When should you begin investing in the stock market? Most people believe they have a choice when it comes to whether or not they decide to invest. The truth is, you don’t. At some point, you need to start investing your money and saving for the future.

You could be reading this as a 20 year old (lucky you) or someone who put this off until their 40s or 50s. Regardless of your age and financial situation, you need to be participating in some kind of investment to allow your money to grow into even more money.

“The best time to plant a tree was 20 years ago. The second best time is now.” - Chinese Proverb

Now, does this have to be a stock market investment? Absolutely not. Here at Investing Simple, we discuss all kinds of investments such as passive real estate investments, side hustles and more. You do not need a lot of money to invest. Your time is often your most valuable resource.

However, for the purpose of this article we are going to assume that you are interested in investing in the stock market.

At a time when consumer debt is at all time highs and stock market participation is at all time lows, I applaud you for reading this and considering entering the realm of investing. The good news is, thanks to the wide array of commission free trading apps, there has never been a better time to begin investing.

Let me ask you a question.

Let’s say you have $100 in the bank, but you also owe your friend $100.

Your friend Bill is charging you $1.50 each month until that $100 is paid back.

Now, your friend Jack calls you up and asks you if he can borrow $100. He agrees to pay you $0.50 a month until he is able to pay you back that $100.

Should you…

A. Keep that $100 in the bank

B. Pay back your debts with Bill

C. Loan your money to Jack

If you picked Choice A, this is actually the worst move you could make.

Your money is sitting in the bank earning a very small rate of return. For most people, this is a rate that does not outpace inflation. Your first goal when it comes to investing is to protect the buying power of your money by outpacing inflation.

If you didn’t take economics class in high school, inflation is an increase in prices over a period of time. As prices increase, the buying power of each dollar decreases. To explain this simply, bread is more expensive now than it was back in 1930.

In recent years, inflation has been at a rate of around 2 to 3% per year. The average interest rate on a US savings or checking account is around 0.05% per year. Assuming these figures remain the same, let’s take a look at how this plays out.

Let’s assume you have $100,000 sitting in a US checking account. A dollar today is worth more than a dollar tomorrow.

$100,000 Now = $98,000 1 Year From Now (2% Inflation)

Thanks to our friend inflation, your $100,000 will only buy you $98,000 worth of goods next year.

$100,000 Saved = $100,050 1 Year From Now (Is it really?)

Thanks to the “generous” interest rate paid by your bank, your $100,000 grew in value by $50! But since inflation was 2% and your return in your bank account was only 0.05% you really lost 1.95%

So what exactly happened here? You earned a return of $50, but you lost $2,000 worth of buying power.

Your net loss was $1,950!

This is what people are talking about when they mention "outpacing inflation". All investors look for investments that will either keep pace with or outpace inflation in order to maintain their purchasing power!

One of the best comparisons I have heard is that inflation is like having termites in your house. Day by day, it goes unnoticed. The real damage is done over a long period of time.

So what exactly happened here? You earned a return of $50, but you lost $2,000 worth of buying power.

Your net loss was $1,950!

Keep this in mind when your friends or family members tell you they keep their money in the bank because it is safe. Termites!

If you picked Choice B, you chose the best option!

It does not make any sense to loan your money to Jack when you owe Bill money. Now, you might argue that this could make sense if you could get a higher rate of return than you are paying in interest.

This is something people try to do with the stock market. They borrow money against the shares they already own and they invest that borrowed money. This is known as buying on margin, a key contributor to the stock market crash in 1929.

Before diving into investments, understanding the types of debt you're dealing with is crucial. Unsecured debts (like credit card debt) often carry higher interest rates, usually between 15%-25%, making them the most urgent to address.

On the other hand, secured debts (like mortgages and car loans) usually have lower rates because they’re backed by collateral. If you have both types, focus first on paying off those high-interest unsecured debts.

On average, the stock market has averaged a return of 8 to 10% per year. This is the average, meaning you will not experience this every single year!

In a bull market (a time when the price of stocks is rising), you could see returns of 15% per year or more.

In a bear market (a time when the price of stocks is falling), you could see a 20% loss or more.

Buying on margin and investing borrowed money is a result of two things. First of all, it is a result of impatience.

Most financial planners caution against using borrowed money to invest due to the added risks and potential for loss.

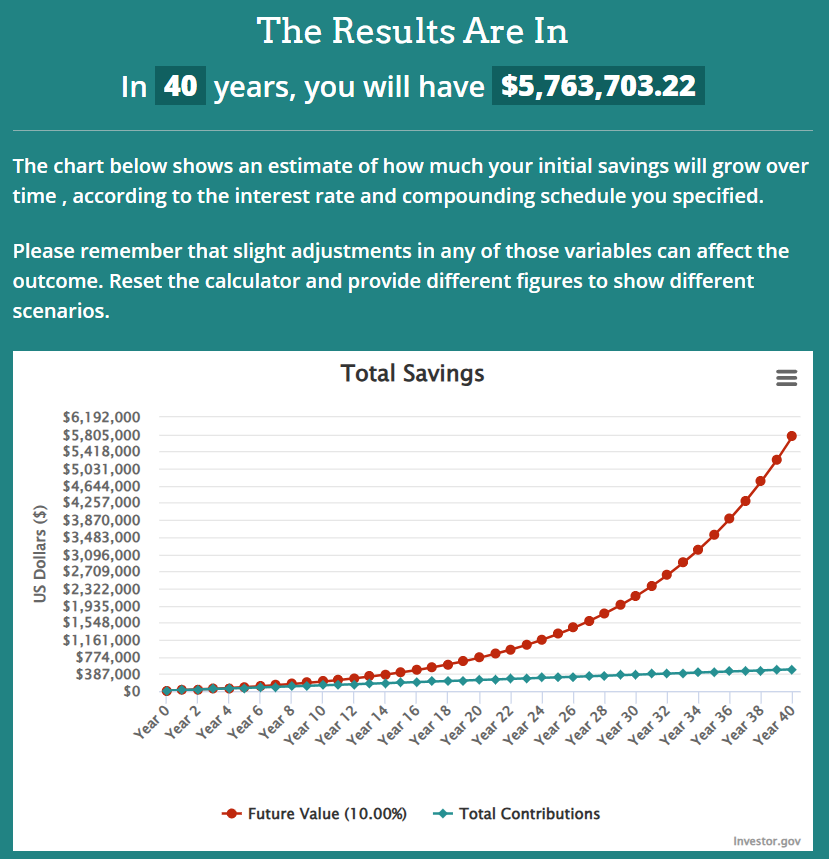

Second of all, it is a result of not understanding compound interest. Einstein called this the 8th wonder of the world for a reason. Warren Buffett attributes a lot of his success to it. It is imperative that you understand the power.

The majority of your gains from the stock market will result from time in the market.

While it may be tempting to shortcut your way to success by investing in leveraged assets or buying on margin, this is not a successful strategy for most people.

I encourage you to play around with a compound interest calculator if you haven’t yet. Here is a link to one.

If you picked Choice C, you made a very common mistake. Most people are so excited about investing in the stock market that they do not consider their personal finances and whether or not it actually makes sense to invest at this point in time.

As we mentioned above, the average return from the stock market is around 8 to 10% per year. Just to restate this, you will not experience this kind of return every year!

The most common debt people have is credit card debt. Since this is unsecured debt, it typically has the highest interest rate. It is not uncommon for people to have a 20% or higher interest rate on a credit card. Unsecured simply means that there is no asset backing your debt. Your car loan, for example, is secured debt. If you don't make your car payment, eventually they will repo your car and sell it at auction. This is how the bank protects themselves.

If you have credit card debt, you need to pay it off before investing in the stock market. It is no different than loaning $100 to Jack when you owe Bill $100. The best return you can get with your $100 investment at this point in time will be from paying off your high interest debt.

The majority of your gains from the stock market will result from time in the market.

While it may be tempting to shortcut your way to success by investing in leveraged assets or buying on margin, this is not a successful strategy for most people.

As a rule of thumb, it's often advised tocash re prioritize paying off any debts that exceed your expected rate of return from investing. For instance, if the average return from the stock market is 8%, focus on clearing debts with interest rates near or above this threshold first.

Let me give you an example.

Let’s say you have a car loan of $20,000 but you also have $20,000 in the bank. You have good borrowing history, so your interest rate on this car loan is 4% per year. Rather than pay off your car loan, you decide to invest that money. Your anticipated rate of return is 8% over the next year.

Interest Paid = $800 Investment Return = $1,600 Net Gain = $800 or 4%

You were able to earn a return that exceeded what you paid in interest. On top of that, you were able to build your credit in the process.

Both methods have their merits, so choose the one that aligns with your personality and financial situation.

Let me ask you a question, why do people go into debt?

Sure, it could be compulsive spending or keeping up with the Joneses. However for a lot of people, debt is a result of an expense that was not anticipated or planned for. This could be something like a car repair or a medical bill. Once you have committed to being a participant in the stock market, you have hopefully followed the steps outlined in Phase 1.

Unfortunately, the next step is not to go on a stock shopping spree. The next step is to eliminate the future need for debt.

Most people don’t plan on going into debt. You don’t wake up on a Saturday morning and say “I want a $3,000 credit card balance.” However, most people do not plan for unexpected expenses.

Here is a tip: Don’t be like most people.

The next step is to build up an emergency fund. This is going to eliminate the need for debt in the future.

A general rule of thumb for this is that this should be enough to cover all of your expenses for the next 6 months.

Pretend you lost your job or main source of income tomorrow. How long would you be able to sustain yourself before you needed to grab your credit card? If the answer is anything less than 6 months, you need to build up your cash cushion.

Let me give you an example:

John has the following monthly expenses.

Car Payment = $300

Mortgage = $1,200

Utility Bill = $150

Food = $500

Entertainment = $200

Other = $200

Total = $2,550

If John has $2,550 in monthly expenses—covering his mortgage, car, utilities, food, and other costs—he should aim to save around $15,000 for a 6-month emergency fund.

This cash should be kept in a liquid, safe place like a high yield checking account or money market account—not invested.

Yes, inflation does reduce purchasing power over time, but the purpose of an emergency fund is stability, not growth. You need this money to be available when life throws you a curveball.

You want your emergency fund to be in a separate savings account. We recommend online savings accounts, since they pay a much higher interest rate than traditional bank accounts.

Consider Betterment Cash Reserve. They pay a better than average APY on their online savings account with just a $10 minimum to open an account. The best part? No fees of any kind!

You want your emergency fund to be in a separate account from where you do your day to day banking. If you leave your emergency fund in checking, you will see it every time you conduct banking online. Trust me, you will be tempted to spend it!

If it is tucked away in a separate account, you will forget that you even have it. That is the point, as this is for emergency situations only!

So why not invest your emergency fund to earn a return on it? Here's the answer.

Let’s assume you buy shares of a red hot technology stock.

You picked up 10 shares at a cost of $250 per share. In doing this, you drained your checking account and left yourself with $500 until payday. You picked up your shares the day before this company is reporting earnings because you anticipate that this stock will beat expectations.

When this happens, the share price can go soaring!

The next day, they report earnings that fall short of expectations. The stock drops 15% on the news. Your initial investment of $2,500 (10 shares at $250) is now worth $2,125 (10 shares at $212.50).

You “lost” $375.

To tell you the truth, you didn’t lose a penny. You do not recognize a loss until you sell those shares to someone else at a price that is lower than what you paid for them.

Often times, people will say that the stock market is a scam or that the stock market took money from them. As if the stock market reached into your brokerage account and plucked the money out!

The stock market never took a penny from anyone. If you lost money, you handed it over.

Back on topic here, you are now down 15% on your shares of this red hot technology stock and you have $500 in checking.

After listening in on the earnings call, you decide to go grab breakfast. You walk out to your car, turn the key and hear clicks. After punching the steering wheel a few times, you call a tow truck. Your car repair and tow bill ends up costing you $2,000! This was clearly an unexpected expense and like most people, you did not plan for it.

Here is a tip: Don’t be like most people.

At this point, you have two lousy options.

Your first option is to sell your shares of the red hot technology stock and recognize the loss. You will use this money to pay for your car repair bill. On top of that, it will take 3 business days for the funds to settle before you can transfer the funds back to your bank account.

Your second option is to pull out that shiny credit card and slap on a $2,000 repair bill and tow at a 20% interest rate.

Both of these options are bad. If you end up in this situation, flip a coin.

THIS is why you do not invest your emergency fund. The stock market is not a guaranteed place to earn returns. In the short term, it will move up and down. The stock market is a vehicle for building wealth over the long term. In the short term, it is entirely unpredictable.

An emergency fund should serve as a buffer against life’s unpredictabilities. It's essential not only for covering unexpected expenses but also for reducing stress during challenging times. Consider the psychological aspects too: having an emergency fund can provide peace of mind, making it easier to focus on long-term investment goals without fretting over immediate cash flow issues.

Have you ever seen a horse race before?

Don’t worry, this will make sense shortly. People spend hours upon hours analyzing the horses and the different variables involved. Then, the horses go off and the fastest horse is the winner.

No matter how much research is conducted by the handicapper, they are frequently wrong about what horse will come in first.

Is this due to a lack of intelligence or research?

In most cases, no. It is because horses are horses and sometimes they just don’t feel like running. But what if instead of picking the winner of this race, you were able to make a different bet on all of the horses?

That’s right, you are betting on the outcome of the entire race and not just one horse.

This is exactly how stock picking works. Everyone has their own strategy when it comes down to the analysis of the investments, but at the end of the day nobody knows how the market will perform and what stocks will come in the lead.

While you can’t bet on the entire horse race, you can bet on the entire stock market with an investment known as an index fund.

An index fund is a pool or collection of different stocks designed to replicate an underlying benchmark. This benchmark could be the S&P 500 (the 'top' 500 companies in the USA), foreign telecommunication companies or even the entire global stock market. This fund is designed to replicate the performance of the underlying benchmark as closely as possible.

Some mutual funds and ETFs are actively managed, and the expenses associated with this type of investment are often significantly higher. The truth is, most actively managed mutual funds do not beat the market.

Actively managed funds are often benchmarked against the S&P 500, an index that tracks the performance of the 500 largest publicly traded companies in the US.

What most people do not realize is that you can simply invest in the S&P 500 through a low fee index fund instead of trying to pick stocks or an actively managed mutual fund that will hopefully outperform.

In fact, Warren Buffett recommends that people simply invest in a low fee S&P 500 index fund!

One example of this is the Vanguard 500 Index Fund.

You can invest directly into this fund through Vanguard, or you can purchase shares on the market through a financial instrument known as an ETF. This is simply an exchange-traded fund. Shares of this fund trade openly on the market under the symbol VOO.

Most people who choose to passively invest in the market purchase low fee index funds. Now, am I telling you this to deter you from going out and picking stocks on your own? Absolutely not.

It is possible to beat the market and you can learn a lot by investing in individual stocks. However, if you are brand new to investing, you should start with an index fund. It is in your best interest to build your tolerance for risk and your understanding of the stock market before you begin to hold individual stocks.

By holding ETFs, you get to experience what it is like to be a stock market investor without holding individual stocks that can be volatile.

Volatility is the degree of variation seen in the price of a stock. Individual stocks are far more volatile than the overall market, meaning you will see more drastic price fluctuations.

One of the easiest ways to determine the volatility of a stock that you are looking at is to look at the beta. If a stock has a beta above 1, that means this stock is more volatile than the overall market.

When the beta is below 1, that means this stock is less volatile than the overall market. If you are investing in individual stocks as a complete beginner, you should consider investing in stocks with a beta below 1.

Some stocks are inherently more volatile than others.

For example, a technology stock like Advanced Micro Devices is going to see more variation in the share price than a 'blue chip' stock like Coca Cola. These durable, time tested investments are named blue chip stocks after the blue chip in poker. The blue chip is the poker chip with the highest value.

If you are looking to invest in an individual stock as a beginner, you should familiarize yourself with these blue chip stocks.

A great place to start is the Dow Jones or DJIA. This is a list of 30 well established, financially responsible industry leaders. This includes companies like Apple, 3M and UnitedHealth.

If you want to participate in the stock market without picking individual stocks or building a portfolio from scratch, check out the platform Betterment.

This is a robo-advisor that will build you a portfolio from scratch based on your age, time horizon, goals and risk tolerance. In most cases, Betterment is a great option for beginners because they do not have any minimum account balance to get started.

Betterment provides a completely passive approach to investing in the stock market. Betterment allows you to bet on the outcome of the entire race by investing in low fee index funds. Instead of building a diversified portfolio yourself, Betterment does it for you.

They do charge a fee for this, but it is much less than a traditional financial advisor. This is because your money is passively managed by algorithms, not people. The basic or Digital plan from Betterment has an annual asset management fee of just 0.25%.

In recent years, fractional shares have gained popularity, making investing more accessible to beginners. Fractional shares allow you to buy a portion of a share of stock rather than needing to purchase a whole share. This is particularly advantageous for high-priced stocks like Amazon or Google, where a single share might be prohibitively expensive for new investors.

By investing in fractional shares, you can diversify your portfolio more effectively, even with a limited budget. For example, if a stock is priced at $1,000 and you only wish to invest $100, you can purchase 0.1 shares instead of needing the entire amount.

Here’s why fractional shares are beneficial:

Most major brokerages and trading platforms, such as Robinhood and Fidelity, now offer fractional shares, making it easier than ever for you to build a diversified investment portfolio without needing substantial upfront capital.

If you're new to investing and wary of spending a large amount on a single stock, opting for fractional shares is an excellent strategy to get started on your investment journey.

Thematic ETFs are exchange-traded funds that focus on specific investment themes or trends, such as technology, renewable energy, or healthcare innovation. Unlike traditional ETFs that track broader indexes (like the S&P 500), thematic ETFs target niche sectors or unique trends within the market.

How They Work: By investing in a thematic ETF, you gain exposure to a basket of stocks that align with a particular theme, allowing you to capitalize on emerging trends without the need to pick individual stocks. This lowers your risk compared to individual stocks while still giving higher exposure to a industry. For instance, if you believe in the growth of electric vehicles (EVs), you can invest in an EV-themed ETF (like DRIV) that includes companies developing EV technologies, manufacturing batteries, or producing charging stations.

Benefits:

Considerations:

Examples: Several brokers offer thematic ETFs focused on technology (like AI or cybersecurity), sustainability (such as clean energy), and even social trends (like aging populations). Choosing something you truly believe in and have confidence will grow over the coming years can be very rewarding financially as much as it might be emotionally.

Incorporating thematic ETFs into your investment strategy can help you target your interests and beliefs about future market trends, making your portfolio more aligned with your personal values and financial aspirations.

When it comes to investing in the stock market, there are two different ways you can make money.

The first way you can make money is through asset appreciation. You purchase a stock and hopefully sell it at a higher price in the future. It is important to remember that share prices can be completely erratic, and you should always invest in a company you fully understand.

Consider the investing style of Warren Buffett.

He invests in simple businesses like Kraft Heinz, American Express and Coca Cola. There is a lot of temptation out there to invest in complicated industries like biotechnology. At the end of the day, you need to ask yourself one question: Do I understand what I am buying?

The second way that you can make money in the stock market is through dividends.

Dividends can provide investors with a form of residual income. Companies can decide to share a portion of their earnings with shareholders through dividends. These dividends are typically paid on quarterly basis, but in some instances companies pay annual, semiannual or quarterly dividends.

It is important to understand that these dividend payments are never guaranteed. A company that pays a dividend can cut or cancel this dividend payment at any time.

Generally speaking, companies like to increase dividend payments over time and avoid a dividend cut at all costs. A dividend cut almost always results in a decline of the share price, which hurts the reputation of the company.

Stocks that pay dividends are referred to as income stocks.

Stocks that are growing at a faster rate than the overall market are referred to as growth stocks.

You will also find that there are some stocks that are both growth and income investments. The company pays a dividend and it is also experiencing a faster rate of growth than the overall market.

You also have conservative growth stocks and aggressive growth stocks. As the name suggests, aggressive growth stocks are likely to experience a higher growth rate than conservative growth stocks.

When you begin investing in the stock market, it is important to consider what type of investor you want to be.

Do you want to invest in aggressive growth stocks?

Or, do you want to invest in durable blue chip stocks that pay dividends?

Maybe you want to invest in stocks that pay dividends while also having growth potential?

Like anything else out there, it is important to have a game plan and a strategy. A dividend investor would be focused on companies with a consistent operating history and a durable competitive advantage.

A growth investor would be focused on what the most innovative companies are. Determining what type of investor you are is above and beyond the scope of this article, but you should begin to think about what type of investing seems most appealing to you.

Remember, if this seems too overwhelming you can always bet on the outcome of the entire race! This is why many investors simply invest in index funds rather than bother with picking individual stocks.

If you are bullish on a particular sector or industry, like semiconductor technology, you can invest in a sector or industry specific ETF.

When it comes to investing in the stock market, you’ll often encounter two primary strategies: passive investing and active investing. Understanding the differences between these two approaches can help you determine which method aligns better with your financial goals and lifestyle.

What It Is: Passive investing involves a long-term strategy where you buy and hold assets, with minimal trading. The goal is to replicate the performance of a specific market index, such as the S&P 500, through investments like index funds or ETFs (Exchange-Traded Funds).

Advantages:

Disadvantages:

What It Is: Active investing involves a more hands-on approach where investors frequently buy and sell stocks in an attempt to outperform the market. Active investors typically rely on research, analysis, and experience to make informed decisions.

Advantages:

Disadvantages:

Choosing between passive and active investing ultimately comes down to your individual financial goals, risk tolerance, and time commitment. For beginners or those looking for a hands-off approach, passive investing through index funds is often recommended as a solid starting point. However, if you have a deep interest in the market and are willing to dedicate the necessary time for research, active investing might be more appealing.

In addition to making money through asset appreciation and dividends, consider diversifying your income sources to achieve a more stable cash flow. Here are a few alternatives to explore:

By considering these diversified income sources, you can reduce your overall portfolio risk and generate a more consistent cash flow. This approach will allow you not only to benefit from appreciation and dividends but to create a well-rounded investment strategy that meets various financial goals.

There are a number of core investing principles that you should know before you begin investing in the stock market. You should also refresh your memory once in a while to ensure that you are following them.

Here are the cardinal rules for sensible investing that will help you stay out of trouble.

This is the most important investing principle, yet so few actually practice this. Let me give you an example.

In 2017, Bitcoin went mainstream.

Cryptocurrency was the topic of bar room conversations all over the world. By the time the average person learned about Bitcoin, it was trading at a price of over $10,000 per coin. Looking at the chart, you could see that Bitcoin had gone nowhere but up.

At this point, FOMO was triggered. Also known as the fear of missing out, masses of people entered the cryptocurrency market because they were afraid of missing out on the hottest investment.

Do you know what all of these people did?

They purchased Bitcoin at all time highs.

To the untrained eye, it looked like Bitcoin had nowhere to go but up. But experienced investors know that strong momentum doesn’t guarantee future gains. Buying at all-time highs isn’t always a mistake—but it can be risky if it’s driven by emotion instead of a plan. Ironically, many new investors are hesitant to buy when prices are low, fearing something must be wrong. Yet that’s often where the real opportunities are.

If you went to the grocery store and found out that Tide laundry detergent was on sale, you would stock up and buy extra. But when Procter & Gamble stock goes on sale, the maker of Tide laundry detergent, people are afraid to buy it. Stocks are the only thing that people do not buy on sale.

When it comes to investing, noise is everywhere.

There is always a line of people waiting to give you their opinion regardless of whether or not you wanted to hear it. To some extent, you can control the noise. Most of it is coming from the news outlets.

Keep in mind, many parts of the financial industry make money when you trade. The more you buy and sell, the more fees they collect.

They want you to invest in a stock on Monday and change your mind Thursday, sell it and buy something else only to sell that Friday. There is a difference between staying informed about your investments and being obsessed.

Check on your stocks once a day, maybe twice.

Keep track of the major company announcements, quarterly earnings reports and annual reports. Beyond that, the rest is just noise. While investing in stocks can be a social activity, you should be careful about where you get your advice from. Hot stock tips are a dime a dozen.

Beyond that, even if they are right about their hunch, what is your next move? Is your plan to wait for someone else to give you a stock tip at the bar? That is not an investment strategy. An investment strategy needs to be scale able and repeatable.

A man by the name of Benjamin Graham once said that the market is a pendulum, forever swinging between optimism and pessimism.

Warren Buffett learned a lot from Benjamin Graham.

For example, Buffett has said that you should be greedy when others are fearful and fearful when others are greedy.

Optimism leads to greed and pessimism leads to fear. Buying from the pessimist means that you are buying stocks when there is fear in the market, or buying low. Selling to optimists means that you are selling stocks when there is optimism or euphoria in the market, or selling high.

If you hear everyone talking about a hot stock, it is probably time to sell it.

The underlying value of a stock does not change in the short term, only the price does. At some points, the price is high due to greed and feelings of euphoria. At other points, the price is low due to feelings of fear.

Benjamin Graham has a great book called The Intelligent Investor that we recommend picking up.

If you are completely new to investing in the stock market and you want to place a bet on the stock of one company, I understand where you are coming from.

As a beginner, you likely do not have a lot of capital to invest or you are just looking to get your feet wet with investing. It doesn’t make a lot of sense to try to diversify when you are investing a small sum of money. Diversification becomes more important as you invest more money.

For example, if you are simply looking to invest $1,000 diversification might not make a lot of sense at this point.

Once you have invested $10,000 or more, you should consider diversifying.

There are a couple of different rules of thumb you might want to follow. One of my favorite ones is never to have more than 20% of your money in any one thing. Some would argue that even investing 20% into one stock or asset is too risky.

This all comes down to your individual risk tolerance.

What you are trying to avoid here is placing an all in bet. While it may be tempting to let it all ride on one particular stock, most would agree this is not a great strategy.

If you are correct about this all in bet, the situation gets even worse as you fall under the hot hand fallacy. You will likely now believe that you have some skill above the ordinary investor and you will begin placing one all in bet after another and letting it all ride.

At some point, your luck will run out. If you placed all in bets in the past and ended up ahead, consider yourself lucky and understand it is likely in your best interest to diversify.

Some new investors confuse diversification with owning dozens of different stocks. But holding a small number of shares across 50 or more companies can quickly become unmanageable. You’re unlikely to stay informed on all those businesses, and that lack of oversight can increase your risk, not reduce it.

If you want broad diversification without the hassle of tracking dozens of companies, consider using index funds or ETFs. These provide exposure to hundreds or even thousands of companies with a single investment, and they’re easier to manage and rebalance.

Platforms like M1 Finance also offer fractional shares, allowing you to invest small amounts across multiple funds or stocks, which can help build a diversified portfolio even if you’re starting with limited capital.

Valuing a stock is a complicated process.

People have written entire books on strategies for determining the underlying value of a stock. This is a beginner’s guide, so I will not be going into great detail about this but it will be mentioned later.

What I will tell you is that the share price has absolutely nothing to do with how cheap or expensive a stock is.

A lot of beginners make this fatal mistake when it comes to investing in the stock market.

They see a stock like Amazon trading for close to $2,000 a share and they see these other companies trading for under $1.

If they have $2,000 to invest, they can buy 1 share of Amazon or over 2,000 shares of this penny stock.

What a bargain, right?

Wrong. In order to understand why this is not the case, we need to define a few important terms…

“Market Capitalization” - What the market has valued this company at.

“Shares Outstanding” - Total number of shares available.

Market Capitalization = Shares Outstanding X Share Price

Consider the following example.

Company A issued 1,000 shares of their stock and the market has valued this company at $100,000. This gives each of these shares of Company A a value of $100.

Company B on the other hand issued 100,000 shares of their stock and the market has valued this company at $100,000 as well. This gives each of these shares of Company B a value of $1.

Company A: $100,000 Market Cap = $100 X 1,000 Shares

Company B: $100,000 Market Cap = $1 X 100,000 Shares

The share price has nothing to do with whether or not a stock is cheap or expensive. It simply has to do with how many shares are available.

Companies will often split the stock to lower the share price. Once a stock becomes out of reach for the average retail investor, the company will often split the stock in a given ratio.

If you are holding a stock that splits, you will end up with more shares but the same ownership stake. Some companies, like Berkshire Hathaway, have never split their shares.

Warren Buffett has stated he made this decision because he was looking to attract investors with similar goals as him. Eventually, Berkshire Hathaway decided to offer both BRK.A and BRK.B to provide retail investors with the option to invest.

Most retail investors cannot afford to invest over $300,000 in one share of BRK.A!

Not everyone will agree with me on this, but I share the same belief as Warren Buffett when I say that stocks are a long term investment.

Warren Buffett believes that you should have a minimum time horizon of 5 years when investing in a stock. Investing with a time horizon of less than 5 years is speculation or gambling.

You might be wondering about those who are trading stocks on a daily or weekly basis.

I am a long term investor and that is my area of understanding. I do not know much of anything about short term trading. When I began investing, I tried my hands as a swing trader and I learned relatively quickly that this was not for me.

Trading is completely different than investing, and it takes a unique type of person to be a consistently profitable trader.

There is a well known fact that 90% of traders lose 90% or more of the value of their account in the first 90 days of trading.

The success rate with trading is extremely low. Successful traders have a very high risk tolerance and they have complete control over their emotions and do not involve them with trading.

Personally, I invest with a minimum time horizon of 1 year.

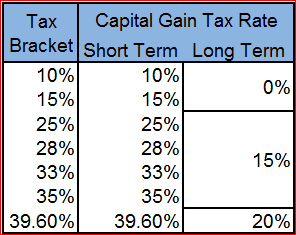

The main reason why I do this is for tax reasons. In the United States, capital gains on investments can be classified as long term or short term capital gains.

Believe it or not, there is a significant tax advantage associated with being a long term investor.

If you buy a stock and sell it within 365 days, the gains are classified as short term capital gains and taxed as ordinary income.

If you buy a stock and hold it for longer than one year before selling it, the gains are classified a long term capital gains.

Depending on what tax bracket you are in, this could result in a tax savings of up to 20%.

In the short term, the price of a stock is unpredictable.

The market can be volatile at times and stocks can move up and down for seemingly no reason. If you are unable to stomach these hills and valleys, you should not be an individual stock investor.

You are better off investing in index funds as they are typically much less volatile. When you invest in a stock, have an idea in your head what the time horizon is that you plan on holding it.

If your stock goes up in the short term, you might be tempted to grab these easy profits. In some cases, it makes sense to do this.

Keep in mind however that in doing so you are likely exposing yourself to short term capital gains! You will be paying the highest tax rate possible on your profits.

You will always hear people talking about timing the market.

The principle behind this is simple; buy when the market is low and sell when the market is high. This is unfortunately easier said than done. Most investors would agree that time in the market will always beat timing the market.

If you get out of the market when it is high and it continues to climb higher, you miss out on potential gains. Whenever I am asked about this, I always tell people to look at some of the greatest investors like Warren Buffett. Do you see Warren Buffett jumping in and out of the market, moving from 100% stocks to 100% cash? Absolutely not.

If Warren Buffett wouldn’t do it, you probably shouldn’t either.

Keith Banks said it best. Your success with investing will come from time in the market, not timing the market.

One of the greatest books you will ever read on the stock market is a book by a man named Benjamin Graham.

That book is The Intelligent Investor. In this book, Graham discusses at length the difference between an investment and a speculation. Here is how he defines these two…

"An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative." - Benjamin Graham

If you insist on speculating with your money, in the words of Benjamin Graham, you should do so with no more than 5% of your portfolio.

Beyond that, you should speculate in a separate account as to not confuse this with investing. Graham also recommends that you do not continue to funnel money into this speculative portfolio.

Instead, you should simply reinvest the earnings from your past speculations. If you are correct on your bet, you can reinvest that money into another speculation. If you are not correct on your bet, you should not funnel more money into a losing strategy.

It is imperative that you understand the difference between an investment and a speculation. Personally, I consider investing in any company that is not turning a profit as a speculation.

As an investor, you are taking a gamble on whether or not that company will achieve profitability before going bust.

Behavioral finance shows how psychological factors influence investor behavior and decision-making. Understanding these influences can help you make more rational investment choices.

By understanding these psychological traps, you can work to eliminate emotional trading decisions and develop a disciplined, rational investment strategy. Consider setting predetermined buy and sell rules for your investments, which can help mitigate the influence of emotions and ensure that decisions are based on logic rather than fleeting sentiments.

Additionally, consider journaling your investment decisions and the reasons behind them. This practice allows you to reflect on your thought processes and identify patterns, ultimately fostering more informed investment behaviors.

As soon as you buy a stock, the price begins to change.

If you watch the live charts, you will see that the quotation price for any stock is always changing. Why does this occur?

There are a number of different reasons why a stock price changes. Some of these reasons are normal occurrences while others are red flags.

It is important to understand the difference and what to look for! While the price of a stock is changing on a minute to minute basis, the underlying value does not change.

Value investors look to acquire stock in a company when the price is below the underlying value. By understanding the difference between price and value, you can unearth opportunities where the market has priced something wrong.

Remember, in the short term, the market can be totally erratic and irrational. You should not base long term investing decisions on short term moves in the market.

One of the most common catalysts for a price change is an earnings report.

Publicly traded companies are required to report earnings to shareholders on a quarterly basis. On the days before and after earnings, you typically see more volatility.

Wall Street analysts place bets on how they anticipate the company to perform that quarter.

Typically, this is a bet on revenue and earnings per share.

When you hear that a company beats earnings, it means that the actual figures came in above these Wall Street estimates.

When you hear that a company misses earnings, it means the actual figures came in below these Wall Street estimates.

Some companies offer guidance as well, which is forward looking earnings estimates. Changes to these guidance estimates can also result in drastic price changes in the share price. A company can raise or lower guidance based on their earnings data for the most recent quarter and anticipated sales.

Now, do not assume that beating earnings and raising guidance will result in an increase in the share price.

Often times, the earnings beat is priced in and the positive news does not result in any price move. Betting on earnings is risky, and most investors would not recommend it. It is important to understand however that the share price typically has some drastic moves around earnings.

As a long term investor, you should be more interested in the earnings report and earnings call. I encourage you to listen in on earnings reports as a well informed investor.

If earnings are positive and the share price moves, you should determine whether or not you feel the stock is fairly valued.

Stocks can become overvalued very quickly as the herd moves in on a particular asset. If you believe the stock has become overvalued, you might want to consider selling off a portion or all.

One of my favorite moves in this situation is to sell enough to cover my initial investment and let the profits ride. This is called playing on house money!

If earnings are negative, you could see the stock plummet. You should not sell simply based on the fact that the price went down. You should evaluate the fundamentals and see if there has been a drastic change.

If you are an income investor or you are holding a stock that pays a dividend, you need to understand that changes to that dividend can result in movement of the share price.

Remember, a dividend is never guaranteed!

While companies like to continue paying and increasing quarterly dividends, it doesn’t always pan out this way.

I experienced this with General Electric, one of my investments. I purchased the stock and a few months after I bought it, they announced a 50% dividend cut.

Later on, they slashed the dividend down to a penny per share. Bad news!

Due to poor management of finances, General Electric was no longer able to pay this dividend. They were paying more in dividends than they were earning. After the cut was announced, the stock took a major dip.

Typically…

As a dividend investor, you want to keep track of the coverage ratio of your dividends.

There are a number of different ways to calculate this, but this is the method I prefer:

Dividend Coverage Ratio = EPS / DPS

You want to take the earnings per share paid out over the last four quarters and divide it by the dividends per share paid out in the same timeframe. You will end up with a number that represents the dividend coverage ratio.

If that number is below 1, it means that this company is paying out more in dividends than they are earning. This is a huge red flag as a dividend cut is almost guaranteed to occur.

If the dividend coverage ratio is between 1 and 1.5, you should be careful. While a cut might not be immediate or necessary, this company has slim overage of the dividend.

Ideally, I look for a coverage ratio of 1.5 to 2.

This indicates that the company is retaining enough earnings to maintain financial health. On the other hand, if the dividend coverage ratio is well above 2 this can indicate that the company is retaining earnings and holding them back from investors.

If your company is selling a product, understand that product announcements or recalls can result in a price change.

Take GoPro for example. They planned on getting in on the drone market, but after months of development they pulled the plug on the operation. Investors were not happy and the price of the stock fell.

A few years back, Chipotle had a recall of lettuce that had traces of e coli bacteria.

While only a few dozen people got sick, this still has hurt them to this day. Physical product recalls typically have the same effect on a stock. Finally, new product announcements can result in a price move.

Take Apple for example. Each year, they unveil the latest and greatest products. Wall Street essentially votes on whether or not they like the products with their money. If they love the new products, they buy. If they hate them, they sell.

As an informed investor, you should pay attention to any upcoming product announcements and anticipate price moves around these announcements.

Apple has been releasing new products for decades and they have mostly pleased investors with their new ideas. Sometimes, a recall can result in a buying opportunity for investors. If you feel that the recall is not as severe as everyone is saying, this could be a good time to buy shares.

In most instances, Wall Street overreacts to bad news.

Layoffs are not always a bad thing, but Wall Street typically thinks they are. If a company announces layoffs, you will often times see a sell off take place.

Layoffs and consolidation efforts are not always a bad thing.

A lot of businesses operate in a cyclical industry. This means that sales can be great at some points and poor at other times. If they are approaching the slow end of the business cycle, layoffs might be a very logical move.

On the other hand, layoffs often indicate consolidation and shrinking.

It is similar to when stores close locations in an effort to save money. By closing stores, they have reduced the companies footprint and they have less retail locations to move product. This almost always results in fewer sales.

If a company has massive layoffs, this could significantly reduce the innovation and research within the company. This almost always results in falling out of favor in the market.

Acquisitions almost always result in price moves.

If you are holding a stock that gets acquired, you are typically having a good day. In most instances, the acquisition is seen as a positive.

However, it is not always the case for the company that is acquiring the other company.

Take AT&T for example. In 2018, they acquired Walt Disney. On the day that the deal was closed, the stock took a hit. The reason behind this was that investors were not happy with AT&T taking on more debt.

As you can imagine, there are always different ways to interpret the news of an acquisition.

Public companies can also be taken private during acquisitions.

Take Panera Bread for example. Back in April of 2017, a German company called JAB Holdings announced the acquisition of Panera Bread. They would be buying out the company and taking it private at $315 per share.

If you were a shareholder at the time, you would have received $315 per share of Panera stock you owned. Companies typically pay a takeover premium when acquiring a company.

This is expressed as a percentage above the current market value. When JAB Holdings purchased Panera, they paid a premium above the current share price. As a result, this is almost always good news for investors when a stock they own is taken private.

A stock split is typically something that is voted on, and it is becoming less and less common as years go on.

Innovative brokerages like M1 Finance allow you to buy partial shares of a stock, making the need for stock splits virtually disappear.

When the price for a single share of a stock climbs to a level that seems out of reach for the average retail investor, a company might decide to split the stock. Shareholders will receive more shares than they initially had in a ratio determined by the company. This is typically seen as good news, and new investors might decide to take a position in the company.

For example, on June 9th 2014 Apple completed a 7 to 1 stock split. Each outstanding share of Apple stock became 7.

Now, what we just mentioned above is a forward stock split. There is another type of split that is not desirable at all, and that is a reverse split.

A reverse split occurs when a company needs to consolidate shares into fewer shares. Typically, this is done to fulfill listing requirements.

Major stock exchanges like the NYSE and NASDAQ have a set of requirements a company must fulfill in order to remain listed on the exchange. If they do not meet these requirements, they can get delisted from the exchange.

At that point, the stock would trade on a less desirable OTC exchange. A reverse stock split is seen as artificially inflating the price of the stock, and Wall Street is not a fan. This might be a confusing concept, so let me go through an example.

ABC Company has an initial public offering of 100,000 shares at $10 a share giving them a market capitalization of $1,000,000.

In order to remain listed on a major exchange, they need to maintain a share price above $1.

Everything possible goes wrong for ABC Company. They have a product recall, layoffs and earnings continue to miss.

Two years after the IPO, the stock is trading at $0.55 a share.

If they do not get the share price above $1, they will be delisted at the end of the year. Management has a discussion and they realize that the only option is to initiate a reverse split in a 5 to 1 ratio. The reverse split is voted on by shareholders and it passes.

Now, each shareholder will receive 1 share per 5 they once had.

Before the split, they have a market capitalization of $55,000 or 100,000 X $0.55 per share.

After the split, the shares outstanding are reduced to 20,000 and the market capitalization does not change.

As a result, each share is now worth $2.75 after the consolidation. Now, they can fulfill the listing requirements. The tricks do not fool Wall Street though, and the announcement of the reverse split results in a 5% sell off.

Management is like the captain of the ship that is a company.

The management team determines what direction the company is heading in. Changes in management can result in price moves. Take General Electric for example.

Recently, the new CEO was booted because the turnaround plans were not clear for this company.

A new CEO was put in charge and Wall Street reacted positively to this change. On the other hand, if you suddenly hear about a member of management leaving the company this is usually a bad sign and Wall Street reacts accordingly.

As an informed investor, you should be familiar with the company management. A change of management is one of the only times where I will consider exiting a position.

Good management can take a company to the moon.

Bad management can bury them.

If you find out that a company has changed management and you do not like the new leader, it might be time to evaluate whether or not you want to be a part owner of this company.

I am lumping all three of these together as they almost always result in a share price move to the downside.

Here are a few examples…

Often times, a broad market correction is taking place.

This could be entire global markets or just a correction taking place within one industry.

If you suspect this is occurring, you should simply benchmark your stock to a market index. What you may find is that both the broad market and your stock are seeing a correction. This likely has nothing to do with your company.

If the broad market is moving ahead and your stock is taking a dip, this is probably a price move that is isolated to your company and it is definitely a red flag. Further investigation is required!

Note: The rest of these catalysts for a price change are economic factors. They have little to do with individual companies, but they almost always have an impact on the broad market. Often times, these are the catalysts behind a broad market correction.

Changes in Federal interest rates always have an effect on the stock market.

When the economy is in a slump, the Federal Reserve will often lower interest rates to artificially stimulate the economy.

Lower interest rates are passed on to the consumer and corporations are able to borrow money at a cheaper rate. As a result, spending increases and the economy moves forward.

On the other hand, when the economy is roaring and inflation is getting out of control, the Federal Reserve can hike interest rates to pump the brakes.

This discourages corporate borrowing and lowers overall spending. Lower interest rates result in lower operating costs for companies, inflating earnings. Higher interest rates result in higher operating costs for companies, deflating earnings.

Recently, the FED dropped interest rates to near zero to stimulate the economy. This was due to the global economic shutdown related from the Coronavirus. This is a tool they use to have some level of control over the economy.

Interest rates also have an effect on the bond market, but that is above and beyond the scope of this article.

Unemployment is typically an indicator of how the overall economy is doing.

In a prosperous economy, unemployment is low because companies are hiring left and right.

In a poor economy, unemployment is high because companies are laying off employees left and right.

Changes in the unemployment rate almost always have an effect on the overall market. Investors should pay attention to the unemployment rate and these jobs reports.

Politics can have a huge impact on the stock market.

When Trump was elected, the market went into a sell off as this news shocked the nation.

Each political officer has an agenda, and changes to government policy can have a positive or negative impact on the economy. For example, corporate tax cuts under the Trump administration have had a positive impact on the overall economy as corporate earnings have soared.

On the other hand, as of writing this article we are amidst a trade war with China. These decisions on policies for how the US and China will conduct trade will have a massive impact on the overall market. This trade war has resulted in a bear market in China as of late 2018.

An informed stock market investor should have a general idea of what is going on with the government and policies being enacted.

As the world becomes more and more interconnected, financial markets are becoming incredibly sensitive to global events. Factors such as geopolitical tensions, trade agreements, pandemics, and natural disasters can create volatility and significantly influence stock prices, often leading to rapid changes in investor sentiment.

For instance, international conflicts, such as wars or diplomatic disputes, can cause uncertainty among investors, resulting in market declines. Stock prices often fluctuate based on news from hotspots around the globe. For example, military tensions between countries can lead to potential sanctions or disruptions in trade, impacting the supply chain of major corporations and leading to drops in stock prices.

Changes in economic policies, particularly those enacted by major economies (like the U.S., China, or the European Union), can also have significant effects. Trade agreements or tariffs can either boost or hinder certain sectors. For example, the announcement of trade tariffs might lead to decreased profitability for companies reliant on imports or exports, causing their stock prices to fall.

The COVID-19 pandemic is a prime example of how a global health crisis can lead to market upheaval. Lockdowns, health regulations, and shifts in consumer behavior can drastically impact earnings, causing broad market declines. Stocks in sectors like travel, hospitality, and retail often suffer immediate downturns, while others, like technology and healthcare, may see boosts in demand, changing the market dynamics.

Natural events—such as hurricanes, earthquakes, or wildfires—can disrupt supply chains and operations, leading to drops in stock prices for affected companies. For instance, when wildfires affect agricultural regions, the stock prices of companies in food production may suffer due to anticipated increases in costs and decreased supply.

As a stock market participant, staying informed about global events can help you anticipate potential market movements. Monitoring economic indicators, government policies, and major news stories will enable you to make well-informed investment decisions. Additionally, consider the diversification of your portfolio across different sectors and geographies to mitigate risks associated with any single event or market.

We covered a lot here, and it is easy to get overwhelmed. But it is important to remember that investing is a marathon, not a sprint. Just like with returns, knowledge of the stock market is a long term process. You won't learn all of the ins and outs in a day.

Here are some of the most important key points to remember:

Thanks so much for reading! This piece took dozens of hours to put together. Please consider sharing it with a friend.

Don't forget to grab your free stock worth up to $200 from Robinhood today!