If you're looking to make the switch from Acorns over to M1 Finance, this is a simple process.

This guide will walk you through the process, step by step!

Check out my video on how to transfer your brokerage account below, let's dive in!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

The first step in the transfer process is to create an M1 Finance account.

Keep in mind, the account type you are looking to transfer needs to match the account type you open with M1 Finance.

Look at your most recent Acorns statement and organize the necessary information, which includes your account number and account type.

M1 will need these details to process the transfer. In addition, they may ask you to upload a copy of the statement, so be sure to download a copy.

Before initiating the transfer process, ensure that you have an open account with M1 Finance that matches the specific account type you're transferring.

For instance, if you're transferring a Roth IRA, it must be directed to an M1 Roth IRA Account.

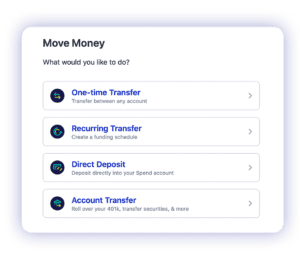

Once you've confirmed the compatibility, navigate to the Home tab within your M1 Finance account.

Look for the "Move Money" option and click on it to proceed with the transfer process.

Within the "Move Money" section, opt for the "Account Transfer" feature, which serves as the starting point for initiating the transfer process.

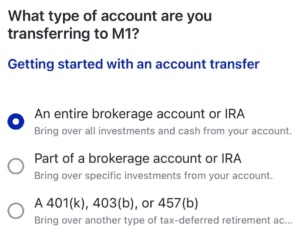

To kick off a full brokerage account transfer, select the appropriate option based on your specific needs and account type.

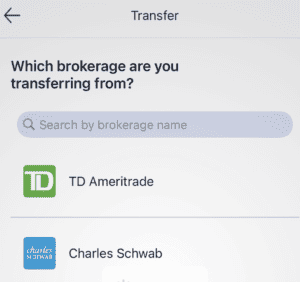

Choose the brokerage from which you're transferring your account - which is Acorns in this case.

Enter the account number of the brokerage account you intend to transfer into your M1 Finance account.

Ensuring the accuracy of this information is crucial for a successful and smooth transfer process.

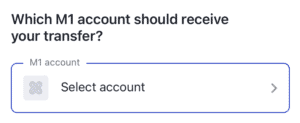

Choose the specific M1 Invest Account that will receive the transferred funds.

After reviewing the details, click the "Continue" button to confirm and initiate the transfer process.

You'll receive a confirmation email shortly after submission.

Keep in mind that Acorns collects a $50 fee per ETF you transfer out of the Acorns portfolio for an account transfer.