American Express is one of the most well known payment card providers globally.

From debit cards to credit cards and more, Amex has become a one stop shop for your financial needs.

However, there might come a time when you are looking to send and receive money using your Amex account.

That brings up a good question; does American Express (Amex) work with Zelle?

Check out my Zelle Tutorial below to learn how to use Zelle!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

Zelle, a digital payment network, facilitates swift, secure, and convenient money transfers between individuals.

The platform's user-friendly interface and quick transaction processing have made it a go-to solution for many individuals and businesses.

Users can access Zelle either through the Zelle app or directly via their banking app - provided their bank has established a partnership with Zelle.

Unfortunately, American Express does not offer a Zelle integration within the Amex app.

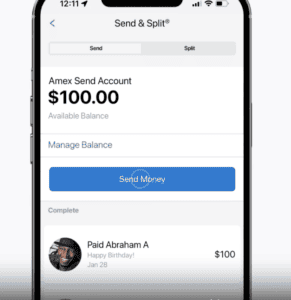

That's because American Express has partnered with PayPal to offer Send & Split - a peer-to-peer payment service right within the Amex app.

You might be wondering if it's possible to link your American Express card within the Zelle app as a workaround.

The answer to that is a no as well - American Express cards are not compatible with the Zelle app.

You can send money using Venmo or PayPal, and you can even do this within the American Express app!

Here's how to do this: