Many brokerage platforms now offer access to a variety of REITs (Real Estate Investment Trusts) that pay dividends, allowing investors to potentially earn regular income from real estate investments.

These dividends can be paid out on varying schedules, with many popular REITs paying on a quarterly basis while some premium options like Realty Income pay monthly.

A REIT, or Real Estate Investment Trust, is like a mutual fund for real estate. It's a company that owns, operates, or finances income-producing real estate across various sectors, such as apartments, office buildings, malls, or hotels.

Investors can buy shares in a REIT, which allows them to invest in real estate without having to buy properties themselves.

REITs typically generate income through rent collected from tenants, and they're required by law to distribute at least 90% of their taxable income to shareholders as dividends.

In simple terms, think of REITs as a way for people to invest in real estate without having to buy or manage properties directly, while still earning dividends from the rents collected by the REIT.

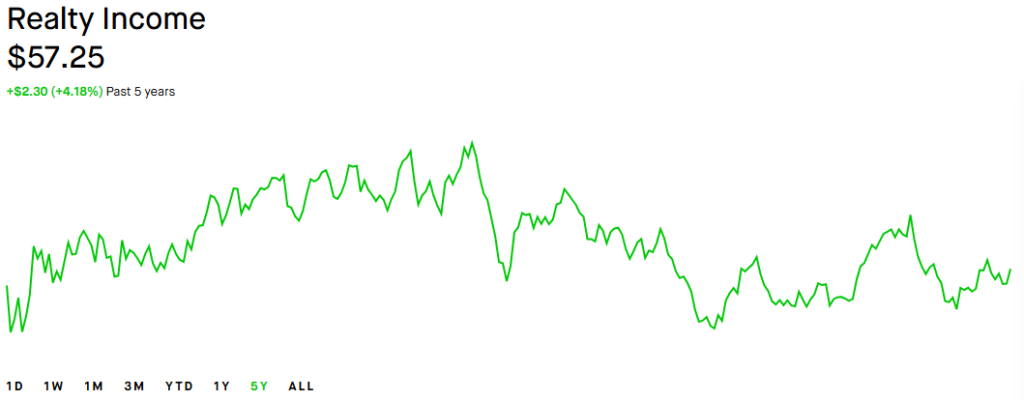

Realty Income Corp is the most popular monthly dividend stock, known as "The Monthly Dividend Company" with an uninterrupted dividend streak spanning 56 years. It focuses on commercial real estate properties with defensive retail segments resistant to e-commerce disruption.

Current Dividend Yield: 5.34%

Realty Income owns over 15,000 properties mostly focused on retail and spread across more than 1,000 tenants operating in roughly 90 different industries. Nearly half of its tenants have investment-grade credit ratings, providing substantial insulation against tenant defaults. The REIT's occupancy rate has never dipped below 96%, even during the financial crisis and pandemic. With an A- credit rating, this defensive positioning makes Realty Income one of the safest monthly dividend payers available.

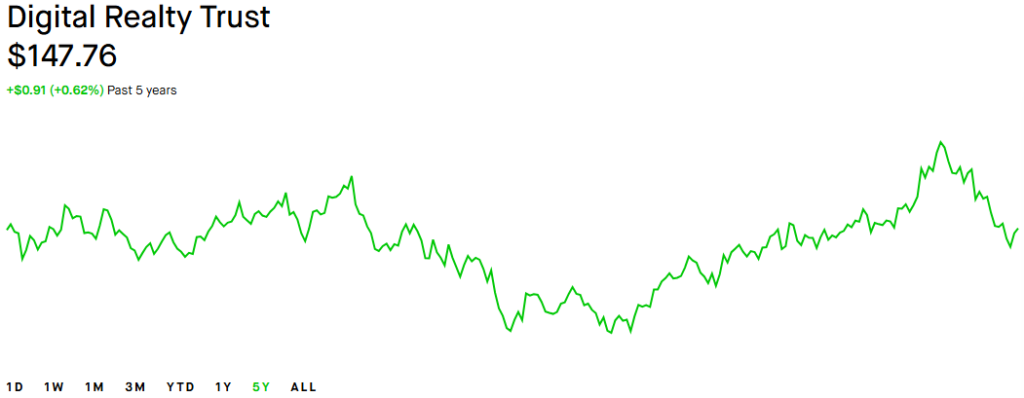

Digital Realty Trust specializes in data center and colocation facilities that serve as the backbone of the digital economy.

Current Dividend Yield: 2.84%

With data center power demand expected to grow 5x-7x over the next 3-5 years driven by AI expansion, Digital Realty is strategically positioned to capitalize on this trend. The company operates globally and provides mission-critical infrastructure to technology companies. Approximately $170 billion in data center asset value needs development or permanent financing in 2025, creating significant growth opportunities for DLR's portfolio. The company maintains its track record of paying regular dividends while strategically investing in high-growth data center markets worldwide.

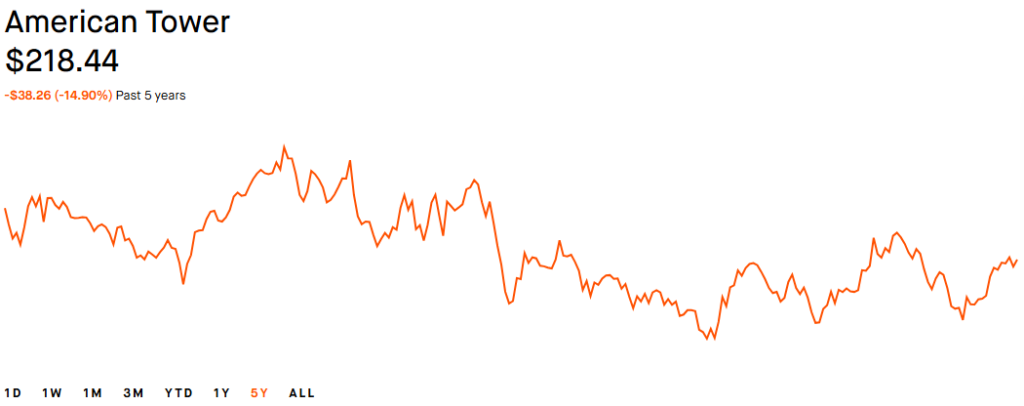

American Tower Corp is a REIT that owns and operates wireless communication towers across the globe. It leases space on these towers to telecommunications companies, including all major wireless carriers.

Current Dividend Yield: 3.53%

American Tower operates over 220,000 cell towers globally, with approximately 40,000+ towers in the US, 75,000+ in India, and significant presence in Latin America, Europe, and Africa. Despite the promising growth from 5G expansion and global wireless infrastructure demand, investors should note the concerning 238.27% payout ratio which suggests the company may be distributing more than it's earning. This could indicate potential sustainability concerns for the dividend in the long term unless operational improvements materialize. American Tower remains a significant player in the communication infrastructure industry with established relationships with major telecommunications companies worldwide.

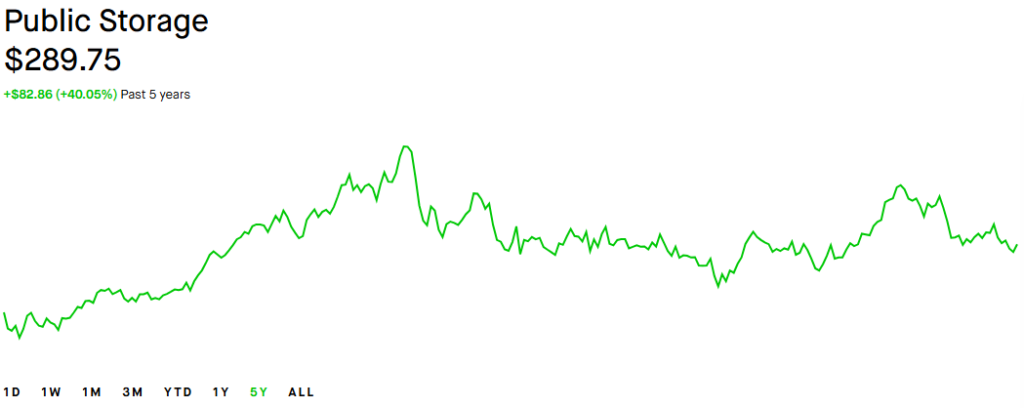

Public Storage is a leading self-storage REIT that owns and operates storage facilities across the United States.

Current Dividend Yield (as of October 2025): 3.86%

This self-storage giant benefits from the sector's resilience amid housing market dynamics, as periods of housing transitions typically increase demand for storage solutions. The company generates revenue by renting storage units to both individuals and businesses. With current valuation suggesting Public Storage is trading below fair value estimates, it represents one of the most compelling value opportunities in the REIT sector for income-focused investors seeking above-average yields.

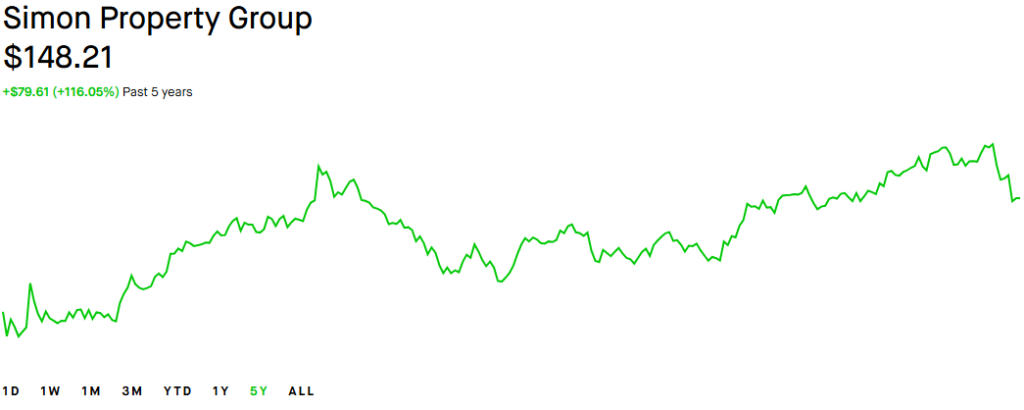

Simon Property Group is a REIT focused on owning and operating high-quality shopping malls and premium outlet centers across the United States.

Current Dividend Yield (as of October 2025): 4.83%

Simon Property Group maintains a portfolio of over 200 high-quality properties, primarily focusing on A-rated malls and premium outlets rather than struggling regional malls. This strategic focus has allowed SPG to maintain strong fundamentals despite e-commerce pressures, with same-store net operating income (NOI) growth in the recent quarter. The company has consistently increased its dividend for several consecutive years, demonstrating management's commitment to shareholder returns. As consumers continue to value experiential retail destinations, Simon's portfolio of high-traffic properties remains well-positioned to deliver reliable income and modest growth.

When considering REIT investments, dividend yield alone provides an incomplete picture. Here are key metrics to evaluate:

When investing in Real Estate Investment Trusts (REITs), understanding the tax treatment of your dividends and gains is essential. Here are the key tax considerations with updated information:

Most REIT dividends are taxed as ordinary income. This means they're subject to your marginal federal income tax rate, which can be as high as 37%. Unlike qualified dividends from regular corporations, REIT dividends typically do not receive preferential tax rates.

Under the Tax Cuts and Jobs Act of 2017 (as amended by the One Big Beautiful Bill Act), investors are eligible for a permanent 20% deduction on qualified REIT dividends through the Qualified Business Income (QBI) deduction (Section 199A). This deduction reduces the effective maximum federal tax rate on REIT dividends from 37% to 29.6% for eligible taxpayers. Additionally, starting in 2026, there will be a minimum QBI deduction of $400 for taxpayers with at least $1,000 in total QBI. The phase-in ranges have been increased from $100,000 to $150,000 for joint filers and $50,000 to $75,000 for other taxpayers.

A portion of a REIT's dividend may be classified as a return of capital. This amount is not immediately taxable but instead reduces your cost basis in the investment. When you eventually sell your REIT shares, your capital gains may be higher due to the adjusted basis, resulting in taxes at that time.

Holding REITs in tax-advantaged accounts such as IRAs or 401(k)s can be particularly beneficial. Since income earned in these accounts isn't taxed annually, you can defer taxes on dividends and capital gains, or even avoid them altogether in the case of Roth accounts. This strategy is especially valuable for high-yield REITs where the tax implications of ordinary income taxation would otherwise reduce your net returns.

In addition to federal taxes, REIT dividends may also be subject to state and local income taxes, depending on your jurisdiction. Because tax laws vary by state, it's important to consult with a tax advisor to understand your specific obligations, especially if you're investing in REITs that own properties across multiple states.

REIT stock prices tend to appreciate more slowly than other stocks due to their unique structure and investment focus, but 2025 has shown improving fundamentals. Here's why:

While they may not offer high-growth potential like some technology stocks, REITs can be a reliable source of income and portfolio diversification. With current sector fundamentals showing 3% NOI growth and trading at discounts to fair value, REITs offer an attractive combination of income and modest appreciation potential in 2025.

Beyond individual REIT stocks, investors have several other options to gain exposure to the real estate sector:

REIT ETFs: The ALPS REIT Dividend Dogs ETF (RDOG) tracks an equal-weighted index that selects the five highest yielding US REITs within nine REIT segments. With 47 holdings including Medical Properties Trust (MPW), Digital Realty Trust (DLR), and LXP Industrial Trust, this ETF provides diversified exposure to high-yield REITs with a single investment. Other popular options include the Vanguard Real Estate ETF (VNQ) and iShares Core U.S. REIT ETF (USRT).

REIT Mutual Funds: For investors preferring professionally managed portfolios, funds like Morgan Stanley Institutional Fund Real Estate Portfolio (MXREX), Ivy Real Estate Fund (IVRSX), and Cohen & Steers Quality Realty Fund (CSQ) offer experienced management of REIT portfolios.

Real Estate Crowdfunding: Platforms like Fundrise, RealtyMogul, and Yieldstreet allow investors to participate in private real estate investments with lower minimums than traditional commercial real estate. These platforms offer diversification across property types and geographic regions.

A: REITs have shown strong resilience in 2025, with the sector delivering approximately 4.1% year-to-date returns. With dividend yields averaging around 4-6% across many quality REITs and projected FFO growth of 3% in 2025, REITs offer a compelling combination of income and modest growth potential. They also provide portfolio diversification benefits as real estate often has a low correlation with traditional stocks and bonds.

A: REITs offer significant advantages over direct real estate ownership, including liquidity (publicly traded REITs can be bought and sold like stocks), lower investment minimums (typically the price of a single share), instant diversification across multiple properties, and no management responsibilities. However, direct real estate ownership provides more control and potential tax advantages like depreciation deductions that aren't available through REITs.

A: Most publicly traded REITs can be purchased for the price of a single share, which typically ranges from $50-$200 depending on the company. If your brokerage supports fractional shares, then this amount could be even less! REIT ETFs often have similar minimums. Real estate crowdfunding platforms usually require minimum investments between $500-$1,000, while private REITs may require minimum investments of $25,000 or more.

A: Most REIT dividends are taxed as ordinary income (up to 37% federal rate), unlike qualified dividends from regular corporations which receive preferential tax rates (maximum 20%). However, REIT investors can claim the 20% QBI deduction which effectively reduces the maximum rate to 29.6%. Additionally, a portion of REIT dividends may be classified as return of capital (not immediately taxable) or capital gains (taxed at lower rates).

A: Yes, and it's often advantageous to do so. Holding REITs in tax-advantaged accounts like IRAs or 401(k)s allows you to defer taxes on the dividends (in traditional accounts) or avoid them entirely (in Roth accounts). This is particularly beneficial for high-yield REITs where the tax implications of ordinary income taxation would otherwise significantly reduce your net returns in a taxable account.

REITs continue to offer investors a compelling combination of current income and modest growth potential. With sector fundamentals showing improving occupancy rates, stable rent growth, and moderating interest rates, now presents an attractive entry point for income-focused investors.

When building your REIT portfolio, consider diversifying across sectors to balance risk and reward. Data center and healthcare REITs offer growth potential, while self-storage and triple-net lease REITs like Realty Income provide defensive characteristics. Always evaluate the sustainability of dividends by examining payout ratios and FFO growth trends.

As with any investment, REITs should be part of a well-diversified portfolio aligned with your risk tolerance and investment goals. Consider holding REITs in tax-advantaged accounts to maximize after-tax returns, and remember that quality REITs with strong balance sheets and defensive business models tend to weather economic downturns better than their more leveraged counterparts.

With current valuations suggesting many REITs trade at discounts to fair value and dividend yields providing attractive income potential, the sector offers a valuable opportunity for patient investors seeking reliable income streams in today's market environment.