Anyone who has ever played a game of Monopoly has experienced the thrill of having plenty of cash in hand – even though it’s not real currency.

If you are new to the world of investing, any dollar you lose can feel like a big hit, because it’s not play money, it’s your hard-earned cash you are putting up.

Wouldn’t it be great if you had a chance to try your hand at investing without the risk?

There is a way, and it’s called paper trading. This is where you are investing with play money, monopoly money if you will.

However, you might be wondering if the popular commission free trading app Robinhood offers a trading simulator (a.k.a. paper trading).

Here's the verdict on this!

New to Robinhood? Check out my full tutorial below!

Robinhood is a popular "all-in-one" investing app.

While they are most well-known for their commission free stock trading, they've recently shaken up the Retirement Investing World too.

Introducing Robinhood Retirement; home of the biggest IRA match on the market.

Here's what you need to know:

And don't worry, this comes with a Portfolio Builder Tool. You don't have to construct your investment portfolio from scratch if you don't want to.

Lastly, you'll even get a free stock worth up to $200 when you open a new Robinhood account using our link.

Paper trading is essentially a simulation of real trading, where individuals practice buying and selling financial instruments like stocks without risking any actual money.

It's a valuable tool for beginners to hone their trading skills, test strategies, and gain confidence without the fear of losing capital.

The reason why it's called paper trading is because most people would jot down their hypothetical trades on paper, including the number of shares they would've purchased and the cost basis.

Then, they could check back and see how they would've done.

Today, paper trading has largely been replaced with trading simulators - which allow you to do this within an app.

Robinhood does not offer a trading simulator at this time. However, they do offer an array of educational tools within the app to help you learn.

If you're looking for a trading simulator, consider Webull - as they offer one built in.

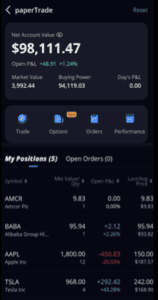

With the Webull Paper Trading Simulator, you can test new strategies and hone your skills using unlimited virtual cash.

New to Webull? Check out my full tutorial below!

There is no risk, as it's pretend money, but everything else is exactly how it would be when using real cash.