If you are looking to get started with crypto investing, one of the first things you will need is a reliable exchange to buy, sell, and manage your digital assets.

There are many platforms out there, each offering different features - from the number of tokens supported to trading tools, fees, and overall user experience.

With so many options, it can be tough to know which one is best. We'll be breaking down 7 of the most popular cryptocurrency exchanges right now.

Keep reading for the full breakdown, or check out the video below for a quick overview. Let's dive in!

Coinbase is one of the most popular crypto investing apps solely used for buying and selling cryptocurrencies. It is important to note that they do not offer stocks or ETFs - because some other platforms like Crypto.com do offer stocks.

Coinbase is one of the most popular crypto exchanges globally with over 108 million users worldwide. They offer over 250 different cryptocurrencies and you can open an account in over 100 different countries.

The free version of Coinbase has varying transaction fees depending on the payment method, cryptocurrency, transaction size, and platform used.

However, Coinbase also offers a premium feature called Coinbase One which is currently $30 a month. There are no trading fees in Coinbase One if you stay below the $10k monthly trading limit. So if you plan to trade a high volume of crypto monthly, Coinbase One could be a cost effective option to offset fees.

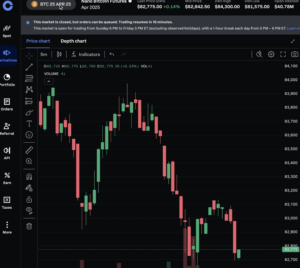

Coinbase also offers a more complex version of their service called Coinbase Advanced, which offers features such as advanced charting tools, low volume-based fees, and access to various trading pairs. This version also comes at no additional subscription cost.

One final noteworthy feature is called Coinbase Wallet. Coinbase Wallet is a platform that allows you to securely store, manage, and trade a wide range of digital assets, including cryptocurrencies.

It is a self-custody wallet, which means that you are able to own the private keys to the wallet. However, this comes with added responsibility too.

Coinbase Wallet is available as a separate app as well as a browser extension for your computer.

Crypto.com is another popular crypto platform where you can trade cryptocurrencies and stocks.

The exchange supports over 400 cryptocurrencies, which is even more than what Coinbase has to offer. They also have commission-free trading of stocks and ETFs.

One of the most unique features they offer is a Visa debit card that allows you to spend your cryptocurrency holdings by converting it into USD or other fiat currencies. The cards have no annual fees and include benefits such as cash back earned, as well as rebates on services such as Spotify, Netflix, Airbnb, and Expedia.

There are also Derivatives on Crypto.com, which let you trade based on the future price of cryptocurrencies without actually owning them. However, this comes with additional risks.

Similar to Coinbase, Crypto.com also offers a non-custodial wallet called the Onchain Wallet. This wallet gives you the private keys. The onchain wallet can be used as an app on your phone or web extension for desktop.

Robinhood is a popular commission free stock trading app with over 20 million users, but they also support other assets like crypto and even options and futures trading. For the sake of this section, we are solely going to be focusing on Robinhood Crypto.

For cryptocurrencies, Robinhood offers about 25 different digital assets, with some having limited availability in specific states like New York. While this number is less than many competitors, they still carry most of the bigger cryptocurrencies.

Robinhood also gives the option to use Robinhood Wallet as a self custody option to manage your digital assets and private key.

From a fee perspective, Robinhood often comes in ahead of the pack compared to the other options on this list. However, the digital asset selection is a lot more limited.

Gemini is another popular crypto exchange that was founded in 2014. They are available in over 60 different countries, including all 50 US states. Gemini is a very secure "regulation-first platform" that could be a good option for users who prioritize safety and compliance.

In addition, they also support over 80 different cryptocurrencies.

Gemini also offers their own crypto credit card which offers cash back in the form of crypto and has no annual fee.

The cash back ranges from 1- 4% depending on the type of purchase, and can be received in your choice of over 50 different types of cryptocurrencies. There is also a welcome bonus of $200 in crypto when you spend $3,000 within the first 90 days of opening an account (subject to change).

Kraken has been around for a long time, and is one of the oldest crypto exchanges on our list.

Founded in 2011, it now boasts over 15 million users globally and is supported in over 190 different countries. It also supports over 400 cryptocurrencies, which is definitely on the higher end of our list.

Kraken is often a good option if you live outside of the USA due to the wide number of countries it is available in. While it is one of the most widely available crypto trading platforms, it is important to note that certain services are restricted in some jurisdictions due to regulatory and compliance reasons.

While there may be some fees to use the platform, Kraken offers a Premium subscription called Kraken+ for $4.99/month that offers zero-fee trading up to $10,000/month.

Kraken also offers NFTs and commission free trading of stocks and ETFs.

Uphold is another crypto platform that is available to a wide range of territories. Uphold can be used in over 140 countries and supports over 300 tokens. In addition, Uphold supports the trading of certain precious metals - which is an added plus for some.

One unique aspect about Uphold is their self proclaimed “radical transparency” with customers. Uphold has their own website section in which they post their assets and liabilities in real-time, and it is updated every 30 seconds.

You can find out Uphold’s live assets and liabilities on this site: https://uphold.com/en-us/transparency

They also make it clear that they are 100% reserved and will never loan out their customers money.

This transparency can likely make some people feel a lot more comfortable, as they are able to monitor the company’s standing at any time.

Fidelity is a trusted financial services firm known for managing trillions in assets and offering retirement, brokerage, and wealth management services. In 2022, it expanded into digital assets by launching Fidelity Crypto.

It is important to note that Fidelity Crypto is only primarily available within the United States, so if you do not live in the US, it probably will not be available to you.

Fidelity currently offers only three cryptocurrencies for direct trading; Bitcoin, Ethereum, and Litecoin.

They also offer two Crypto ETF funds - one for Bitcoin and one for Ethereum - which allow for crypto exposure in various traditional financial accounts.

Note: These ETFs (e.g., FBTC, FETH) are offered through Fidelity's brokerage platform and are not part of the Fidelity Crypto app directly.

With so many exchanges available in 2025, choosing the right one comes down to understanding your needs and how each platform aligns with them.

Here are some of the key factors to consider before signing up.

Are you a long-term holder, an active trader, or just looking to earn passive rewards?

If you're new to crypto, you'll want a platform that's intuitive.

Fees can eat into your profits, especially on smaller trades.

The variety of assets may matter to you.

Some platforms offer more guidance and research than others.

Not every exchange is available in every country or state.

Security should always be a priority.

Having help when you need it is essential.

Finally, trust matters.

Look at platform reviews, regulatory track records, and how well the exchange has handled past challenges or market downturns.

Choosing the right crypto exchange is all about finding the best match for your goals, experience, and trading habits.

Take the time to compare your options, prioritize what matters most to you, and always make sure your investments are secure and well-informed.