Cash App and Webull are two platforms designed to make investing and banking easy.

In this article, we provide all the steps necessary to transfer from Cash App to Webull.

There are at least two possible options for transfers, all of which are covered within:

Let's dive right in!

Check out my video on how to transfer your brokerage account below, let's dive in!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

Regardless of what type of transfer you're looking to do, you'll need to open a Webull account.

Use the button above to get free stocks when you sign up!

New to Webull? Check out my full tutorial below!

Webull does not support account transfers under $500 in value, so keep this in mind.

Investors often find themselves wanting to transfer their stock holdings from one brokerage platform to another for various reasons.

If you're a Cash App Investing user looking to move your stocks to an external brokerage account, you can do so using the Automated Customer Account Transfer Service (ACATS).

In order to initiate the ACATS transfer from Cash App to Webull, you will need to find your Cash App account number.

This number can be found at the top of any trade confirmations or monthly statements.

With the account number, you are all set to initiate the transfer. The receiving broker - Webull - will work with Cash App's carrying broker, DriveWealth, LLC, to facilitate the transfer.

Cash App Investing charges a $75 fee for all completed outbound stock transfers.

Webull does not charge any fees on the receiving end.

Cash App Investing supports the transfer of whole shares only. Any fractional shares you own will remain in your Cash App Investing account.

However, you have the option to sell these fractional shares through Cash App after the transfer is complete.

If you are looking to close your entire Cash App Investing account after the transfer, you may wish to sell the fractional amount of shares that you own prior to the transfer.

Make sure you consider any tax consequences first!

Once you have your 17 digit Cash App account number, the transfer is pretty simple.

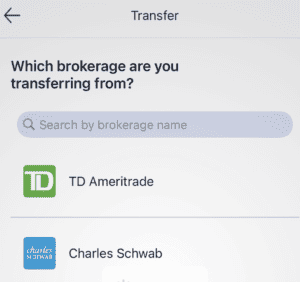

You will perform the steps below within the Webull app:

Finally, the other option you have is transferring your Bitcoin from your Cash App wallet to your Webull crypto wallet.

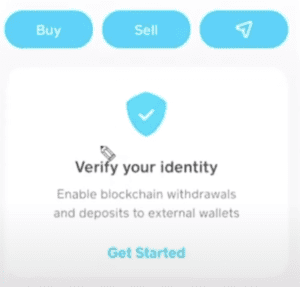

In order to send Bitcoin from Cash App to Webull, you will need to verify your account.

This entails taking a photo of the front and back of your government issued ID.

You will also have to activate a Webull Crypto Wallet, which will also require verification as well as enabling 2 Factor Authentication.

Here is how to send Bitcoin to another wallet, such as Webull, from Cash App: