There are tons of new cryptocurrency platforms each with various benefits and offerings.

MetaMask, founded in 2016, has become popular as it functions as an extension rather than a full web platform. While MetaMask was initially built for Ethereum, it now supports many EVM-compatible blockchains such as Polygon, Binance Smart Chain (BSC), and Avalanche.

Crypto.com has one of the largest collections of coins available for trading.

If you want to transfer your assets to a new platform, we highlight each step to transfer from MetaMask to Crypto.com within.

New to the world of Crypto? Check out my full Coinbase tutorial below!

You will need a fully verified Crypto.com account.

The first step is to locate the type of cryptocurrency you are transferring over.

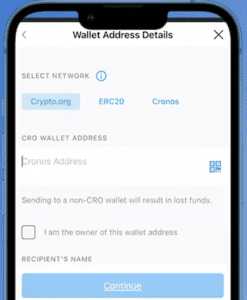

Each crypto has a unique wallet address.

Copy the address for the crypto you are looking to send over from MetaMask.

If you use the Crypto.com DeFi Wallet (non-custodial), transfers from MetaMask may be even easier since both wallets function similarly and support similar chains.

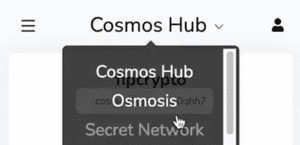

Now, head over to the MetaMask app to locate the crypto asset you're sending over to Crypto.com.

Make sure it matches the type of crypto for the wallet you just copied!

One of the most critical steps in transferring assets from MetaMask to Crypto.com is ensuring that you select the correct blockchain network.

Each cryptocurrency can exist on different blockchains — for example, USDT can operate on Ethereum (ERC20), Binance Smart Chain (BEP20), and others.

When copying the wallet address from Crypto.com, pay close attention to which network it specifies. Then, in MetaMask, make sure you're sending the asset using the same network.

If you send crypto to the wrong network, you could lose your funds permanently — so always verify before confirming the transaction.

Pro Tip: When receiving assets on Crypto.com, it will show you a specific network (ERC20, BEP20, etc.). Always double-check the network and match it in MetaMask — never assume it's ERC20.

Next, paste in the wallet address you copied over from Crypto.com - ensuring it matches the type of crypto you are sending over.

Lastly, before you confirm and send the transaction through, check out the fees.

Gas fees are the transaction fees you must pay to miners when transferring assets on blockchains like Ethereum. These fees can sometimes be higher than the amount you're transferring if you aren't careful!

Before sending your crypto:

Saving even a few dollars on gas fees adds up, especially if you're making multiple transfers over time.

Even when following instructions carefully, hiccups can happen. Here's how to handle some common problems:

Transferring crypto from MetaMask to Crypto.com is usually not a taxable event by itself — but it can become taxable if it involves selling, swapping, or spending crypto.

Depending on your country's laws:

Pro Tip: Use a crypto tax tracking tool like Koinly, CoinTracker, or TokenTax to automatically log your transactions for tax time.

When in doubt, consult a licensed accountant familiar with cryptocurrency taxation in your jurisdiction!

Transferring crypto from MetaMask to Crypto.com involves a few simple yet crucial steps.

Ensure accuracy in copying the crypto address and selecting the correct network to prevent any loss of assets.