M1 Finance was launched in 2016 and is an online robo-advisor and brokerage hybrid designed for everyday people who want to invest in stocks, exchange-traded funds (ETFs), and now even cryptocurrencies. The platform focuses on low-cost passive investing with powerful automation features like dynamic portfolio rebalancing and tax efficiency strategies.

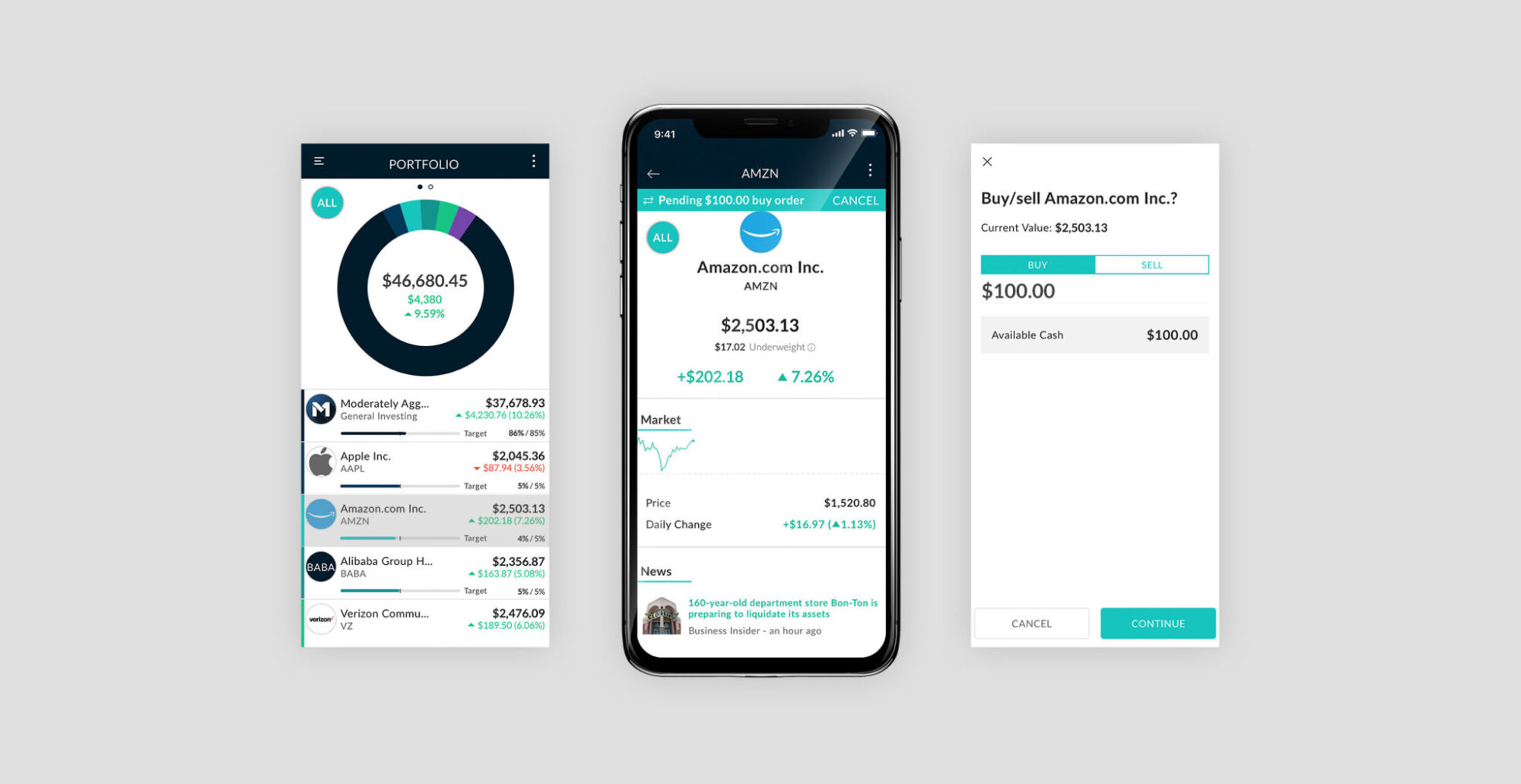

M1 Finance allows you to create your own custom portfolio of ETFs, stocks, and digital assets — all with no trading fees or commissions. You can also invest in one of the dozens of expert-built portfolios for free, something other platforms like Stash and Acorns charge extra for. M1 Finance stands out as one of the few reputable investing platforms offering expert-created portfolios at no additional cost.

A key differentiator for M1 Finance is its support for fractional shares and automated investing. Fractional shares let you invest in high-priced stocks with as little as 1/10,000th of a share, so you can build a diversified portfolio even with limited funds. Your account can be set up to automatically invest your cash balance, and M1 intelligently maintains your portfolio’s target allocations.

Today, investors can start building a well-diversified investment portfolio with as little as $100 for a taxable account, or $500 for a retirement account.

M1 Finance’s most notable features include tax efficiency, Dynamic Rebalancing, automatic investments, dividend reinvestment, and no commissions. Let’s take a closer look at some of these features.

M1 Finance’s Dynamic Rebalancing is more than just smart rebalancing—it’s an intelligent system that automatically prioritizes buying underweight holdings and selling overweight ones to keep your portfolio aligned with your target allocation whenever you add or withdraw funds.

Here’s how it works: you define your “pie”—a visual representation of your desired asset allocation. Each “slice” is a specific stock, ETF, or cryptocurrency, and you set the percentage you want each to occupy in your portfolio. Every time you deposit money or withdraw, M1 queues trades so your portfolio matches your pie, buying low and selling high on your behalf.

This automation makes portfolio management easy, especially for beginners who want to maintain diversification without ongoing manual intervention.

M1 Finance offers a simplified form of tax efficiency. While it does not provide advanced tax-loss harvesting like Betterment, it helps you minimize taxes by prioritizing the sale of assets in the most tax-favored way when you withdraw money.

Here’s the order of operations when you withdraw:

This helps reduce potential tax liabilities and keeps more money in your pocket.

In addition to stocks and ETFs, M1 now supports cryptocurrency investing within your pies. This means you can diversify your portfolio with digital assets, all managed through the same automated, rebalancing system.

With M1 Borrow, you can use your investment account as collateral to access a low-interest portfolio line of credit—up to 35% of your portfolio’s value. This cash can be used for anything, from investing to major purchases. Be aware that if your portfolio’s value drops significantly, M1 may require you to add more funds.

M1 Spend is a digital checking account and debit card that integrates seamlessly with your investment account. It now offers a 4.00% APY on your cash balance, making it a competitive high-yield cash option. Transfers from M1 Spend to your investment account are instant, so your money is always ready to invest.

The account is available to all users, but you’ll need an M1 Plus subscription for premium features like higher cashback rates and other perks.

The M1 Owner’s Rewards Credit Card lets you earn up to 10% cashback when you shop at companies whose stock you own, with over 70 participating brands across three tiers (2.5%, 5%, and 10% cashback). Every other purchase earns 1.5% cashback. You can set your cashback to automatically invest in your pies.

M1 Plus members get the card with no annual fee (pending application approval), while non-Plus members pay a $95 annual fee.

Smart Transfers let you automate money movement between your M1 accounts based on customizable rules. For example, you can set up a rule to automatically invest any excess cash in your M1 Spend account above a certain threshold into your investment account. Smart Transfers are available exclusively to M1 Plus members.

When you sign up with M1, you start with a free account. The premium plan, M1 Plus, costs $125 per year and comes with a host of additional benefits, including:

M1 Plus also offers a 3-month free trial for new subscribers.

M1 Finance is a registered broker-dealer with FINRA and provides account protection through the Securities Investor Protection Corporation (SIPC). SIPC coverage protects up to $500,000 per client, including up to $250,000 for uninvested cash, in the event that M1 fails and is unable to return your securities or cash—such as in cases of misappropriation or bookkeeping errors. It does not protect against losses from market fluctuations.

M1 also uses strong security measures including encryption, two-factor authentication, and secure account protocols. To date, there have been no significant breaches compromising customer accounts.

M1 Finance is known for its low fees, but it’s important to know the details:

M1 Finance makes money from payment for order flow, lending, and premium subscriptions, but these costs are not directly passed on to users as commissions.

M1 Finance is ideal for several types of investors:

M1 Finance is not built for active day traders or investors seeking to trade mutual funds—those users may prefer other brokerages like Robinhood or Fidelity.

When considering M1 Finance vs. competitors like Betterment, Robinhood, or Wealthfront, here’s how M1 stands out:

M1 Finance is a strong choice for long-term investors of all experience levels. With its blend of automation, customization, and integrated financial products, it makes portfolio management both simple and powerful.

Beginners especially will appreciate the easy-to-use “pie” model, fractional shares, and low account minimums. The ability to borrow expert-built portfolios offers a helpful stepping stone for those new to investing.

With robust security, FDIC and SIPC insurance, and a focus on low costs, M1 Finance is one of the most appealing platforms for new investors or anyone looking to streamline their investments.