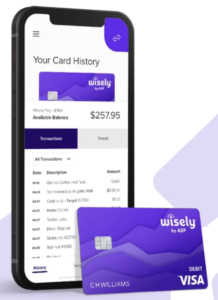

myWisely by ADP is a comprehensive financial wellness platform designed to help individuals manage their money effectively.

It offers features such as a user-friendly mobile app, a reloadable debit card, budgeting tools, and access to various financial services.

Many employers use myWisely to offer their employees convenient and flexible payment options, giving them early access to earned wages and tools to track and manage spending.

But one popular question remains:

Does myWisely work with Zelle?

👉 Check out my Zelle Tutorial below to learn how to use Zelle!

Zelle is a widely-used peer-to-peer (P2P) payment network that allows users to send and receive money instantly between U.S. bank accounts.

You can access Zelle through:

Zelle is known for its speed, security, and simplicity, especially when both parties are with banks that support direct integration.

Zelle's services are designed for users with US bank accounts, providing a seamless and secure way to transfer funds.

Does myWisely Work With Zelle?

Here’s the bottom line:

However…

You can still try using your myWisely debit card with the Zelle app (if you had access before the standalone Zelle app was discontinued).

That said, many prepaid debit cards—including some issued by myWisely—are not always accepted by Zelle, depending on their issuing bank and card network restrictions.

Important: Since mid-2025, the standalone Zelle app is no longer available for new users. Only customers of Zelle’s partner banks can now access Zelle through their respective banking apps.

If you're looking for Zelle-style alternatives to send and receive money quickly with your myWisely card, here are some great options:

You can link your myWisely debit card to PayPal to send or receive money. PayPal offers free transfers to friends and family and instant transfer options (with a small fee).

Owned by PayPal, Venmo supports prepaid debit cards, including myWisely in most cases. You can send and receive money, split bills, and even pay at participating merchants.

Cash App is another good alternative that works with many prepaid debit cards. It offers fast transfers and supports direct deposit for paychecks as well.

You can link your myWisely account to a traditional bank account and use that to connect to Zelle (if your bank supports it). This may take a few extra steps, but it enables access to Zelle’s features.