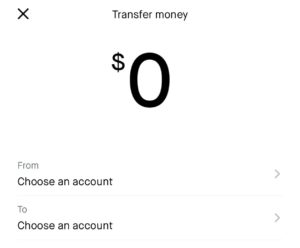

Choose the account you want to withdraw money from - which will be Robinhood if you are looking to withdraw funds to your bank account.

Select the linked account you want to withdraw the money to. This can be a bank account or a debit card.

Enter the amount you want to transfer from your Robinhood account to your external account.

Before you confirm your transfer, review the details to make sure everything is correct. Robinhood offers instant transfers for a fee, but standard transfers come with zero fees.

Finally, select "Transfer" to initiate the transfer of funds.

The transfer can take up to 3 to 5 business days to reflect in your bank account. If you choose an instant transfer, it will normally show up within just a few minutes.

Instant transfers may be subject to a fee, which may change.

While Robinhood is known for its commission-free trading, there are still small regulatory fees that apply when selling stocks. These fees are not charged by Robinhood but are instead imposed by financial regulators.

Though these fees are minimal, it’s important to be aware of them, especially if you engage in frequent trading.

When you sell stocks on Robinhood, you may be subject to capital gains taxes, depending on how long you held the stock and how much profit you made.

In addition, investors should be aware of the IRS wash sale rule, which disallows a capital loss deduction if you buy the same or a substantially identical security within 30 days before or after the sale.

Robinhood provides Form 1099 for tax reporting. You can access it in your account under the Tax Documents section.

You may also be eligible for tax-loss harvesting, where you offset capital gains by selling underperforming stocks at a loss. Robinhood does not offer automated tax-loss harvesting, but investors can manually sell investments at a loss to offset capital gains.

Robinhood operates using a business model called Payment for Order Flow (PFOF), which allows the platform to offer commission-free trading.

Although Robinhood uses payment for order flow, brokers are still required under SEC rules to provide 'best execution' for client trades.

PFOF is when a brokerage firm (like Robinhood) receives compensation for directing customer orders to specific market makers for execution.

Instead of routing trades directly to stock exchanges, Robinhood sells order flow to third-party firms, which execute the trades.

While PFOF allows Robinhood to offer zero-commission trading, some critics argue that it may not always provide the best trade execution price for users. They also can halt trading on their platform anytime (remember the GameStop short squeeze?).

The SEC requires brokers to disclose their PFOF practices, and Robinhood’s execution quality is continuously monitored.