If you're looking to switch brokerage platforms, the ACATS transfer makes things simple.

In this article, we will discuss how to transfer from E*TRADE to Robinhood, as well as any applicable fees.

Don't forget to grab your free stock worth up to $200 from Robinhood today!

Check out my video on how to transfer your brokerage account below, let's dive in!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

E*TRADE supports account transfers through the ACATS service. This type of transfer is also supported by Robinhood.

For a full account transfer, E*TRADE charges a $75 one time fee deducted from your brokerage account cash balance.

The good news is, Robinhood will reimburse you this transfer fee up to $75 if your transferred account value is $7,500 or more.

The first step you need to take is setting up your new brokerage account with Robinhood.

Use the button above to get a completely free stock when you sign up!

Once you download the app on your phone or begin creating an account on their website, you will be prompted to provide basic information.

In order to transfer your account, you will need your account number.

You can view this by logging on to your E*TRADE account.

Robinhood may also ask you to upload or email a copy of your most recent statement, so it is a good idea to have this on hand.

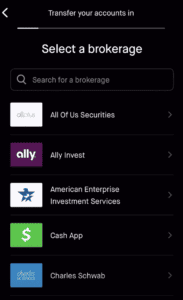

Once you have opened a brokerage account with Robinhood, the next step is to initiate the transfer within Robinhood.

Follow the steps below to initiate the transfer:

Robinhood enables users to track their transfer requests through the app's history section.

Upon initiating a transfer request, it typically takes 5-7 business days for the assets to settle in the Robinhood account. During the transfer period, users will be unable to access the positions being transferred from the external brokerage.

Account transfer requests can face rejection due to various reasons, including incorrect account numbers, the presence of ineligible assets, unmet margin balance requirements, or a lack of approved options trading status.

In such instances, users may need to resubmit their transfer requests to initiate the process again.