Stock options can be a great way for someone to bet on the price movement of a stock. However, options are not an investment strategy suitable for beginners. Options come with high risk and high reward where total loss of your investment is possible.

That being said, if you are an intermediate-to-advanced trader interested in options, there are several platforms that offer a great options trading experience. However, not all investment platforms give you the ability to invest using stock options for free, and some do not offer options trading at all.

Robinhood is a popular investing app that allows you to trade options. This app has provided options trading on its platform since the end of 2017.

In this article, we will cover options trading on the Robinhood platform. We will also cover a bit of basic information about options if you are new to this investment strategy.

Don't forget to grab your free stock worth up to $200 from Robinhood today!

Summary

Trading options on Robinhood remains a decent choice in 2025. While it is not the best platform for extensive research or technical analysis, it offers many features that make it attractive to beginners and intermediate traders. The trading that Robinhood provides extends fully to options trading, meaning you will never pay extra fees to complete your trades.

The sign-up process is straightforward, and getting options trading enabled requires minimal stock trading experience. When Robinhood approves your account, you will be able to engage in some basic options strategies. For access to advanced strategies, you will need to build experience and progress through the options tiers.

There are hoops to jump through to access more advanced features, which mainly serves to protect newer traders from excessive risk. As a beginner, you likely won't need these advanced trades, making Robinhood a suitable entry point for options.

Pros

Cons

Robinhood is an online investment platform that launched in 2013.

The organization offers free trades on stocks, ETFs, and cryptocurrencies..

Since its launch, it has grown to over 20 million users as of 2025; making it one of the most popular investment platforms to date. From these investors, it manages around $70 billion in assets under management.

The company caters mostly to beginner investors with many features tailored to users new to investing. Since it is aimed at beginners, the platform lacks some tools that more seasoned investors might expect on a stock trading platform.

Robinhood allows you to invest in over 5,000 stocks listed on U.S. Exchanges and over 650 American Depositary Receipts (ADRs). All of this is available on the free mobile app and through the newer desktop platform called Robinhood Legend, which offers enhanced charting and technical analysis tools for advanced traders.

Most sources encourage you to have some investing experience before trading options. We’ll cover the basics so you can understand what Robinhood offers.

Options offer investors a different way to participate in the stock market other than buying securities outright. They give you the choice, but not the obligation, to buy or sell a security at a predetermined price by a set date.

There are two broad types of options that investors use: puts and calls.

Various subtypes and strategies exist, but these are the most basic ones to help you get a feel for them.

Puts: Purchasing a put gives you the right to sell the underlying security at a fixed price. Puts are used when an investor believes a security's price will fall within a timeframe.

Calls: Calls give you the right to buy a security at a set price by the contract expiry date. Investors purchase calls when they believe the stock's price will rise within the specified timeframe.

Using a simple call option example can clarify how they work. Most options contracts represent 100 underlying shares.

Take a hypothetical stock called XYZ. Its price is currently $150 and an investor believes it will rise.

Instead of buying shares outright, the investor could purchase a call option with a strike price of $150 for a premium of $2.00 per share (total $200 for the contract). The option becomes profitable if the stock rises above $152 before expiration.

If the stock fails to reach this price, the investor can let the option expire and lose only the premium paid.

While this is a simplified example, options trading can rapidly become complex, which is why it is not recommended for beginners without sufficient knowledge.

Options contracts provide leverage because each contract controls 100 shares of the underlying stock.

Thus, the price movements in options tend to be more volatile compared to owning the shares directly.

A call option priced at $2.00 requires $200 upfront, but controls 100 shares, amplifying gains or losses.

Options offer flexibility in investing beyond traditional stock trading but with magnified risks.

Most options traders lose 100% of their investment because all options have expiration dates. When an option expires out-of-the-money (unprofitable), it becomes worthless.

On Robinhood, you can select the expiration date for options contracts. Generally, longer expiration dates increase the cost because there is more time for the contract to become profitable.

You need to carefully consider the balance between expiration date duration and premium cost when trading options on Robinhood.

When trading options on Robinhood, the platform offers several standout features:

Overall, there are no extra costs to trade options on Robinhood beyond contract premiums and regulatory fees, such as the $0.0022 CAT Fee and $0.04 OCC Clearing Fee per contract (effective July 2025). The SEC fee is currently set at $0 since May 2025, reducing costs for traders.

However, Robinhood’s lack of advanced analytics and research tools may be limiting for experienced options traders. Platforms like Webull and Fidelity provide more robust data and technical analysis tools, which can be critical for more complex option strategies. A practical approach is to conduct research externally and use Robinhood primarily for trade execution.

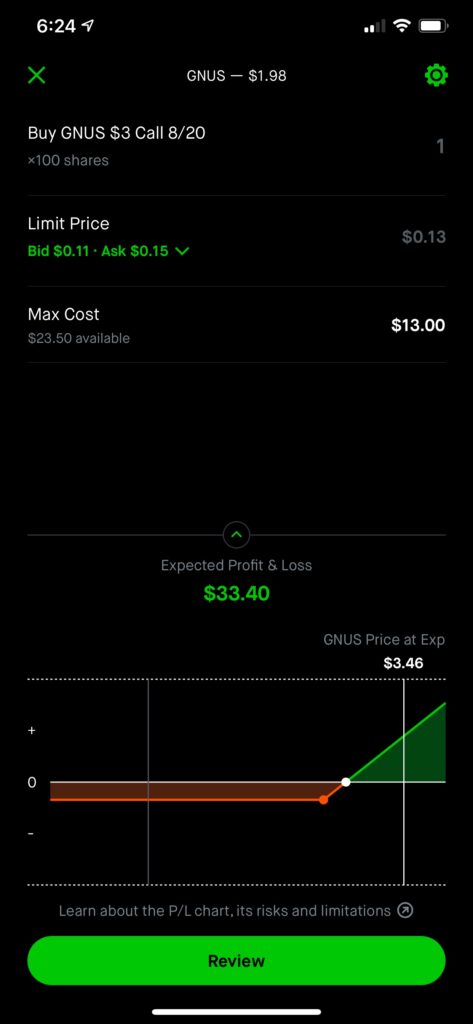

Robinhood includes a user-friendly Profit and Loss Chart when you select an options contract. This chart visually represents potential profits or losses at expiration based on stock price movement.

The horizontal zero line indicates the break-even point at expiration. Green and red lines depict potential profit and loss zones. This chart helps confirm your trading strategy visually.

Robinhood stands out by providing onboarding educational content to help options beginners. When you tap on a stock and choose to trade options for the first time, you will see helpful educational resources about options basics in the Options Chain interface.

Additionally, the Strategy Builder guides you through selecting from four basic stock price predictions (e.g., bullish, bearish, neutral) and suggests compatible options strategies. You can read summaries explaining how each strategy works, making it easier to get started without extensive background knowledge.

To trade options with Robinhood, start by creating a Robinhood account. Creating an account is fast and simple through the mobile app or desktop platform.

To enable options trading, you need some prior stock trading experience unless starting at the basic tier.

Go into account settings and tap on Options Trading to apply.

Robinhood offers three options trading tiers, based on your experience and approval level:

| Tier | Access | Example Strategies | Requirements |

|---|---|---|---|

| Level 1 | Stocks, ETFs, and Cryptos only (No options access) | --- | Basic account - no options experience needed |

| Level 2 | Basic Options Trading | Long calls, Long puts, Covered calls, Cash-secured puts | Requires minimal trading experience; application approval |

| Level 3 | Advanced Options Trading | Credit and debit spreads, Iron condors, Calendar spreads, and other advanced strategies | Requires demonstrated options trading experience; approval required |

You start at Level 1 or 2 depending on your background and must gain experience and request approval to access advanced Level 3 features.

Advanced strategies allowed at Level 3 offer increased potential rewards but come with higher risk, including the possibility of losing more than your initial investment.

Once approved for Level 2 or 3, you can start buying options contracts. Tap the magnifying glass on the app or desktop, search for the desired stock, tap 'Trade' then select 'Trade Options' to view available contracts.

Robinhood defaults to the 'Buy' option first but also allows selling options if you have appropriate permissions.

Trading options on Robinhood remains a solid choice, especially for beginners. While it lacks some of the advanced research tools offered by competitors, its free stock promotions, and educational resources make it appealing for those just starting with options.

The platform also provides commission-free cryptocurrency trading as an added benefit.

To start, the sign-up process is simple. To gain Level 2 options access requires minimal experience, while Level 3 demands more trading knowledge and approval. These measures help protect newer traders from complex, risky strategies.

If you're new to options trading, Robinhood is a good place to begin your journey.

Keep Reading: