If you are looking to transfer assets from one brokerage platform to another, the process is relatively simple and straightforward.

Whatever your reason is for making the switch, we will show you how to transfer from Fidelity to M1 Finance - step by step.

Fidelity does not charge for a full or partial Automated Customer Account Transfer Service (ACAT) transfer, so it won't cost you anything to transfer.

Check out my video on how to transfer your brokerage account below, let's dive in!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

The first step is to open an M1 Finance account.

The next step is to obtain to Fidelity account number.

This information can be found by downloading a copy of your most recent brokerage statement.

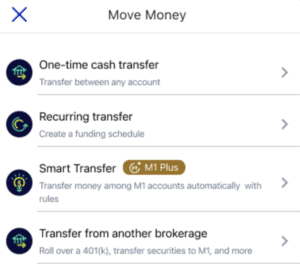

The transfer over to M1 Finance will be initiated within the M1 Finance app.

Here are the steps: