Dividends are a portion of the profits that certain companies pay out to investors.

Usually, this is done on a quarterly basis. However, some stocks pay dividends every single month.

Not all companies pay dividends, but many do. There's no requirement that a company must issue dividends to shareholders.

It is often the larger, well-established companies that pay dividends and have for decades.

Think of companies like Coca-Cola, Walmart, and Procter & Gamble. These companies have been paying their investors dividends consistently over many years.

Some investors choose these stocks because they believe the dividends are often consistent but still subject to company discretion.

Keep in mind that a company can reduce or stop paying dividends at any time. If a company cuts its dividend, many investors might be upset and decide to sell.

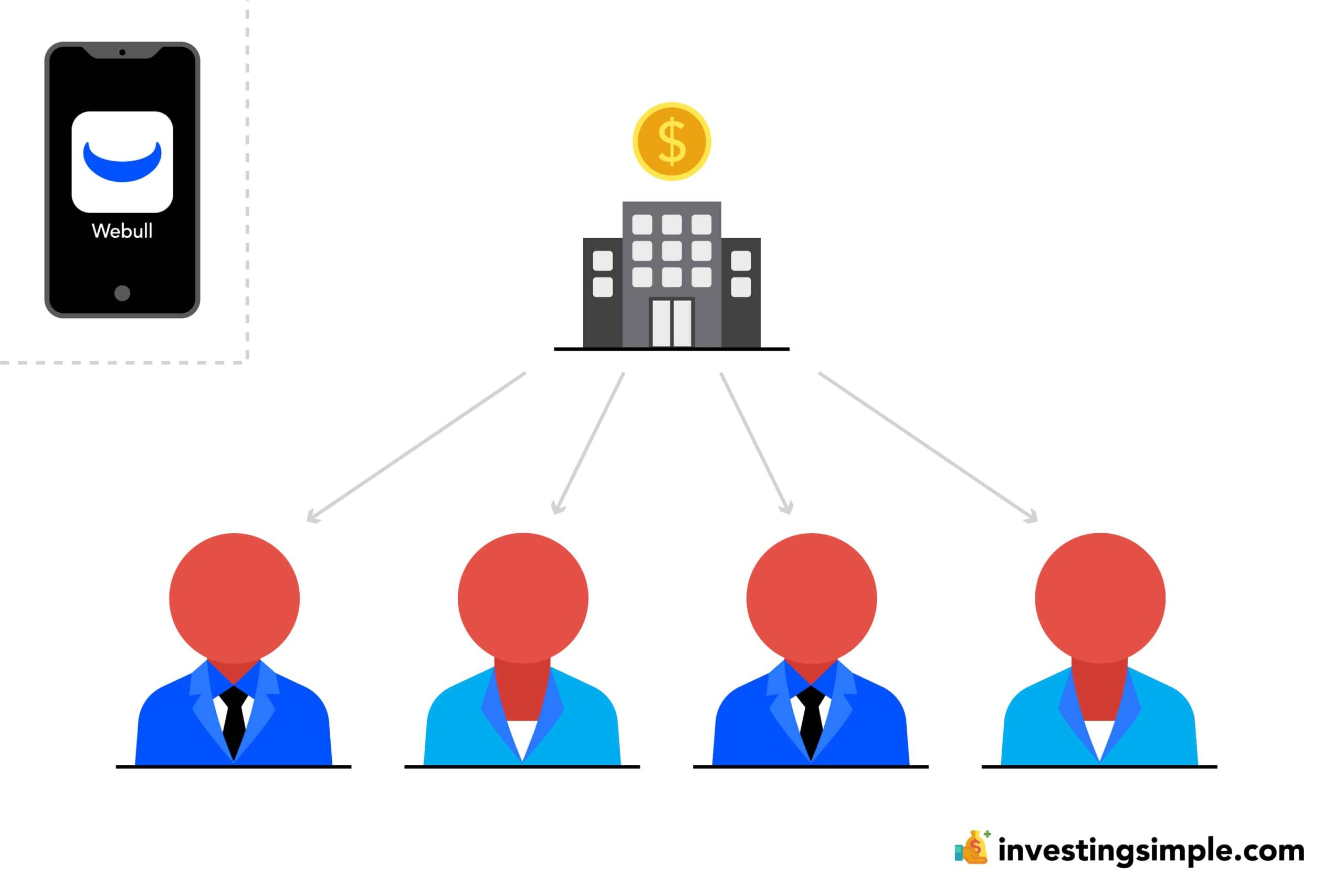

If you are investing using the Webull app, you may earn dividends from stocks or ETFs that you hold.

You might be wondering, what exactly happens with those earned dividends on Webull?

In this article, we will explain how dividends are handled within the Webull app as of 2025.

You have three main options for what to do with your earned dividends on Webull:

Reinvesting your dividends helps you earn compounding returns, which can accelerate your portfolio growth over time.

While many investors reinvest dividends to build wealth, those relying on dividend income for living expenses may prefer to withdraw cash.

Webull now offers an automated Dividend Reinvestment Program (DRIP), introduced in late 2024, which makes it easy to automatically reinvest dividends into additional shares or fractional shares of the paying stock or ETF.

This eliminates the need to manually place reinvestment trades and ensures your dividends are put to work immediately for growth.

To enroll in Webull's DRIP:

Once enabled, dividends will first be credited to your cash balance, typically becoming fully available for reinvestment or withdrawal within a few days.

Thanks to Webull's support for fractional shares, reinvestment can occur even if the dividend amount is less than the price of a full share.

Before the introduction of DRIP, dividends received on Webull appeared as cash credited to your account, and you had to manually decide whether to withdraw or reinvest.

Now, with DRIP available, you can choose automatic reinvestment to grow your holdings without extra effort.

If you opt out of DRIP or don't enable it, dividends still appear as cash and can be withdrawn or reinvested manually.

This flexibility allows you to tailor your dividend strategy to your individual financial goals.

Besides well-known dividend stalwarts like Coca-Cola, Walmart, and Procter & Gamble, consider these popular dividend-paying options:

| Option | How it Works | Benefits | Considerations |

|---|---|---|---|

| Manual Reinvestment | You receive dividends as cash and manually buy shares. | Full control over when and what to buy. | Requires time and attention; possible missed reinvestment opportunities. |

| Automatic DRIP | Dividends automatically reinvested into shares or fractional shares. | Convenient, supports compounding growth, no action needed. | Less control on timing; only reinvests in the paying stock/ETF. |

| Cash Withdrawal | Dividends credited as cash and withdrawn to bank. | Provides regular income for expenses or other uses. | No reinvestment or compounding growth. |

New to Webull? Check out my full tutorial below to get started!