Transferring your brokerage account to M1 Finance is straightforward, though there are important requirements to understand before initiating the process.

Whether you're looking to migrate an entire brokerage account or shift your IRA, M1 Finance offers a structured process through a series of user-friendly steps.

To ensure a smooth transition, here is a comprehensive step-by-step guide on how to transfer your brokerage account to M1 Finance.

In this guide, we will show you how to transfer from Webull to M1 Finance, step by step - specifically.

Check out my video on how to transfer your brokerage account below, let's dive in!

Before initiating your transfer, ensure you've completed these critical steps:

M1 Finance supports 6,000+ stocks and ETFs that are listed on NYSE and the NASDAQ exchanges.

However, M1 does not support options trading at this time. You will need to sell your options before making the transfer.

Additionally, M1 does not support mutual funds, which will be automatically liquidated during transfer. Cryptocurrency can only be held through Bakkt (BTC, ETH, LTC), but you cannot transfer external crypto to M1 - you'd need to sell on Webull and rebuy on M1.

Make sure to carefully consider the tax implications! Selling unsupported assets (mutual funds, options) during transfer may create capital gains.

One final note, you must pay off any Webull margin balance and make sure your account is in "good standing" before transferring your assets to M1.

Keep in mind, the account type you are looking to transfer needs to match the account type you open with M1 Finance. This includes matching joint account structures (transfer from joint to individual requires special forms).

Understanding the key differences between platforms helps determine if a transfer makes sense for your investment strategy:

M1's unique features include automatic dynamic rebalancing, no commission fees, and the ability to invest your cash balance automatically through auto-invest (unlike Webull). M1 Plus members with $25,000+ accounts now have access to both morning (9:30 AM ET) and afternoon (3:00 PM ET) trade windows, offering enhanced trading flexibility.

The first step in the transfer process is to create an M1 Finance account.

Keep in mind, the account type you are looking to transfer needs to match the account type you open with M1 Finance.

Look at your most recent Webull statement and organize the necessary information, which includes your account number and account type.

Important: Webull accounts are either "Omnibus" or "Apex" type, which affects how you enter your account number:

M1 will need these details to process the transfer. In addition, they may ask you to upload a copy of the statement, so be sure to download a copy.

You can find your account type by logging into Webull and navigating to Account Settings. Make sure to verify your account type to prevent errors during the transfer process.

Before initiating the transfer process, ensure that you have an open account with M1 Finance that matches the specific account type you're transferring.

For instance, if you're transferring a Roth IRA, it must be directed to an M1 Roth IRA Account.

Similarly, joint accounts must match exactly - a joint account with "and" between names cannot transfer to an account with "or" between names without special documentation.

Once you've confirmed the compatibility, navigate to the Home tab within your M1 Finance account.

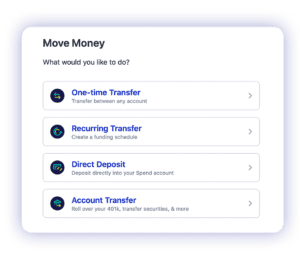

Look for the "Move Money" option and click on it to proceed with the transfer process.

Note: UI may have changed since this screenshot was taken in 2023. The process remains similar but exact button locations may vary.

Within the "Move Money" section, opt for the "Account Transfer" feature, which serves as the starting point for initiating the transfer process.

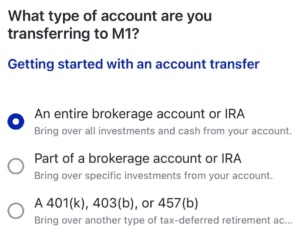

To kick off a full brokerage account transfer, select the appropriate option based on your specific needs and account type.

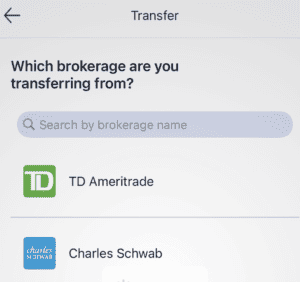

Choose the brokerage from which you're transferring your account - which is Webull in this case.

Enter the account number of the brokerage account you intend to transfer into your M1 Finance account, using the correct format based on your Webull account type (Omnibus or Apex).

Ensuring the accuracy of this information is crucial for a successful and smooth transfer process.

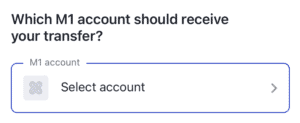

Choose the specific M1 Invest Account that will receive the transferred funds.

After reviewing the details, click the "Continue" button to confirm and initiate the transfer process.

You'll receive a confirmation email shortly after submission.

Your transfer typically completes within 5-7 business days through the Automated Customer Account Transfer Service (ACATS). Status tracking is available in the M1 app under "All Activity."

After your transfer completes:

Use the M1 Research tab to add the stocks and funds you are transferring to your current portfolio. Securities will be displayed outside your Pie upon arrival.

Be aware of the following fees associated with transfers:

These fees are deducted from your account balance during the transfer process.

In-kind transfers typically avoid triggering taxable events, which is a significant advantage over selling and rebuying. However, selling unsupported assets (mutual funds, options) during transfer may create capital gains.

If you have a large transfer with significant unrealized gains, consider consulting a tax professional before initiating the transfer.

If your transfer is rejected, check for these common issues:

For official documentation, see M1's How to Transfer a Brokerage Account into M1 and Webull's How do I transfer assets out of my account?

Both platforms offer strong protection for your assets:

This protection covers your investments in cases of a firm's insolvency or misconduct, providing peace of mind during the transfer process.