If you're looking to move your investments from E*TRADE to Interactive Brokers, you've come to the right place.

In this article, we'll walk you through the steps to transfer your assets without the need to sell your stocks or ETFs and move to cash.

Keep in mind that E*TRADE charges an Account Transfer (ACAT) fee.

This fee is $75 for a full account transfer and $25 for a partial account transfer.

Be prepared to cover these fees as part of the transfer process.

Check out my video on how to transfer your brokerage account below, let's dive in!

Interactive Brokers is a popular brokerage firm known for its advanced trading tools, a wide range of investment products, and competitive fees.

Whether you're an experienced trader or a novice investor, Interactive Brokers offers a platform with many options.

Learn more about Interactive Brokers here!

The transfer between E*TRADE and Interactive Brokers uses the Automated Customer Account Transfer Service (ACATS), a system developed by the National Securities Clearing Corporation (NSCC) to automate asset transfers between brokers.

Initiation: You start the process at Interactive Brokers (the receiving firm).

Verification: E*TRADE (the delivering firm) validates account details within 3 business days.

Asset Transfer: Securities move electronically to IBKR, typically completing in 5-7 business days.

Why timelines matter:

Transfers initiated early in the week avoid weekend/holiday delays.

Retirement accounts may take longer due to custodian requirements.

If you don't already have an Interactive Brokers account, the first step is to open one.

Visit the Interactive Brokers website and follow their account opening process, which typically includes providing personal information.

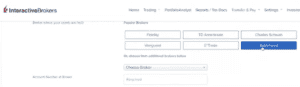

In the dropdown menu that appears under "Transfer & Pay," select "Transfer Positions."

This is the option you'll use to initiate the transfer of your assets from E*TRADE.

In the next window, you'll see a list of popular brokers.

If you don't find E*TRADE listed, use the drop-down menu to access more options.

Stocks/ETFs

Bonds

Cash

Most mutual funds

Options contracts

Fractional shares: Automatically liquidated by E*TRADE

Proprietary investments: E*TRADE-specific funds may need liquidation

Recent dividends: Reinvested dividends create fractional shares that delay transfers

![]()

To initiate the transfer, you'll need to input your E*TRADE account number.

You can typically find this information on your E*TRADE account statements or within your E*TRADE account dashboard.

How to find your E*TRADE account number:

FOP (Free of Payment):

For DTC-member brokers

Requires manual asset authorization

DWAC (Deposit/Withdrawal at Custodian):

Direct transfers from transfer agents

Partial Transfers:

Specify exact assets to move

| Issue | Resolution |

|---|---|

| Rejected transfer | Verify name/Tax ID match exactly |

| Fractional shares | Liquidate manually pre-transfer |

| Dividend timing | Delay transfer until after ex-dividend date |

Cost Considerations:

E*TRADE fee: $75 (full) / $25 (partial)

IBKR fee: $0 for incoming ACATS

Tax implications: ACATS avoids capital gains vs. liquidating