If you're considering moving assets from TradeStation to Fidelity, this article will guide you through the steps required to make the transition.

Fidelity makes this simple with their Transfer Of Assets process.

Check out my video on how to transfer your brokerage account below, let's dive in!

It's important to be aware that TradeStation charges a fee for outgoing account transfers (ACAT).

This fee is set at $125 for all outgoing transfers, regardless of whether you're transferring some or all of your positions.

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

Fidelity is a well known financial services company that provides a wide range of investment options, retirement accounts, and top-notch customer service.

Whether you want to transfer your entire investment account or just a portion of it, Fidelity allows you to move various types of assets.

First things first, you'll need a Fidelity account in order to transfer your assets over from TradeStation.

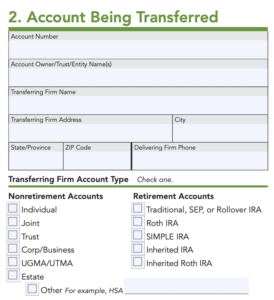

In addition, the name on this account and the type of account this is needs to match the one coming over from TradeStation.

For example, if you're transferring an individual brokerage account, you'll want to open that same type of account with Fidelity.

In order to submit the transfer request, you'll need our current brokerage account number.

The easiest way to find this is by retrieving the most recent copy of your monthly statement.

The next step is to submit your transfer request to Fidelity.

This can be done conveniently online through Fidelity's platform.

During this process, you will need to provide key information, such as your account number and the assets you wish to transfer.

Once your request is submitted, Fidelity will take care of the rest. They will contact your current firm and request the transfer of your account assets.

After your current firm receives the transfer request, they will process it and send your account assets to Fidelity.

The timeline for this part of the process can vary, but it's typically completed within a few days.

Once Fidelity receives the assets from your old brokerage, they will promptly deposit them into your selected Fidelity account. You will have access to your investments, and your transition to Fidelity will be complete.

In most cases, the entire transfer process can be handled online, saving you time and hassle.