If you're looking to make the switch from Acorns over to M1 Finance, this is a simple process that can help you save on fees and gain more control over your investments.

This guide will walk you through the process, step by step!

Check out my video on how to transfer your brokerage account below, let's dive in!

Many investors choose to transfer from Acorns to M1 Finance for several key reasons:

| Feature | Acorns (2025) | M1 Finance |

|---|---|---|

| Monthly Fee | Bronze: $3 Silver: $6 Gold: $12 |

Free (M1 Plus: $12.50/month) |

| Transfer-Out Fee | $35-$50 per ETF | $100 standard $200 for retirement accounts |

| Account Minimum | $0 | $0 |

| Investment Options | Pre-built portfolios (limited customization) | Custom portfolios with 5,000+ stocks/ETFs |

| Retirement Accounts | IRAs with matching feature | IRAs, Trust accounts |

| Banking Features | Checking (2.57% APY), Savings (4.05% APY) | Checking (2.0% APY with M1 Plus) |

The first step in the transfer process is to create an M1 Finance account.

Keep in mind, the account type you are looking to transfer needs to match the account type you open with M1 Finance.

Look at your most recent Acorns statement and organize the necessary information, which includes your account number and account type.

M1 will need these details to process the transfer. In addition, they may ask you to upload a copy of the statement, so be sure to download a copy.

Before initiating the transfer process, ensure that you have an open account with M1 Finance that matches the specific account type you're transferring.

For instance, if you're transferring a Roth IRA, it must be directed to an M1 Roth IRA Account.

M1 Finance requires that you wait at least 6 business days from the last deposit into an investment account before initiating an account transfer. This is a critical detail that many users overlook, which can cause transfer requests to be rejected.

If you've recently deposited funds into M1 that you plan to transfer from another account, make sure to account for this holding period in your transfer timeline.

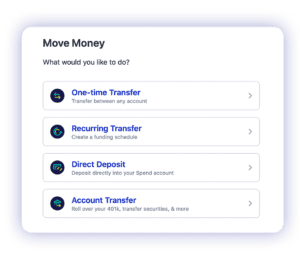

Once you've confirmed the compatibility and waited the required holding period, navigate to the Home tab within your M1 Finance account.

Look for the "Move Money" option and click on it to proceed with the transfer process.

Within the "Move Money" section, opt for the "Account Transfer" feature, which serves as the starting point for initiating the transfer process.

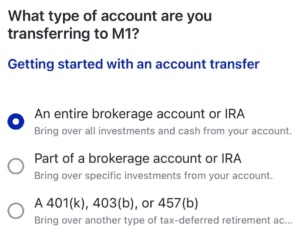

To kick off a full brokerage account transfer, select the appropriate option based on your specific needs and account type.

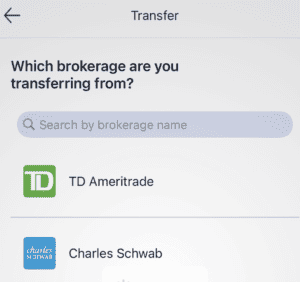

Choose the brokerage from which you're transferring your account - which is Acorns in this case.

Enter the account number of the brokerage account you intend to transfer into your M1 Finance account.

Ensuring the accuracy of this information is crucial for a successful and smooth transfer process.

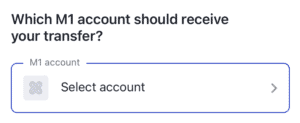

Choose the specific M1 Invest Account that will receive the transferred funds.

After reviewing the details, click the "Continue" button to confirm and initiate the transfer process.

You'll receive a confirmation email shortly after submission.

Keep in mind that Acorns charges $35-$50 per ETF you transfer out of the Acorns portfolio for an account transfer. This fee structure can make transferring accounts with many ETFs expensive.

M1 Finance also charges fees for outgoing transfers:

Alternative Transfer Method: If your Acorns account contains many ETFs, it may be more cost-effective to sell your positions, transfer the cash to your bank, and then reinvest at M1. However, this approach may trigger capital gains taxes in taxable accounts.

Fractional shares cannot be transferred via ACAT (the standard transfer process) and will be automatically liquidated at market value before transfer. This is particularly important for Acorns users who likely hold fractional shares from round-up investments.

When your transfer completes, securities will be displayed outside your M1 "Pie" upon arrival. You'll need to use the M1 Research tab to add these transferred stocks and funds to your current portfolio.

Some investments may not be compatible with M1's platform and will need to be liquidated before transfer. This includes certain proprietary Acorns funds and the Acorns Bitcoin ETF.

Understanding the tax consequences of your transfer is crucial:

Consider consulting with a tax professional before initiating your transfer, especially if you have significant gains in a taxable account.

ACAT transfers typically take 3-6 business days to complete. Both platforms usually provide tracking tools to monitor your transfer progress. During this time, you won't be able to trade the assets being transferred.

If you've sold positions and are transferring cash instead, the process may be faster (typically 1-3 business days for bank transfers).

After your transfer completes, verify these key items:

Transferring from Acorns to M1 Finance can be a smart move for investors seeking more control over their portfolios and lower fees. While the process is straightforward, paying attention to the details—especially regarding fractional shares, transfer fees, and tax implications—will ensure a smooth transition.

Remember that if you choose to transfer your account, only full shares are guaranteed to transfer. Fractional shares may need to be liquidated and transferred as cash. Always double-check your transfer details before confirming, and don't hesitate to contact both Acorns support and M1 support if you encounter any issues during the process.