Robinhood offers access to a variety of REITs (Real Estate Investment Trusts) that pay dividends, allowing investors to potentially earn regular income from real estate investments.

These dividends can be paid out on varying schedules, but most commonly are paid on a quarterly basis.

Here are a few examples of popular REITs available on Robinhood that have historically paid dividends.

New to Robinhood? Check out my full tutorial below!

| Company | Ticker | Dividend Yield | Payment Frequency | Payout Ratio |

|---|---|---|---|---|

| Realty Income Corporation | O | 5.65% | Monthly | 87.02% |

| Digital Realty Trust | DLR | 3.60% | Quarterly | 80.82% |

| American Tower Corporation | AMT | 3.19% | Quarterly | 69.66% |

| Public Storage | PSA | 4.29% | Quarterly | 70.35% |

| Simon Property Group | SPG | 5.62% | Quarterly | 77.32% |

A REIT, or Real Estate Investment Trust, is like a mutual fund for real estate. It's a company that owns, operates, or finances income-producing real estate across various sectors, such as apartments, office buildings, malls, or hotels.

Investors can buy shares in a REIT, which allows them to invest in real estate without having to buy properties themselves.

REITs typically generate income through rent collected from tenants, and they're required by law to distribute a significant portion of their earnings to shareholders as dividends.

In simple terms, think of REITs as a way for people to invest in real estate without having to buy or manage properties directly, while still earning dividends from the rents collected by the REIT.

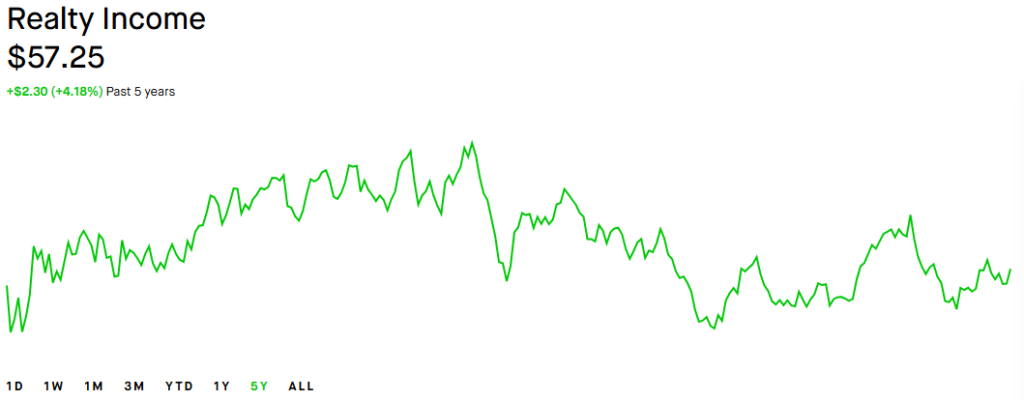

Realty Income Corp is a well-known REIT that focuses on commercial real estate properties.

Dividend Yield (as of 4/16/24): 5.65%

It has a long history of consistently paying monthly dividends, making it popular among income-oriented investors.

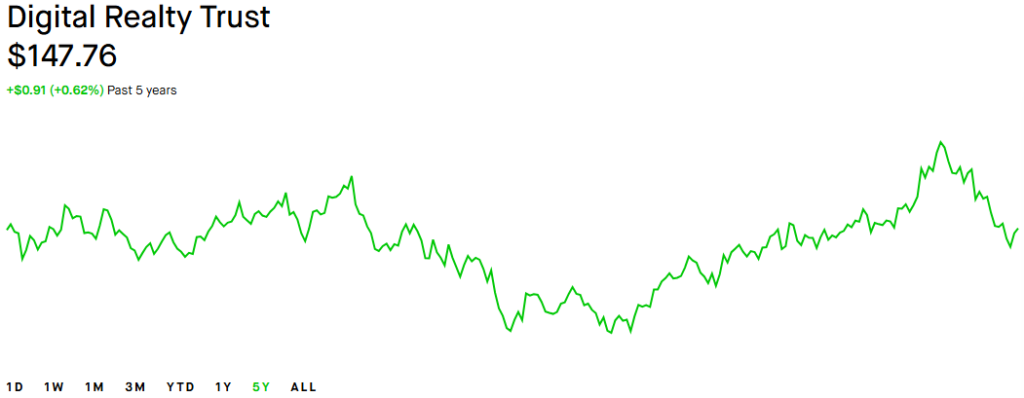

Digital Realty Trust specializes in data center and colocation facilities.

Dividend Yield (as of 4/16/24): 3.60%

It operates globally and provides mission-critical infrastructure to technology companies. DLR has a track record of paying regular dividends to its shareholders.

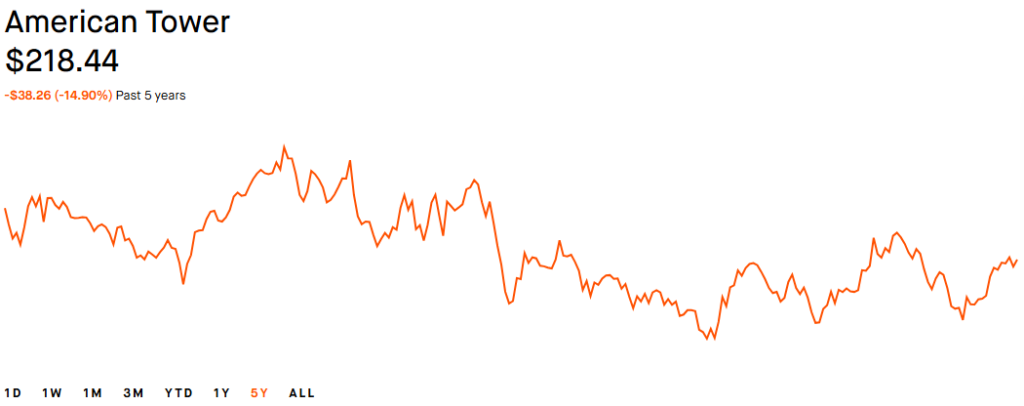

American Tower Corp is a REIT that owns and operates wireless communication towers. It leases space on these towers to telecommunications companies.

Dividend Yield (as of 4/16/24): 3.19%

AMT has a history of paying dividends and is a significant player in the communication infrastructure industry.

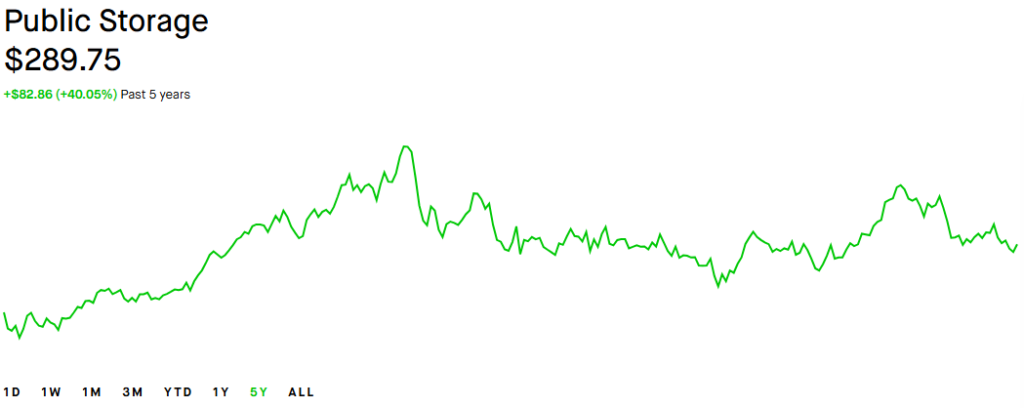

Public Storage is a self-storage REIT that owns and operates storage facilities across the United States.

Dividend Yield (as of 4/16/24): 4.29%

It generates revenue by renting storage units to individuals and businesses. PSA has a consistent dividend payment history and is a recognized leader in the self-storage industry.

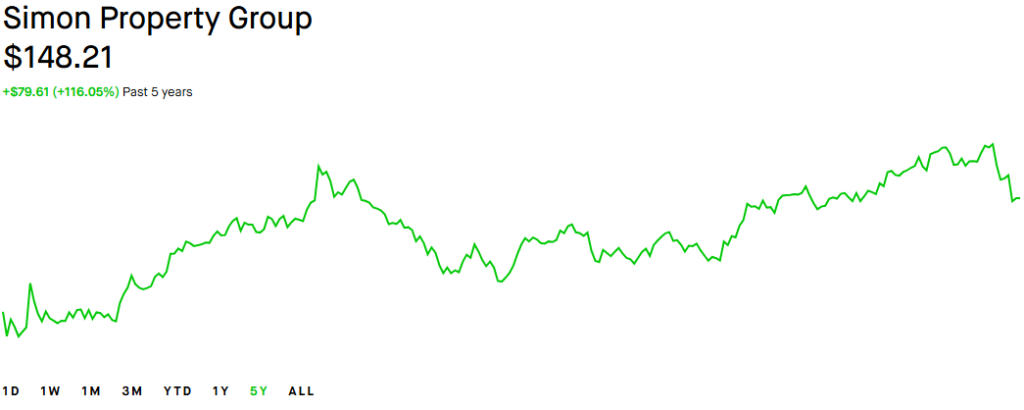

Simon Property Group is a REIT focused on owning and operating shopping malls and premium outlet centers.

Dividend Yield (as of 4/16/24): 5.62%

It has a significant presence in the retail real estate sector and has a track record of paying dividends to its investors.

When investing in Real Estate Investment Trusts (REITs), understanding the tax treatment of your dividends and gains is essential. Below are some key tax considerations:

Most REIT dividends are taxed as ordinary income. This means they're subject to your marginal federal income tax rate, which can be as high as 37%. Unlike qualified dividends from regular corporations, REIT dividends typically do not receive preferential tax rates.

Under the Tax Cuts and Jobs Act of 2017, investors may be eligible for a 20% deduction on qualified REIT dividends through the Qualified Business Income (QBI) deduction (Section 199A). This deduction can effectively reduce the maximum federal tax rate on REIT dividends from 37% to 29.6% for eligible taxpayers. However, this provision is set to expire at the end of 2025 unless extended by future legislation.

A portion of a REIT's dividend may be classified as a return of capital. This amount is not immediately taxable but instead reduces your cost basis in the investment. When you eventually sell your REIT shares, your capital gains may be higher due to the adjusted basis, resulting in taxes at that time.

Holding REITs in tax-advantaged accounts such as IRAs or 401(k)s can be beneficial. Since income earned in these accounts isn't taxed annually, you can defer taxes on dividends and capital gains, or even avoid them altogether in the case of Roth accounts. This can be an effective strategy for income-focused investors.

In addition to federal taxes, REIT dividends may also be subject to state and local income taxes, depending on your jurisdiction. Because tax laws vary by state, it's important to consult with a tax advisor to understand your specific obligations.

REIT stock prices tend to appreciate more slowly than other stocks due to their unique structure and investment focus. Here are a few key reasons:

While they may not offer high growth, REITs can be a reliable source of income and portfolio diversification due to their consistent and legally mandated dividends.