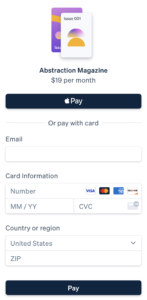

Stripe is a widely recognized online payment processing platform that enables businesses to accept payments securely and efficiently.

Founded in 2010, the company has gained immense popularity due to its user-friendly interface and robust features.

Stripe allows businesses to process payments made through credit cards, debit cards, and digital wallets seamlessly.

It provides an all-in-one platform for managing transactions, handling subscriptions, and even supporting international payments.

However, you might be wondering if you can accept Zelle payments using Stripe.

Check out my Zelle Tutorial below to learn how to use Zelle!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

Zelle is a peer-to-peer payment service that allows individuals to send money directly to one another.

Zelle partners with various financial institutions, including major banks, to facilitate these transactions.

Users can initiate transfers through the Zelle app or directly from their banking app if it supports Zelle integration.

Stripe does not have an option for accepting Zelle payments within the payment processor.

That's because Stripe offers their own Zelle alternative called Payment for Stripe.

This service enables you to accept payments in a similar manner to Zelle.

If you want to accept Zelle payments too, check with your business bank account provider to see if they support Zelle integration.