Are you looking to make the switch from Interactive Brokers to M1 Finance?

M1 Finance has successfully facilitated the transfer of over $2 billion in assets from other brokerage platforms to their platform.

Whether you're moving your full brokerage account, a partial transfer, or even a retirement account, this guide will walk you through the updated steps for 2025.

It's important to note that Interactive Brokers (IBKR) generally does not charge any transfer fees, however, M1 Finance may charge a $100 outgoing transfer fee in some circumstances, such as transferring assets out of M1, so be aware of potential fees depending on your situation.

Also, depending on the type of transfer (full, partial, or retirement), your current brokerage might charge fees, so always check in advance to avoid surprises.

Check out my updated video on how to transfer your brokerage account in 2025 below, and let's dive into the process!

The first step in the transfer process is to create an M1 Finance account.

Make sure the account type you open with M1 Finance matches the account type you plan to transfer (e.g., Roth IRA to Roth IRA, taxable brokerage to taxable brokerage).

Note that in 2025, M1 Finance supports a wide range of account types but some limitations may exist for specific retirement or trust accounts, so verify compatibility on their platform.

Review your most recent IBKR statement and collect all necessary details, including your account number and account type.

Also download a recent account statement because M1 may request it during the transfer process.

Additionally, have handy your broker's DTC number and address, as these might be required during transfer initiation.

M1 Finance requires that the account type you transfer matches exactly the opened account type on their platform.

For example, if transferring a Roth IRA, you must open a M1 Roth IRA account. If transferring a taxable account, the receiving account must be taxable.

In 2025, M1 supports in-kind transfers for supported securities, meaning your holdings can transfer without being sold and rebought, saving costs and preserving investment structure.

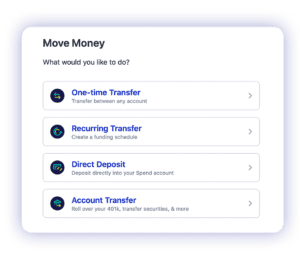

Log into M1 Finance and from the Home tab, click on the "Move Money" option to start the transfer process.

Within the "Move Money" section, choose the "Account Transfer" option to proceed.

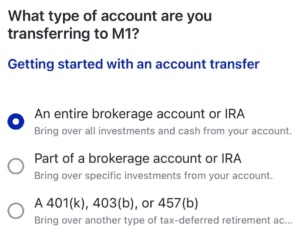

Select whether you want to perform a full transfer or partial transfer based on your needs and account type.

Partial transfers may require you to specify which assets or cash amounts to transfer, and note that fractional shares may be liquidated if not supported on M1’s platform.

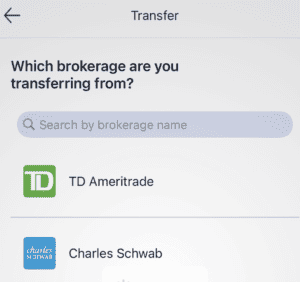

Select Interactive Brokers as the brokerage you are transferring from.

Enter the account number of your Interactive Brokers account to initiate the transfer.

Double-check the information for accuracy to avoid delays.

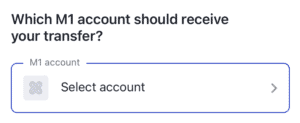

Pick the specific M1 Invest Account that will receive the transferred assets.

After verifying all details, click the "Continue" button to confirm and start the transfer.

You will receive a confirmation email shortly after submission.

Transfer times typically range from 5 to 10 business days, but delays can occur depending on the securities and brokerages involved.

Interactive Brokers offers a vast range of sophisticated trading tools, options, futures, forex, and caters well to active traders, but their interface can be complex and the mobile app has mixed reviews.

In contrast, M1 Finance prioritizes simplicity, automated investing with customizable “pies,” and dynamic rebalancing, making it ideal for long-term, buy-and-hold investors. M1’s platform is more intuitive and user-friendly for average investors looking for ease and automation without trading complexities.