There comes a time when many decide to transfer out of one brokerage account and into another.

If you've found yourself wanting to explore new opportunities or services, such as forex trading or mutual funds, TD Ameritrade might be the next logical step.

In this guide, we'll walk you through the process of transferring your stocks from Robinhood to TD Ameritrade, ensuring a smooth transition.

Check out my video on how to transfer your brokerage account below, let's dive in!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

The easiest and quickest method to transfer your Robinhood account to TD Ameritrade is by utilizing the ACAT system.

ACAT, or Automated Customer Account Transfer, is an electronic service designed to seamlessly move securities between brokerage accounts. This method eliminates the need for physical paperwork, making the transfer process efficient.

Robinhood supports outbound ACAT transfers, but be aware that there is a $100 fee for this service.

TD Ameritrade, however, will reimburse you for this fee once the transfer is complete, provided you submit proof of payment, such as a statement.

You can transfer stocks, options, ETFs and other assets into your TD Ameritrade account from another firm.

However, you are unable to transfer cryptocurrency out of Robinhood. If you have any, you will want to liquidate it into cash.

That cash will transfer into your new TD account. Keep in mind, this could result in a capital gain which you would have to pay taxes on.

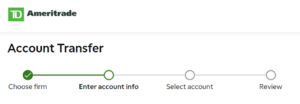

The process is simple from the TD Ameritrade platform:

The standard time period it takes for the transfer into your new TD Ameritrade account is about a week.

Once the transfer process begins, your Robinhood account will be restricted from placing new trades.

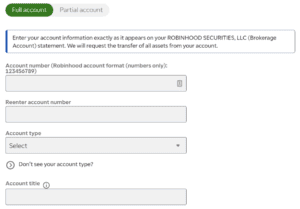

In order to transfer out of Robinhood, you will need to gather some information from them.

The most important is your Robinhood account number. This is also visible on your Robinhood statement, and it is likely that TD Ameritrade will ask you for a copy of this.

How to find your Robinhood account number:

Finally, initiate the ACATS transfer within TD Ameritrade.

This can take a few business days. You will be able to track the progress of the transfer within your TD account.