Investing Simple is affiliated with Fundrise, and we earn commissions for this endorsement of Fundrise.

Back in June of 2018, I became a Fundrise investor.

While I have since cashed out the funds to invest elsewhere, this article details my overall experience with Fundrise.

When you invest with Fundrise, you can get started with as little as $10 - making this a highly accessible investment.

In my case, I ended up investing $5,000 with Fundrise while I was testing the waters with this investment.

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

The deposit hit my account on July 2nd and I was officially a Fundrise investor.

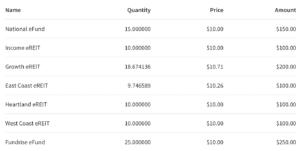

I decided to start out with a $1,000 investment as a test to see how this investment worked and performed.

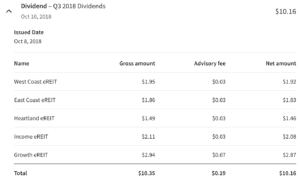

I earned my first dividend on October 10th 2018 which was the Q3 dividend.

This was in the amount of $10.16 and I reinvested it via the auto-invest feature, which allows me to earn compound interest.

I earned my next dividend on January 9th 2019 in the amount of $9.53 which was the Q4 2018 dividend.

My initial account balance was $1,000 but by the time I had earned my Q4 2018 dividend, my balance was up to $1,044.86 meaning I had earned a return of about 4.5% in 6 months!

I was very happy with this.

After 6 months as a Fundrise investor, I decided to scale up my investment to $5,000.

I was satisfied with the return I had received, and I wanted more skin in the game.

Here's what I earned in dividends for the rest of 2019 - after bumping my investment up to $5,000.

Dividends Earned:

As I mentioned earlier, all of my dividends were reinvested back into my Fundrise portfolio.

So, the question everyone is probably wondering is how much money did I make investing with Fundrise?

My total investment of $5,000 earned me a total return of $373.27.

However, I ramped up my investment over time, since I initially started with just $1,000. So this had an impact on the overall return.

Coming directly from the Fundrise dashboard, here are the returns I experienced as a Fundrise investor.

In 2018 I was only invested from July on, so it was only 6 months.

I earned a return of 4.3% or $43.89.

In 2019, I was invested for one full year as a Fundrise investor.

I earned a return of 7.7% or $311.54.

In 2020, I was invested for another full year on the Fundrise platform.

I earned a return of 3.9% or $741.69.

It is important to remember that any real estate investment is going to be a longer term investment, and Fundrise is no exception.

According to their site, Fundrise investors should have a minimum time horizon of 5 years. If you are looking for a short term investment, this is not for you.

Also, keep in mind that liquidity is not guaranteed. They do offer quarterly redemption periods, but you are not guaranteed the ability to cash out at this time.