Investing in the stock market can be a lucrative endeavor, offering various avenues for generating returns.

One such method is through dividends, a form of payment made by companies to their shareholders.

Understanding how dividends work and how they are handled on platforms like Robinhood is crucial for investors.

Here's what happens with your earned dividends within the Robinhood app.

New to Robinhood? Check out my full tutorial below!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

A dividend is essentially a distribution of a portion of a company's earnings to its shareholders.

Typically, dividends are paid out quarterly in the form of cash, although some companies may choose to issue them on different schedules or in other forms like stock dividends.

Notably, not all companies pay dividends, especially those in earlier stages of growth or with alternative plans for their profits, such as reinvestment in the business.

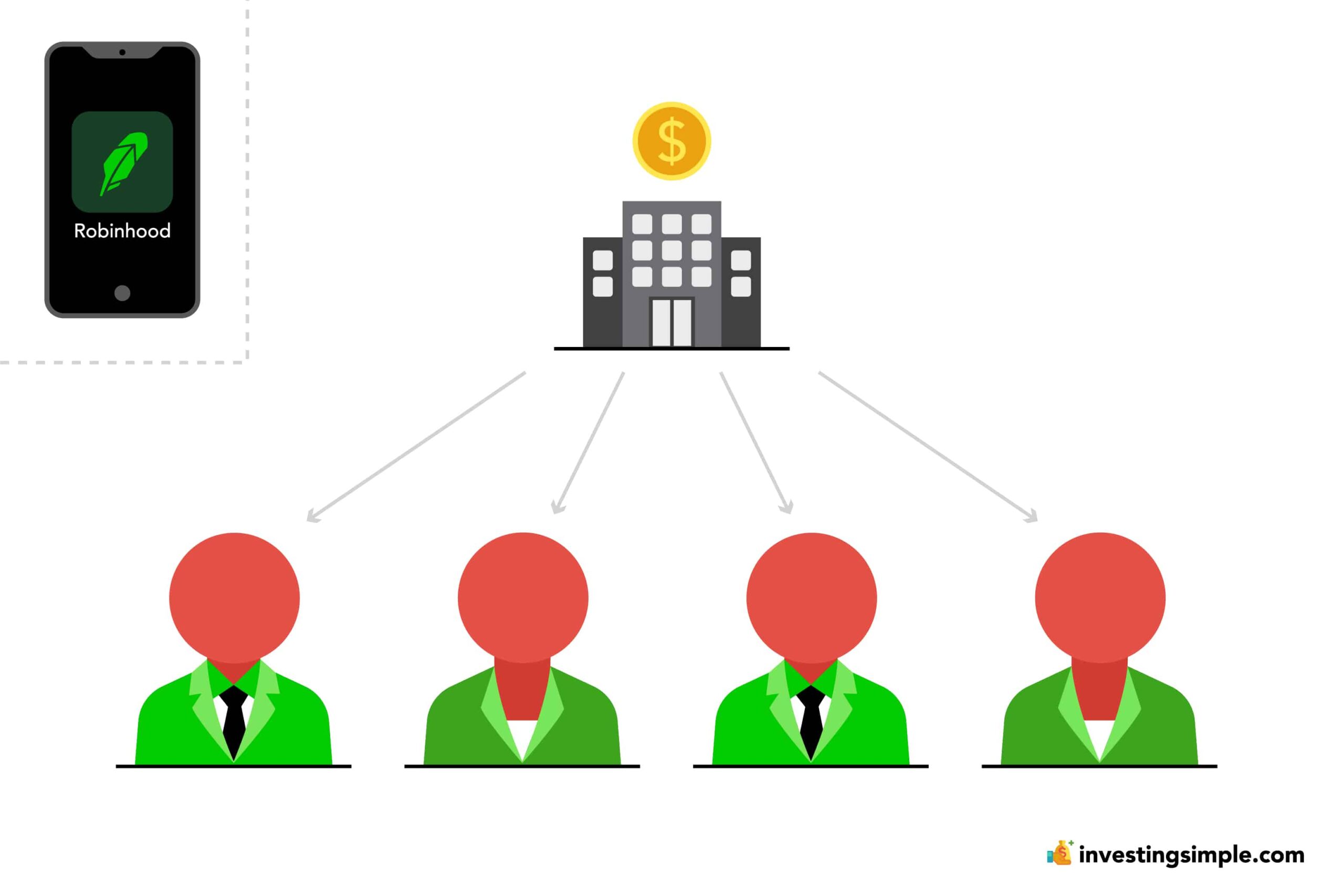

For investors using the Robinhood platform, handling dividends is relatively straightforward.

Robinhood automatically processes dividends for its users, crediting cash dividends directly into their brokerage accounts.

This means that shareholders receive their dividends without needing to take any additional action.

Robinhood provides users with convenient access to their dividend activity.

Users can view both received and scheduled dividends within the app:

Here, users can see pending dividends, including the scheduled date and amount, as well as recently-paid dividends. This allows investors to track their dividend income and plan their investment strategies accordingly.

One feature offered by Robinhood is Dividend Reinvestment, commonly known as DRIP.

With DRIP enabled, investors have the option to automatically reinvest the cash received from dividend payments back into the underlying stocks or exchange-traded funds (ETFs) from which they originated.

This can be a useful strategy for compounding returns over time, as reinvested dividends can purchase additional shares, potentially increasing future dividend payments.

Enabling dividend reinvestment on Robinhood is a straightforward process:

Once enabled, any cash dividends received from dividend-reinvestment eligible securities will be automatically reinvested according to your preferences.

If you want to learn more about Robinhood, check out our full beginner's guide about how Robinhood works here.