If you're looking to transfer your assets from Ally Invest to Robinhood, here is our step by step guide.

This is possible through the ACATS transfer service.

Check out my video on how to transfer your brokerage account below, let's dive in!

| Key Transfer Details | Ally Invest to Robinhood |

| Transfer Fee (Ally Invest) | $50 (standard); $75 for IRAs ($50 transfer + $25 closure) |

| Transfer Fee (Robinhood) | $0 on receiving end |

| Fee Reimbursement | Robinhood reimburses up to $75 for transfers of $7,500+ in assets |

| Standard Transfer Time | 5-7 business days (as of October 2025, new ACATS system may reduce to 3-4 days) |

| IRA Transfer Specials | Robinhood Gold offers 3% match on IRA contributions (requires $5/month subscription) |

| Non-Transferable Assets | Mutual funds, bonds, T-bills, crypto, futures, fractional shares |

Before initiating your transfer, take these important steps to ensure a smooth process:

If you're transferring assets worth $7,500 or more, you'll qualify for Robinhood's transfer fee reimbursement program. Keep documentation of your Ally Invest transfer fee to claim the reimbursement after completing your transfer.

Ally Invest charges a standard $50 fee for all ACATS transfers. This includes both full and partial account transfers.

For IRA accounts, there's an additional fee structure: $50 transfer fee + $25 IRA closure fee = $75 total when closing an IRA account.

Robinhood doesn't charge anything on the receiving side.

Good news for large transfers: Robinhood will reimburse you for up to $75 of the transfer fee when transferring $7,500 or more in equity, options, and cash assets. This means you won't pay any fees for substantial transfers.

You should prepare ahead by having at least $50-$75 available in your Ally Invest cash balance to cover the transfer fees. If you're transferring an IRA, make sure you have $75 available.

Before initiating your transfer, verify that your account type is eligible for transfer:

If you're transferring an IRA, you'll need to maintain the same IRA type (traditional to traditional or Roth to Roth). You cannot convert between IRA types during the transfer process.

Not all assets can be transferred between brokerages. Here's what you need to know:

Assets that CAN be transferred:

Assets that CANNOT be transferred:

For assets that cannot transfer directly:

Cost basis information is crucial for accurate tax reporting. Here's what happens during the transfer:

For your tax records, keep copies of your Ally Invest account statements. This is especially important if you're transferring an account that you've held for multiple years with many transactions.

Understanding the transfer timeline will help set proper expectations:

Starting October 2025, the ACATS system has been enhanced to reduce standard transfer times to 3-4 business days for many transfers. However, IRA transfers may still take up to 10 business days as noted in Ally's documentation.

During the transfer process, your Ally account will be restricted - you cannot buy or sell securities, and you cannot deposit or withdraw cash from the account being transferred.

Here are common problems and how to resolve them:

The first step you need to take is setting up your new brokerage account with Robinhood.

If you already have an account with Robinhood, you can move on to the next step.

Use the button above to get a completely free stock when you sign up! Robinhood offers valued at $5-$200 (approximately 99% receive $5). Plus, Robinhood Gold subscribers earn 3.75% APY on uninvested cash balances.

To locate your Ally Invest account number, follow these steps:

Important additional information you'll need:

For partial transfers, you'll need to specify exactly which positions you want to transfer (entering "all" or "total" will make the request void as per Ally's documentation).

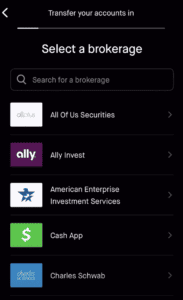

Once you have opened a brokerage account with Robinhood, the next step is to initiate the transfer within Robinhood.

This is only possible via the Robinhood app, so you will want to download this onto your phone.

You can execute the transfer with the steps below:

After submitting, Robinhood will send your transfer request to their clearing firm (Robinhood Securities/RHS), which will then submit it to Ally Invest. You'll receive email confirmation from Robinhood when the transfer is initiated.

Keep in mind that "residual sweeps" may occur after your initial transfer. Any unsettled trades, dividends, or remaining cash will transfer in subsequent sweeps, usually completed within 1-2 weeks.

Once your transfer is complete, take these important steps:

For IRA transfers, remember that Robinhood offers a 3% match on annual IRA contributions if you're a Robinhood Gold subscriber ($5/month). This is in addition to their standard 1% match on IRA transfers and 401(k) rollovers.

Most standard transfers take 5-7 business days to complete. Starting October 2025, the ACATS system has been enhanced to reduce transfer times to 3-4 business days for many transfers. However, IRA transfers may still take up to 10 business days to complete. Cost basis information can take an additional 15 calendar days to appear in your Robinhood account.

No, cost basis information is legally required to transfer with your account. Ally Invest must send your cost basis information to Robinhood within 15 calendar days of the transfer. Your average cost calculations may not display accurately in Robinhood until this information arrives.

Fractional shares cannot transfer directly. Ally Invest will automatically sell them as part of a "residual sweep," and the proceeds will be transferred as cash to your Robinhood account. This typically happens after your initial transfer is complete.

Yes, but there are additional fees and considerations. Ally charges $75 total for IRA transfers ($50 transfer fee + $25 closure fee). You must maintain the same IRA type (traditional to traditional or Roth to Roth). Robinhood offers a 1% match on IRA transfers and 401(k) rollovers, with a 3% match on annual contributions for Robinhood Gold subscribers.

Transfers can sometimes be canceled, but it depends on how far along the process is. Contact Robinhood support immediately if you need to cancel. Note that if Ally has already processed the transfer request, cancellation may not be possible, and you may still be charged the transfer fee.