If you're considering transferring your assets from Fidelity to Vanguard, the process is relatively straightforward. Vanguard has a simple 3 step process for transferring over an existing account.

This article will guide you through the necessary steps to ensure a smooth transfer, whether you're moving individual accounts or transitioning between different account types.

If you're looking to learn more, check out my video below on how to transfer your brokerage account.

Let's dive in!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

The first step in the transfer process is establishing an account with Vanguard. If you already have one, you can move on to the next step.

You also have the option to open a new Vanguard account during the transfer process.

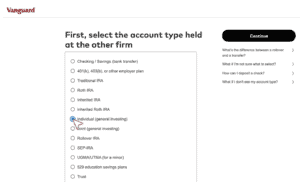

During this step, it's also important to consider the type of account that you'll be transferring. For example, if your Fidelity account is a taxable brokerage account, you will want to open that same type of account with Vanguard.

The same applies to retirement accounts, unless you plan on doing a conversion from one account type to another.

You are going to initiate all of the transfer steps within your Vanguard account. Before initiating the transfer, you'll want to identify the account or accounts you want to move.

Your assets will transfer over "in kind," which means there is no buying or selling. That means you won't have to worry about a potential taxable event associated with selling off your investments.

Keep in mind that transferring between unlike account types may require additional paperwork, such as an IRA Rollover.

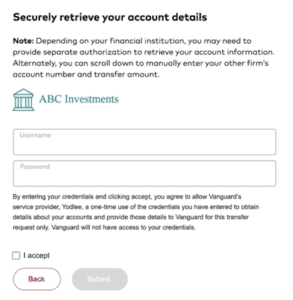

Vanguard is going to need certain information about your Fidelity account in order to complete the transfer. To initiate the transfer, you'll need to gather essential information such as your username, password, and account number from Fidelity.

The easiest method is the electronic transfer, which simply requires you to log in to your Fidelity account.

If an electronic transfer is not possible, submit a copy of your Fidelity account statement dated within the last 90 days.

During this step, it is also important to consider whether or not you are looking to transfer some of your assets or all of your assets. Vanguard supports both partial and full account transfers.

The good news is, Fidelity doesn't charge any fees for transferring assets out. Some platforms charge a fee of $100 or more.

Once you have everything together, you can initiate the account transfer through Vanguard. Electronic transfers can be completed in as little as 5 to 7 days.

You can monitor the progress of your transfer online through the "Track Your Transfer" link on your Vanguard Account Details page.

In the event that a paperwork transfer is necessary, the transfer may take longer.

To initiate a paperwork transfer:

After you initiate the transfer, Vanguard will reach out to Fidelity and provide them with the necessary information. Fidelity will confirm the information provided by Vanguard before transferring your assets. This step ensures accuracy and security.

Once the information is confirmed, your assets will be transferred to Vanguard. Throughout this process, Vanguard will keep you informed about the progress of your transfer.