If you're considering moving assets from TD Ameritrade to Fidelity, this article will guide you through the steps required to make the transition.

Fidelity makes this simple with their Transfer Of Assets process.

Check out my video on how to transfer your brokerage account below, let's dive in!

It's important to be aware of the fees associated with transferring your assets.

In the case of TD Ameritrade, there is an outgoing ACAT (Automated Customer Account Transfer) fee of $75.

This fee is charged by TD Ameritrade when you initiate the transfer. You should call Fidelity and ask if they can reimburse the fee for you. They will sometimes make accommodations for those with larger accounts.

💡 You can avoid this fee by doing a partial transfer and leaving $1 in your TD Account. Keep in mind any fractional shares will have to be liquidated using this method and could result in tax consequences!

Fidelity is a well known financial services company that provides a wide range of investment options, retirement accounts, and top-notch customer service.

Whether you want to transfer your entire investment account or just a portion of it, Fidelity allows you to move various types of assets.

First things first, you'll need a Fidelity account in order to transfer your assets over from TD Ameritrade.

In addition, the name on this account and the type of account this is needs to match the one coming over from TD.

For example, if you're transferring an individual brokerage account, you'll want to open that same type of account with Fidelity.

In order to submit the transfer request, you'll need our current brokerage account number.

The easiest way to find this is by retrieving the most recent copy of your monthly statement.

To locate your TD Ameritrade statement, follow these steps:

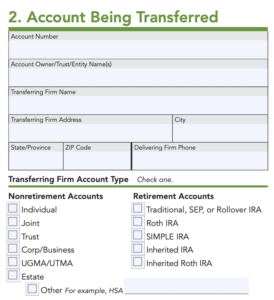

The next step is to submit your transfer request to Fidelity. This can be done conveniently online through Fidelity's platform.

During this process, you will need to provide key information, such as your account number and the assets you wish to transfer.

After submitting your transfer request, you can log in to your Fidelity account and check the status under the "Activity & Orders" section.

Once your request is submitted, Fidelity will take care of the rest. They will contact your current firm and request the transfer of your account assets.

After your current firm receives the transfer request, they will process it and send your account assets to Fidelity.

The timeline for this part of the process can vary, but it's typically completed within 3-5 business days.

Once Fidelity receives the assets from your old brokerage, they will promptly deposit them into your selected Fidelity account. You will have access to your investments, and your transition to Fidelity will be complete.

In most cases, the entire transfer process can be handled online, saving you time and hassle.

Fidelity allows you to transfer most common investment assets, including:

Note: Some proprietary investments or low-liquidity assets—such as certain TD Ameritrade-exclusive mutual funds or penny stocks—may not be eligible for transfer. These will either be left behind or need to be liquidated before the move.

No, transferring your account using the ACATS system is not a taxable event—as long as the account types match (e.g., individual to individual, Roth IRA to Roth IRA). You're simply moving your assets between brokers, not selling them.

However, selling positions or transferring between different account types could trigger tax implications. It’s best to consult a tax advisor if you're unsure.

In most cases, yes—your cost basis, lot information, and purchase history will carry over to Fidelity. However, this data may take a few extra business days to appear after the assets arrive.

Tip: Download your TD Ameritrade transaction history and tax documents before initiating the transfer, just in case anything doesn’t carry over properly.

Yes, Fidelity supports partial ACATS transfers. This allows you to move only specific holdings or a certain dollar amount from your TD Ameritrade account. You can also avoid the fee at TD by doing this!

Be sure to clearly indicate which assets you want to move during the transfer request process.

Most transfers are completed within 5 to 7 business days. Here’s a general timeline:

Your TD Ameritrade account may be temporarily restricted from trading once the transfer process begins.

Yes. TD Ameritrade charges a $75 outgoing ACAT transfer fee if doing a FULL transfer. Partial transfers are free.

Fidelity may reimburse this fee if you’re transferring a significant balance (typically $25,000 or more). You can call their support team at 800-544-6666 to ask about eligibility.

Once the assets arrive in your Fidelity account, consider taking the following steps:

Also, be sure to check for any communications from either broker confirming the transfer details.